Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. What is the value of a bond that matures in 3 years, has an annual coupon payment of RM110, and a par value

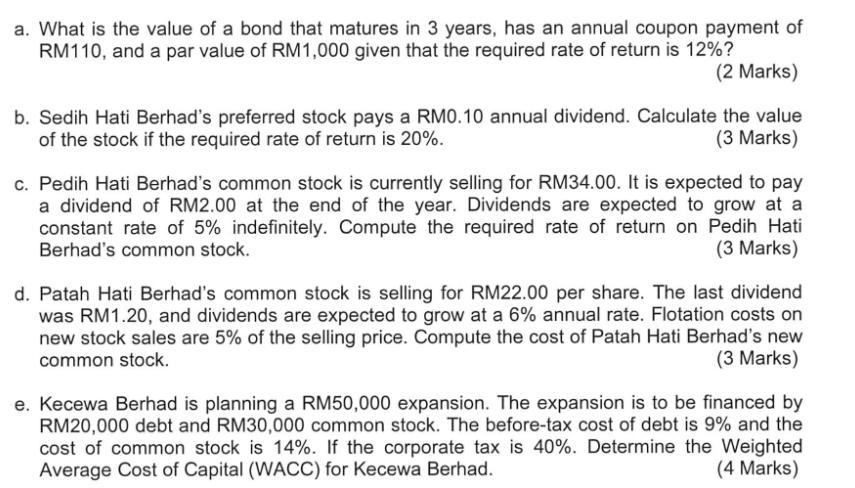

a. What is the value of a bond that matures in 3 years, has an annual coupon payment of RM110, and a par value of RM1,000 given that the required rate of return is 12%? (2 Marks) b. Sedih Hati Berhad's preferred stock pays a RM0.10 annual dividend. Calculate the value of the stock if the required rate of return is 20%. (3 Marks) c. Pedih Hati Berhad's common stock is currently selling for RM34.00. It is expected to pay a dividend of RM2.00 at the end of the year. Dividends are expected to grow at a constant rate of 5% indefinitely. Compute the required rate of return on Pedih Hati Berhad's common stock. (3 Marks) d. Patah Hati Berhad's common stock is selling for RM22.00 per share. The last dividend was RM1.20, and dividends are expected to grow at a 6% annual rate. Flotation costs on new stock sales are 5% of the selling price. Compute the cost of Patah Hati Berhad's new common stock. (3 Marks) e. Kecewa Berhad is planning a RM50,000 expansion. The expansion is to be financed by RM20,000 debt and RM30,000 common stock. The before-tax cost of debt is 9% and the cost of common stock is 14%. If the corporate tax is 40%. Determine the Weighted Average Cost of Capital (WACC) for Kecewa Berhad. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The value of a bond can be calculated using the formula for the present value of a bonds cash flows The annual coupon payment is RM110 the par value is RM1000 the required rate of return is 12 and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started