Question

a. What is the NPV of the Free Cash Flows from Cutting Edge's project? The NPV is $ b. Now assume that the Free Cash

a. What is the NPV of the Free Cash Flows from Cutting Edge's project? The NPV is $

b. Now assume that the Free Cash Flows of Cutting Edge Warehousing is as shown in the table below (ignore your answer in a. and the table above). Further assume that after year 3 the free cash flow will increase with the industry average of 1% per year. Use the cost of capital of 7% and the discounted free cash flow model to estimate Cutting Edge's enterprise value.

| Year | 1 | 2 | 3 |

|---|---|---|---|

| FCF (in $) | 50 000 | 80 000 | 100 000 |

Cutting Edge's Enterprise Value is $ million (answer in millions with two decimals; 2.79 and not 2 790 000).

c. Assume now that Cutting Edge Warehousing Enterprise Value today is $850 000. They have no excess cash, $100 000 in debt and 100 000 shares outstanding. Estimate their share price. Their share price is $ (answer with two decimals).

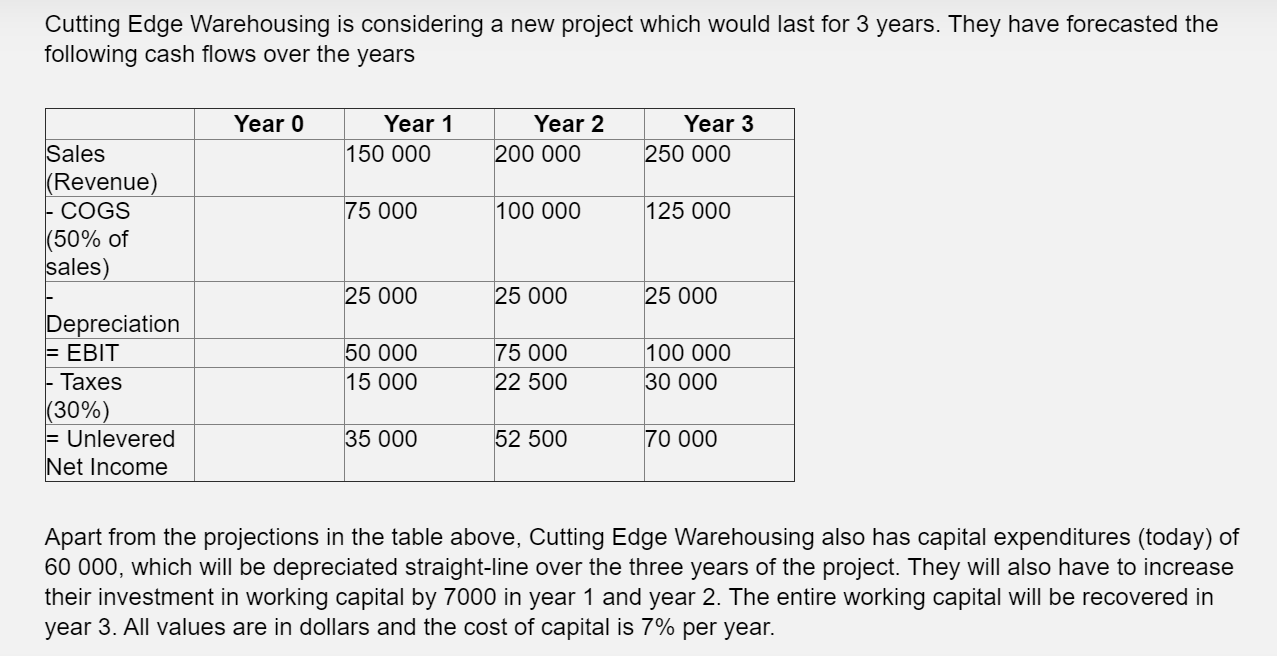

Cutting Edge Warehousing is considering a new project which would last for 3 years. They have forecasted the following cash flows over the years Year o Year 1 150 000 Year 2 200 000 Year 3 250 000 Sales (Revenue) ECOGS (50% of sales) 75 000 100 000 125 000 25 000 25 000 25 000 50 000 15 000 75 000 22 500 100 000 30 000 Depreciation EBIT Taxes (30%) = Unlevered Net Income 35 000 52 500 70 000 Apart from the projections in the table above, Cutting Edge Warehousing also has capital expenditures (today) of 60 000, which will be depreciated straight-line over the three years of the project. They will also have to increase their investment in working capital by 7000 in year 1 and year 2. The entire working capital will be recovered in year 3. All values are in dollars and the cost of capital is 7% per yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started