Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A) What is the projects NPV? B) Should Boilermakers accept or reject the project? Why? C) Which of the following metric would you choose to

A) What is the projects NPV?

B) Should Boilermakers accept or reject the project? Why?

C) Which of the following metric would you choose to evaluate the rate of return of this project: IRR or MIRR under discount approach? Why?

D) Calculate the rate of return using the correct metric. (Report the rate with two digits as in 5.23%)

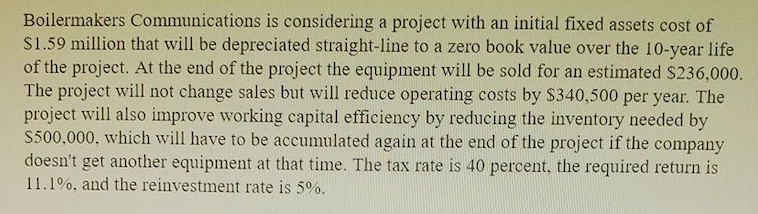

Boilermakers Communications is considering a project with an initial fixed assets cost of $1.59 million that will be depreciated straight-line to a zero book value over the 10-year life of the project. At the end of the project the equipment will be sold for an estimated $236,000. The project will not change sales but will reduce operating costs by $340,500 per year. The project will also improve working capital efficiency by reducing the inventory needed by S500,000, which will have to be accumulated again at the end of the project if the company doesn't get another equipment at that time. The tax rate is 40 percent, the required return is 11.1%, and the reinvestment rate is 5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started