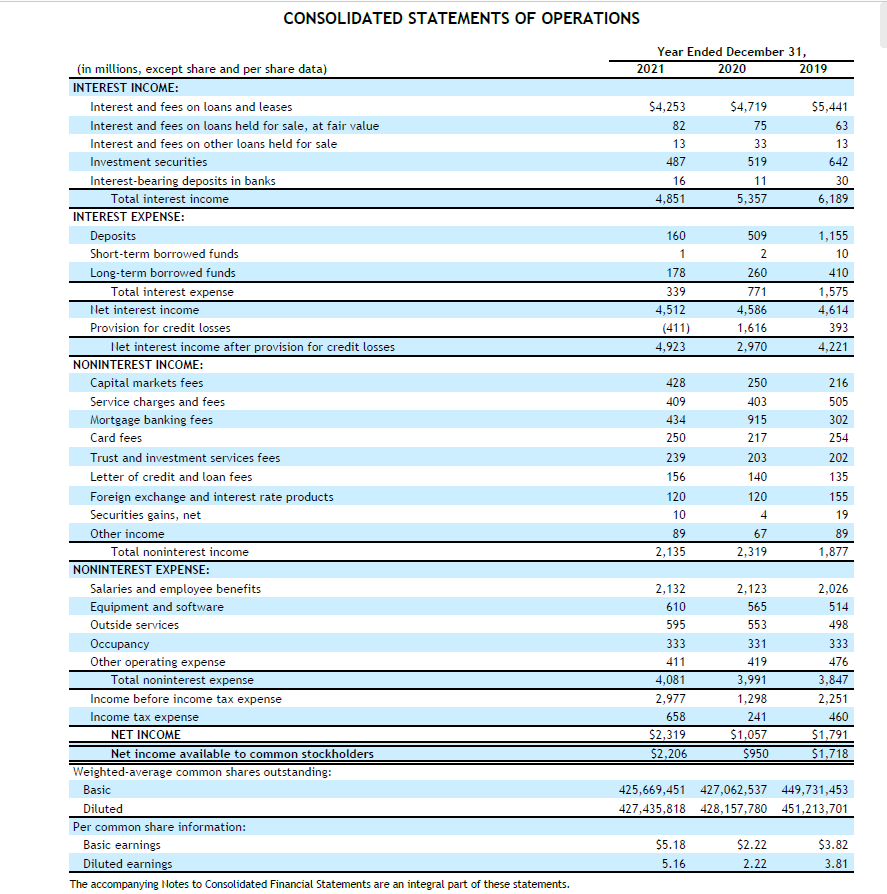

- a) What is the Net Interest Margin for Citizens for the last two reporting years? Show all calculations and interpret. b) Assume that Citizens liabilities are more rate sensitive than its assets. What will be the impact on Net Interest Margin if interest rates increase? Explain.

- What role does capital play for a depository financial institution? Calculate the level of capital held by Citizens for the last two reporting years. Was the firm stronger or weaker on this measure in the last year? Explain.

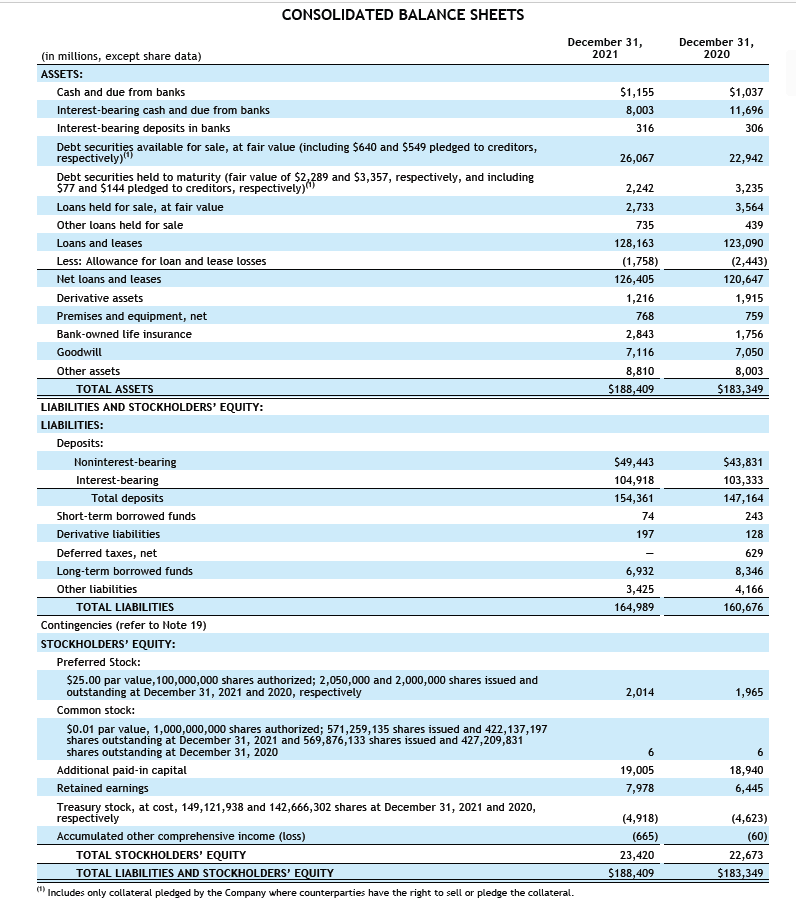

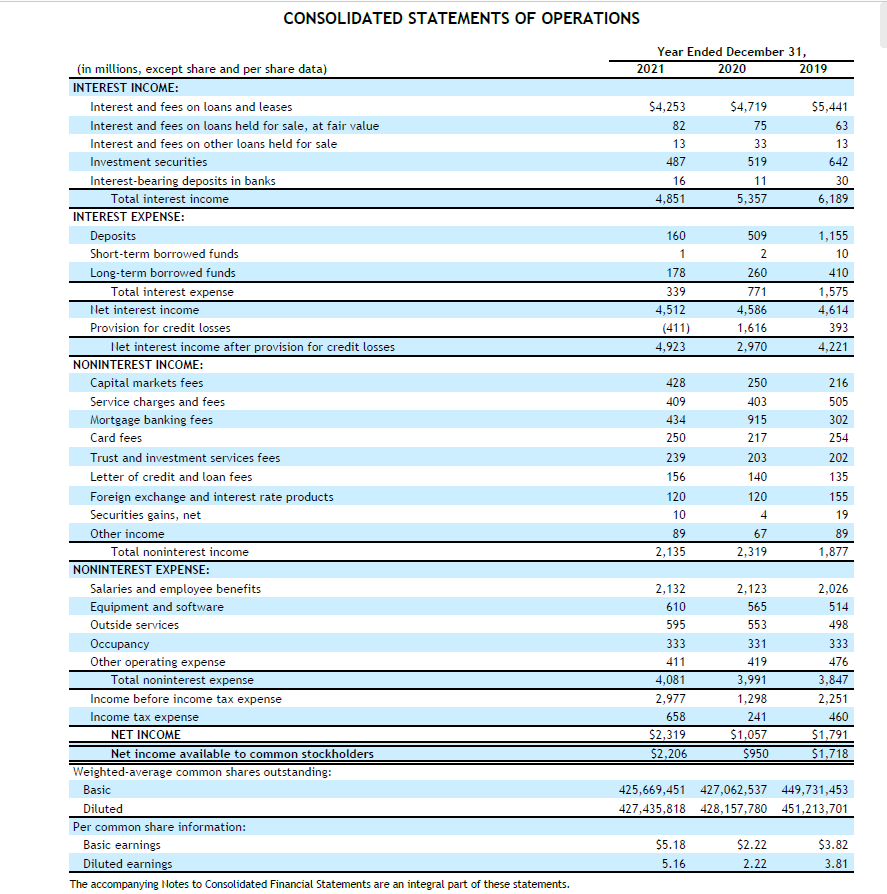

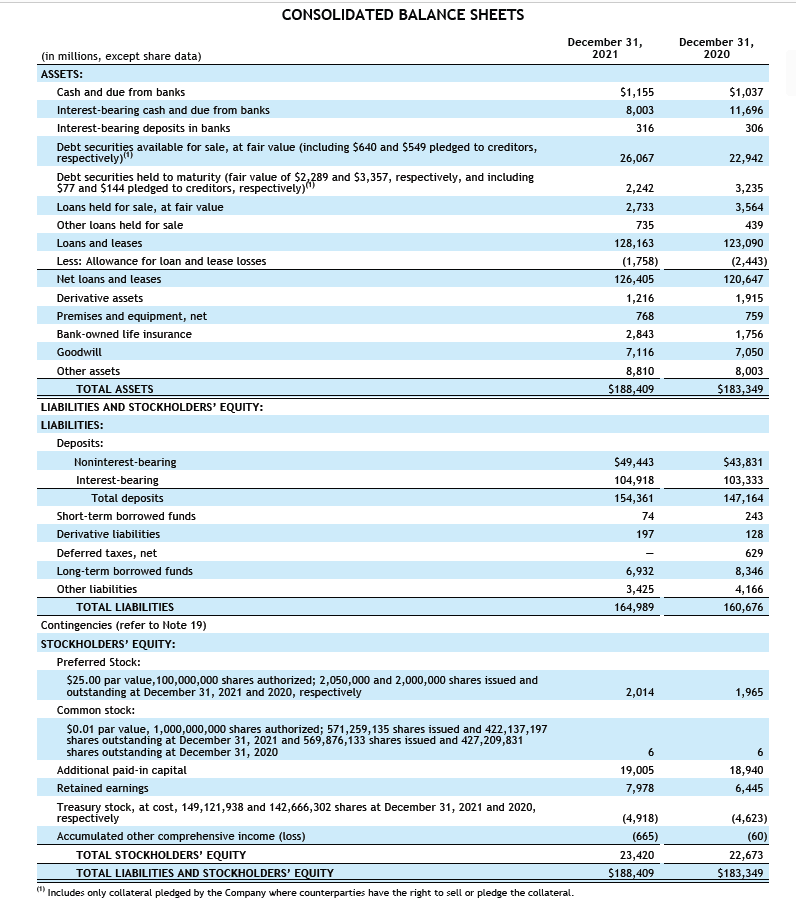

December 31, 2020 $1,037 11,696 306 22,942 3,235 3,564 439 123,090 (2,443) 120,647 1,915 759 1,756 7,050 8,003 $183,349 CONSOLIDATED BALANCE SHEETS December 31, (in millions, except share data) 2021 ASSETS: Cash and due from banks $1,155 Interest-bearing cash and due from banks 8,003 Interest-bearing deposits in banks 316 Debt securities available for sale, at fair value (including $640 and $549 pledged to creditors, respectively) 26,067 Debt securities held to maturity (fair value of $2,289 and $3,357, respectively, and including $77 and $144 pledged to creditors, respectively)" 2,242 Loans held for sale, at fair value 2,733 Other loans held for sale 735 Loans and leases 128,163 Less: Allowance for loan and lease losses (1,758) Net loans and leases 126,405 Derivative assets 1,216 Premises and equipment, net 768 Bank-owned life insurance 2,843 Goodwill 7,116 Other assets 8,810 TOTAL ASSETS $188,409 LIABILITIES AND STOCKHOLDERS' EQUITY: LIABILITIES: Deposits: Noninterest-bearing $49,443 Interest-bearing 104,918 Total deposits 154,361 Short-term borrowed funds 74 Derivative liabilities Deferred taxes, net Long-term borrowed funds 6,932 Other liabilities 3,425 TOTAL LIABILITIES 164,989 Contingencies (refer to Note 19) STOCKHOLDERS' EQUITY: Preferred Stock: $25.00 par value, 100,000,000 shares authorized; 2,050,000 and 2,000,000 shares issued and outstanding at December 31, 2021 and 2020, respectively 2,014 Common stock: $0.01 par value, 1,000,000,000 shares authorized; 571,259,135 shares issued and 