Question

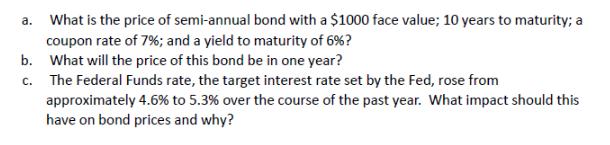

a. What is the price of semi-annual bond with a $1000 face value; 10 years to maturity; a coupon rate of 7%; and a

a. What is the price of semi-annual bond with a $1000 face value; 10 years to maturity; a coupon rate of 7%; and a yield to maturity of 6%? b. What will the price of this bond be in one year? c. The Federal Funds rate, the target interest rate set by the Fed, rose from approximately 4.6% to 5.3% over the course of the past year. What impact should this have on bond prices and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bond Valuation and Interest Rate Impact a Price of the SemiAnnual Bond We can find the price of the bond using the Yield to Maturity YTM formula which ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Structural Analysis

Authors: Kenneth Leet, Chia-Ming Uang, Joel Lanning

5th Edition

0073398004, 978-0073398006

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App