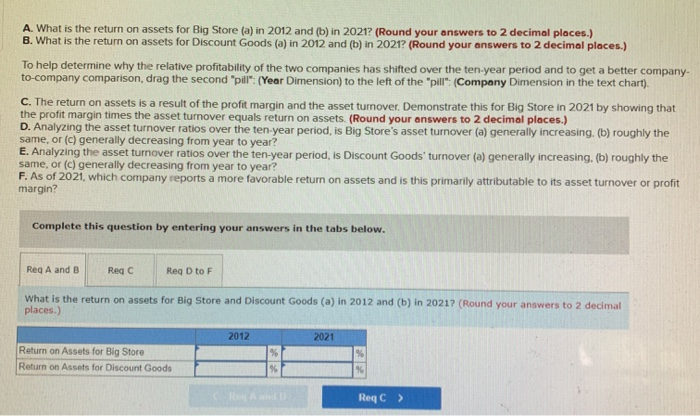

A. What is the return on assets for Big Store (a) in 2012 and (b) in 2021? (Round your answers to 2 decimal places.) B. What is the return on assets for Discount Goods (a) in 2012 and (b) in 2021? (Round your answers to 2 decimal places.) To help determine why the relative profitability of the two companies has shifted over the ten-year period and to get a better company. to-company comparison, drag the second pill": (Year Dimension) to the left of the pill" (Company Dimension in the text chart). C. The return on assets is a result of the profit margin and the asset turnover. Demonstrate this for Big Store in 2021 by showing that the profit margin times the asset turnover equals return on assets. (Round your answers to 2 decimal places.) D. Analyzing the asset turnover ratios over the ten-year period, is Big Store's asset turnover (a) generally increasing. (b) roughly the same, or (c) generally decreasing from year to year? E. Analyzing the asset turnover ratios over the ten-year period, is Discount Goods" turnover (a) generally increasing. (b) roughly the F. As of 2021, which company reports a more favorable return on assets and is this primarily attributable to its asset turnover or profit margin? Complete this question by entering your answers in the tabs below. Reg A and B Reqc Reg D to F What is the return on assets for Big Store and Discount Goods (a) in 2012 and (b) in 2021? (Round your answers to 2 decimal places.) 2012 2021 Return on Assets for Big Store Return on Assets for Discount Goods % ReqC > A. What is the return on assets for Big Store (a) in 2012 and (b) in 2021? (Round your answers to 2 decimal places.) B. What is the return on assets for Discount Goods (a) in 2012 and (b) in 2021? (Round your answers to 2 decimal places.) To help determine why the relative profitability of the two companies has shifted over the ten-year period and to get a better company. to-company comparison, drag the second pill": (Year Dimension) to the left of the pill" (Company Dimension in the text chart). C. The return on assets is a result of the profit margin and the asset turnover. Demonstrate this for Big Store in 2021 by showing that the profit margin times the asset turnover equals return on assets. (Round your answers to 2 decimal places.) D. Analyzing the asset turnover ratios over the ten-year period, is Big Store's asset turnover (a) generally increasing. (b) roughly the same, or (c) generally decreasing from year to year? E. Analyzing the asset turnover ratios over the ten-year period, is Discount Goods" turnover (a) generally increasing. (b) roughly the F. As of 2021, which company reports a more favorable return on assets and is this primarily attributable to its asset turnover or profit margin? Complete this question by entering your answers in the tabs below. Reg A and B Reqc Reg D to F What is the return on assets for Big Store and Discount Goods (a) in 2012 and (b) in 2021? (Round your answers to 2 decimal places.) 2012 2021 Return on Assets for Big Store Return on Assets for Discount Goods % ReqC >