422,137,197 shares outstanding at December 31, 2021 and 569,876,133 shares issued and 427,209,831 shares outstanding at December 31, 2020 Additional paid-in capital 19,005 Retained earnings 7,978 Treasury stock, at cost, 149, 121,938 and 142,666,302 shares at December 31, 2021 and 2020, respectively (4,918) Accumulated other comprehensive income (Loss) (665) TOTAL STOCKHOLDERS' EQUITY 23,420 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $188,409 "Includes only collateral pledged by the Company where counterparties have the right to sell or pledge the collateral. $43,831 103,333 147,164 243 128 197 629 8,346 4,166 160,676 1,965 6 6 18,940 6,445 (4,623) (60) 22,673 $183,349 CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31, 2021 2020 2019 $4,253 82 13 487 $4,719 75 33 519 $5,441 63 13 642 16 11 30 6,189 4,851 5,357 160 1 509 2 178 260 339 4,512 (411) 4,923 771 4,586 1,616 2,970 1,155 10 410 1,575 4,614 393 4,221 428 409 434 250 239 250 403 915 217 203 140 216 505 302 254 (in millions, except share and per share data) INTEREST INCOME: Interest and fees on loans and leases Interest and fees on loans held for sale, at fair value Interest and fees on other loans held for sale Investment securities Interest-bearing deposits in banks Total interest income INTEREST EXPENSE: Deposits Short-term borrowed funds Long-term borrowed funds Total interest expense Net interest income Provision for credit losses Het interest income after provision for credit losses NONINTEREST INCOME: Capital markets fees Service charges and fees Mortgage banking fees Card fees Trust and investment services fees Letter of credit and loan fees Foreign exchange and interest rate products Securities gains, net Other income Total noninterest income NONINTEREST EXPENSE: Salaries and employee benefits Equipment and software Outside services Occupancy Other operating expense Total noninterest expense Income before income tax expense Income tax expense NET INCOME Net income available to common stockholders Weighted-average common shares outstanding: Basic Diluted Per common share information: Basic earnings Diluted earnings The accompanying Notes to Consolidated Financial Statements are an integral part of these statements. 