Answered step by step

Verified Expert Solution

Question

1 Approved Answer

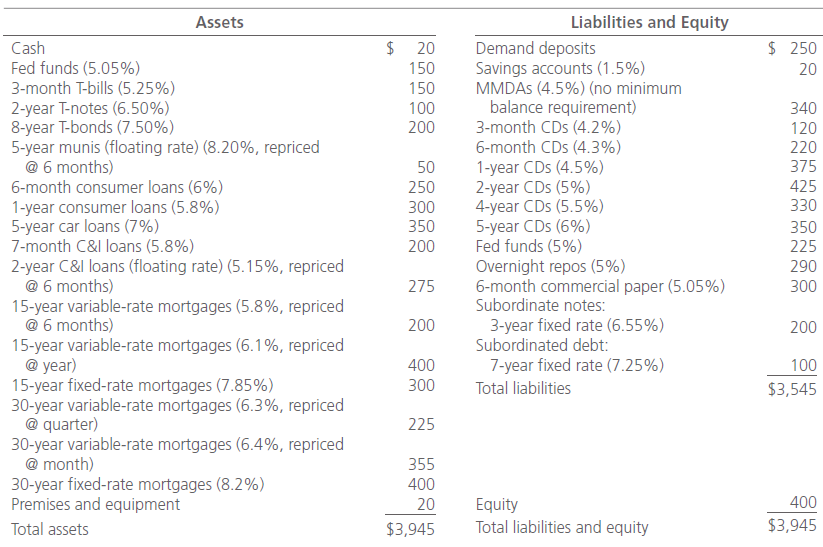

a. What is the repricing gap (cumulative GAP) if the planning period is 30 days? 6 months? 1 year? 2 years? 5 years? b. What

a. What is the repricing gap (cumulative GAP) if the planning period is 30 days? 6 months? 1 year? 2 years? 5 years?

b. What is the interest rate risk exposure of the bank for each planning period?

c. What is the impact over the next six months on net interest income if interest rates on RSAs increase 60 basis points and on RSLs increase 40 basis points? What changes in portfolio composition would you recommend to management (if necessary)? Be specific.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started