Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a.) What is the total expected revenue for this project? b.) How much revenue should your company recognize in 2018 related to this project? It's

a.) What is the total expected revenue for this project?

b.) How much revenue should your company recognize in 2018 related to this project?

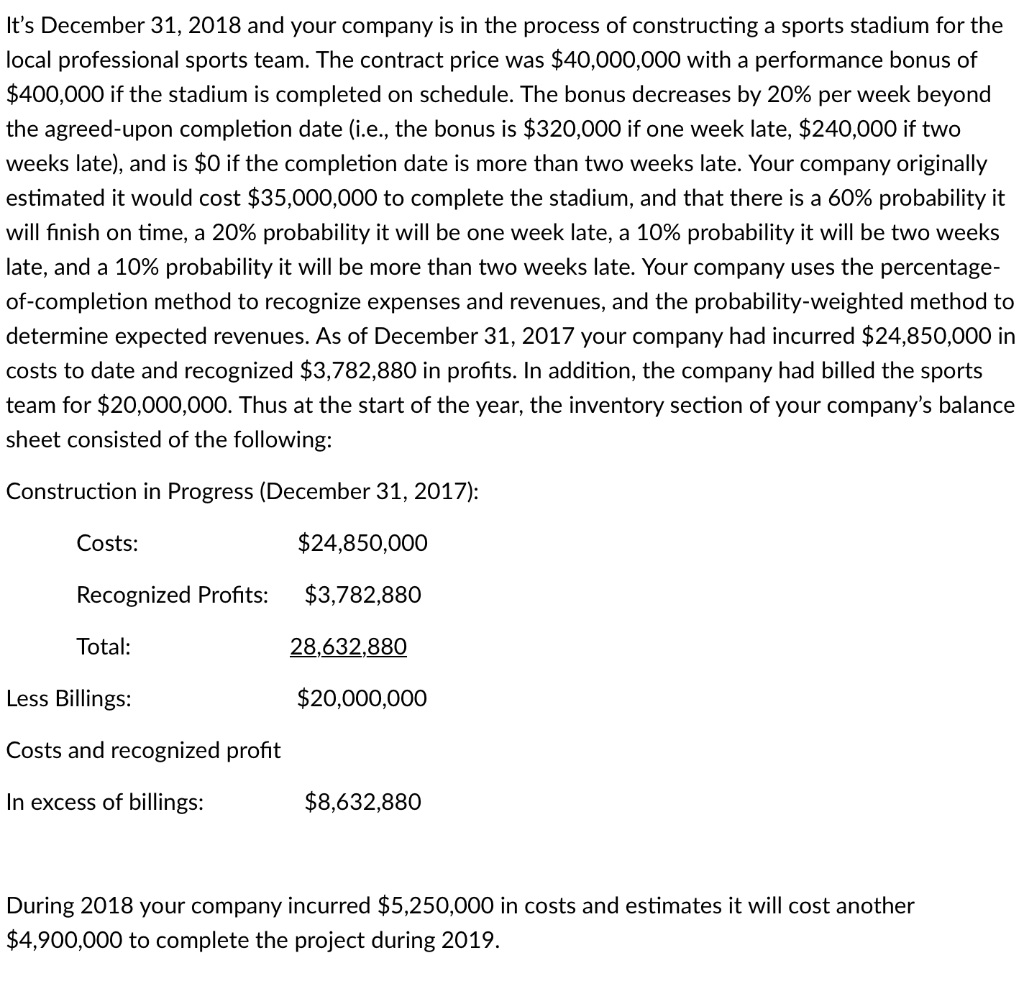

It's December 31, 2018 and your company is in the process of constructing a sports stadium for the local professional sports team. The contract price was $40,000,000 with a performance bonus of $400,000 if the stadium is completed on schedule. The bonus decreases by 20% per week beyond the agreed-upon completion date (i.e., the bonus is $320,000 if one week late, $240,000 if two weeks late), and is $0 if the completion date more than two weeks late. Your company originally estimated it would cost $35,000,000 to complete the stadium, and that there is a 60% probability it will finish on time, a 20% probability it will be one week late, a 10% probability it will be two weeks late, and a 10% probability it will be more than two weeks late. Your company uses the percentage- of-completion method to recognize expenses and revenues, and the probability-weighted method to determine expected revenues. As of December 31, 2017 your company had incurred $24,850,000 in costs to date and recognized $3,782,880 in profits. In addition, the company had billed the sports team for $20,000,000. Thus at the start of the year, the inventory section of your company's balance sheet consisted of the following: Construction in Progress (December 31, 2017): Costs: $24,850,000 Recognized Profits: $3,782,880 Total: 28,632,880 Less Billings: $20,000,000 Costs and recognized profit In excess of billings: $8,632,880 During 2018 your company incurred $5,250,000 in costs and estimates it will cost another $4,900,000 to complete the project during 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started