202 156 120 4 120 10 89 2,135 135 155 19 89 1,877 67 2,319 2,132 610 595 333 411 4,081 2,977 658 $2,319 $2,206 2,123 565 553 331 419 3,991 1,298 241 $1,057 $950 2,026 514 498 333 476 3,847 2,251 460 $1,791 $1,718 425,669,451 427,062,537 449,731,453 427,435,818 428,157,780 451,213,701 $5.18 5.16 $2.22 2.22 $3.82 3.81 December 31, 2020 $1,037 11,696 306 22,942 3,235 3,564 439 123,090 (2,443) 120,647 1,915 759 1,756 7,050 8,003 $183,349 CONSOLIDATED BALANCE SHEETS December 31, (in millions, except share data) 2021 ASSETS: Cash and due from banks $1,155 Interest-bearing cash and due from banks 8,003 Interest-bearing deposits in banks 316 Debt securities available for sale, at fair value (including $640 and $549 pledged to creditors, respectively) 26,067 Debt securities held to maturity (fair value of $2,289 and $3,357, respectively, and including $77 and $144 pledged to creditors, respectively)" 2,242 Loans held for sale, at fair value 2,733 Other loans held for sale 735 Loans and leases 128,163 Less: Allowance for loan and lease losses (1,758) Net loans and leases 126,405 Derivative assets 1,216 Premises and equipment, net 768 Bank-owned life insurance 2,843 Goodwill 7,116 Other assets 8,810 TOTAL ASSETS $188,409 LIABILITIES AND STOCKHOLDERS' EQUITY: LIABILITIES: Deposits: Noninterest-bearing $49,443 Interest-bearing 104,918 Total deposits 154,361 Short-term borrowed funds 74 Derivative liabilities Deferred taxes, net Long-term borrowed funds 6,932 Other liabilities 3,425 TOTAL LIABILITIES 164,989 Contingencies (refer to Note 19) STOCKHOLDERS' EQUITY: Preferred Stock: $25.00 par value, 100,000,000 shares authorized; 2,050,000 and 2,000,000 shares issued and outstanding at December 31, 2021 and 2020, respectively 2,014 Common stock: $0.01 par value, 1,000,000,000 shares authorized; 571,259,135 shares issued and 422,137,197 shares outstanding at December 31, 2021 and 569,876,133 shares issued and 427,209,831 shares outstanding at December 31, 2020 Additional paid-in capital 19,005 Retained earnings 7,978 Treasury stock, at cost, 149, 121,938 and 142,666,302 shares at December 31, 2021 and 2020, respectively (4,918) Accumulated other comprehensive income (Loss) (665) TOTAL STOCKHOLDERS' EQUITY 23,420 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $188,409 "Includes only collateral pledged by the Company where counterparties have the right to sell or pledge the collateral. $43,831 103,333 147,164 243 128 197 629 8,346 4,166 160,676 1,965 6 6 18,940 6,445 (4,623) (60) 22,673 $183,349 CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31, 2021 2020 2019 $4,253 82 13 487 $4,719 75 33 519 $5,441 63 13 642 16 11 30 6,189 4,851 5,357 160 1 509 2 178 260 339 4,512 (411) 4,923 771 4,586 1,616 2,970 1,155 10 410 1,575 4,614 393 4,221 428 409 434 250 239 250 403 915 217 203 140 216 505 302 254 (in millions, except share and per share data) INTEREST INCOME: Interest and fees on loans and leases Interest and fees on loans held for sale, at fair value Interest and fees on other loans held for sale Investment securities Interest-bearing deposits in banks Total interest income INTEREST EXPENSE: Deposits Short-term borrowed funds Long-term borrowed funds Total interest expense Net interest income Provision for credit losses Het interest income after provision for credit losses NONINTEREST INCOME: Capital markets fees Service charges and fees Mortgage banking fees Card fees Trust and investment services fees Letter of credit and loan fees Foreign exchange and interest rate products Securities gains, net Other income Total noninterest income NONINTEREST EXPENSE: Salaries and employee benefits Equipment and software Outside services Occupancy Other operating expense Total noninterest expense Income before income tax expense Income tax expense NET INCOME Net income available to common stockholders Weighted-average common shares outstanding: Basic Diluted Per common share information: Basic earnings Diluted earnings The accompanying Notes to Consolidated Financial Statements are an integral part of these statements. 202 156 120 4 120 10 89 2,135 135 155 19 89 1,877 67 2,319 2,132 610 595 333 411 4,081 2,977 658 $2,319 $2,206 2,123 565 553 331 419 3,991 1,298 241 $1,057 $950 2,026 514 498 333 476 3,847 2,251 460 $1,791 $1,718 425,669,451 427,062,537 449,731,453 427,435,818 428,157,780 451,213,701 $5.18 5.16 $2.22 2.22 $3.82 3.81