Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise(1) ch5 Adjusting Entries for Deferrals 1) Supplies Adjustment Example Yazici Advertising purchased supplies costing 2,500 on October 5. Yazici recorded the purchase by

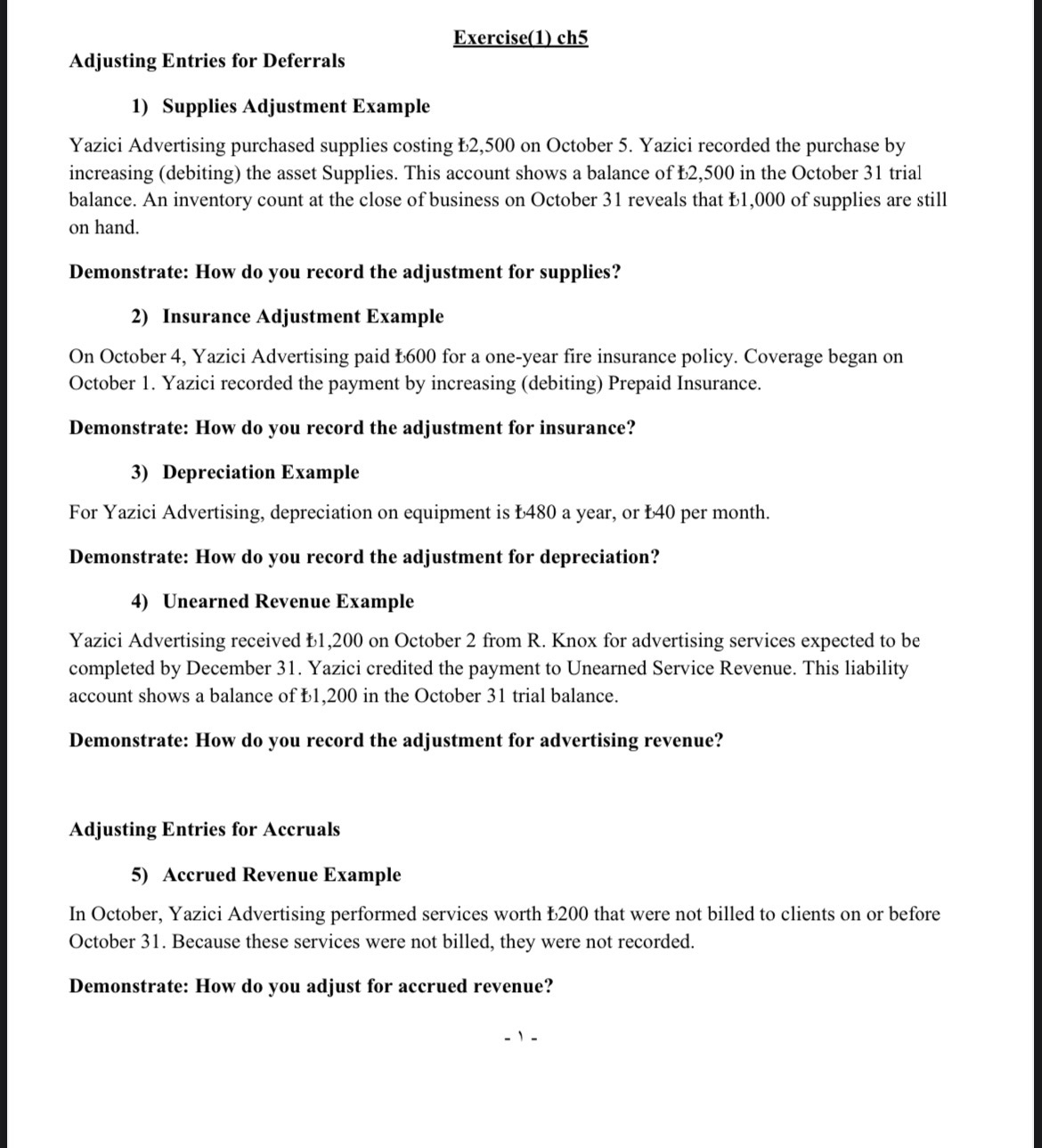

Exercise(1) ch5 Adjusting Entries for Deferrals 1) Supplies Adjustment Example Yazici Advertising purchased supplies costing 2,500 on October 5. Yazici recorded the purchase by increasing (debiting) the asset Supplies. This account shows a balance of 2,500 in the October 31 trial balance. An inventory count at the close of business on October 31 reveals that 1,000 of supplies are still on hand. Demonstrate: How do you record the adjustment for supplies? 2) Insurance Adjustment Example On October 4, Yazici Advertising paid 600 for a one-year fire insurance policy. Coverage began on October 1. Yazici recorded the payment by increasing (debiting) Prepaid Insurance. Demonstrate: How do you record the adjustment for insurance? 3) Depreciation Example For Yazici Advertising, depreciation on equipment is 480 a year, or 40 per month. Demonstrate: How do you record the adjustment for depreciation? 4) Unearned Revenue Example Yazici Advertising received 1,200 on October 2 from R. Knox for advertising services expected to be completed by December 31. Yazici credited the payment to Unearned Service Revenue. This liability account shows a balance of 1,200 in the October 31 trial balance. Demonstrate: How do you record the adjustment for advertising revenue? Adjusting Entries for Accruals 5) Accrued Revenue Example In October, Yazici Advertising performed services worth 200 that were not billed to clients on or before October 31. Because these services were not billed, they were not recorded. Demonstrate: How do you adjust for accrued revenue? 1-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets Analyze the Adjusting Entries Understanding the Problem The image presents four types of deferrals and one type of accrualproviding examples for each and asking how to record the adjusting entrie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started