Question

(a) What is the weighted average cost of capital of CAPEX Inc.? (b) What is the NPV of Project Azure? Should you accept the project?

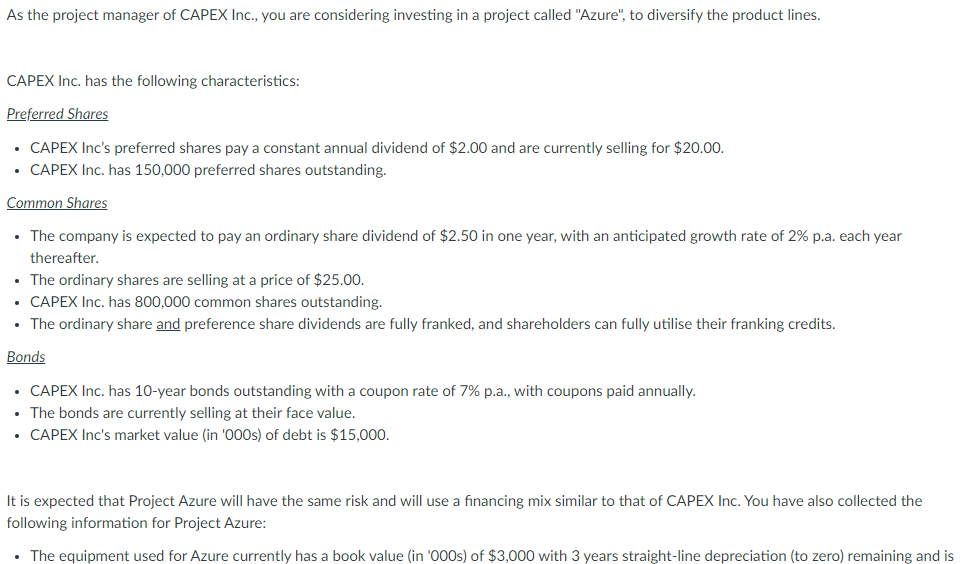

(a) What is the weighted average cost of capital of CAPEX Inc.?

(b) What is the NPV of Project Azure? Should you accept the project? Explain.

(c) Now your director says he has three other independent projects (Alpha, Beta, Gamma), each lasting for 3 years (that are not divisible), with the following characteristics (in '000s):

| Project | Initial Outlay | NPV | IRR |

| Alpha | -$1,000 | $500 | 50.46% |

| Beta | -$2,000 | $750 | 20.42% |

| Gamma | -$1,500 | $1,000 | 38.37% |

| Project Azure | ? | ? | 18.60% |

Your director says CAPEX Inc, has a total budget of $6 million only. How many project(s) should CAPEX Inc. undertake in total, including Project Azure? Is Project Azure included in your decision or not? Explain.

(d) Is your decision in part (c) wealth maximising for your shareholders or not? Explain.

PLEASE ANSWER THE SPECIFIC QUESTION THAT I ASKED BASED ON THE DATA YOU GOT FROM HERE. ANY IRRLATED ANSWERS WILL BE MARKED AS 'NOT HELPFUL'

THANK YOU FOR ANSWERING, PLEASE PROVIDE THE DETAIL OF THE CALCULATION.

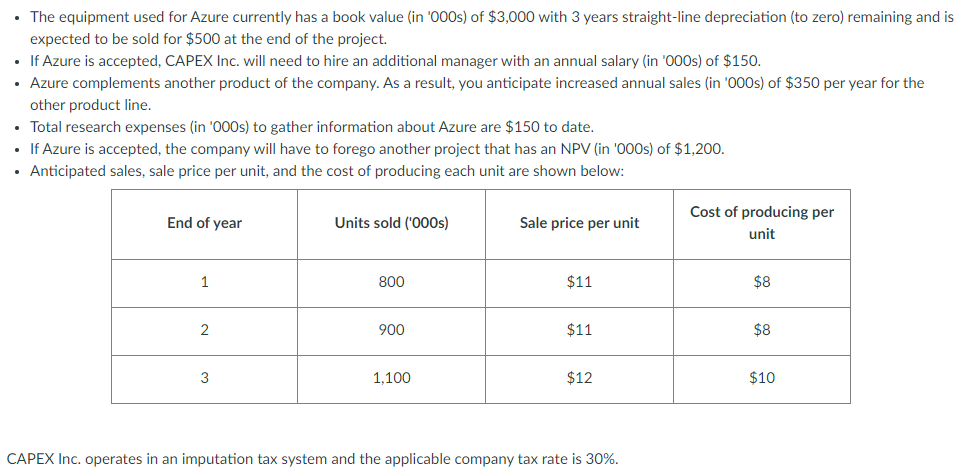

The equipment used for Azure currently has a book value (in '000s) of $3,000 with 3 years straight-line depreciation (to zero) remaining and is expected to be sold for $500 at the end of the project. If Azure is accepted, CAPEX Inc. will need to hire an additional manager with an annual salary (in '000s) of $150. Azure complements another product of the company. As a result, you anticipate increased annual sales (in '000s) of $350 per year for the other product line. Total research expenses (in '000s) to gather information about Azure are $150 to date. If Azure is accepted, the company will have to forego another project that has an NPV (in '000s) of $1,200. Anticipated sales, sale price per unit, and the cost of producing each unit are shown below: End of year Units sold ('000s) Sale price per unit Cost of producing per unit 1 800 $11 $8 2 900 $11 $8 3 1,100 $12 $10 CAPEX Inc. operates in an imputation tax system and the applicable company tax rate is 30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started