Question

(a) What is the weighted average cost of capital of CAPEX Inc.? (b) What is the NPV of Project Azure? Should you accept the project?

(a) What is the weighted average cost of capital of CAPEX Inc.?

(b) What is the NPV of Project Azure? Should you accept the project? Explain.

(c) Now your director says he has three other independent projects (Alpha, Beta, Gamma), each lasting for 3 years (that are not divisible), with the following characteristics (in '000s):

| Project | Initial Outlay | NPV | IRR |

| Alpha | -$1,000 | $500 | 50.46% |

| Beta | -$2,000 | $750 | 20.42% |

| Gamma | -$1,500 | $1,000 | 38.37% |

| Project Azure | ? | ? | 18.60% |

Your director says CAPEX Inc, has a total budget of $6 million only. How many project(s) should CAPEX Inc. undertake in total, including Project Azure? Is Project Azure included in your decision or not? Explain.

(d) Is your decision in part (c) wealth maximising for your shareholders or not? Explain.

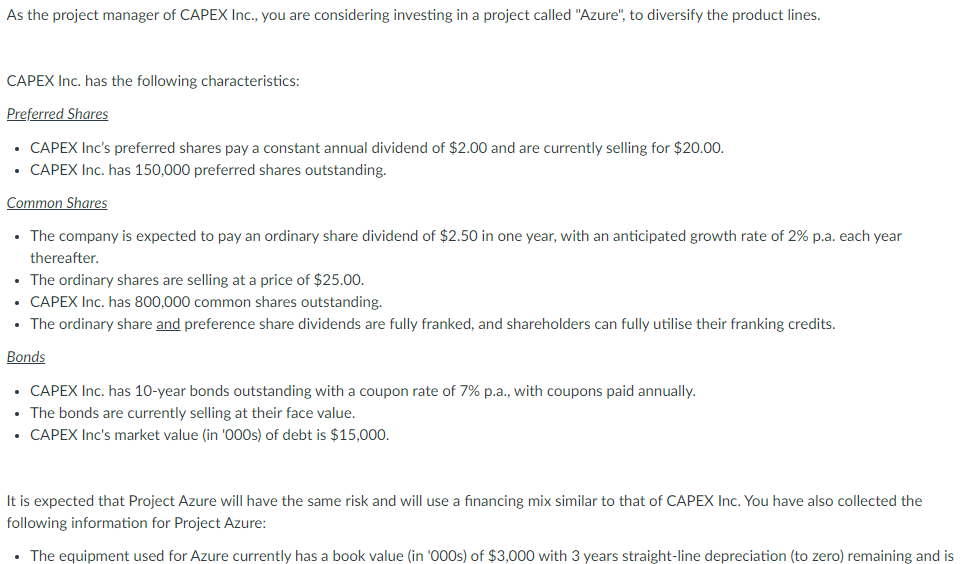

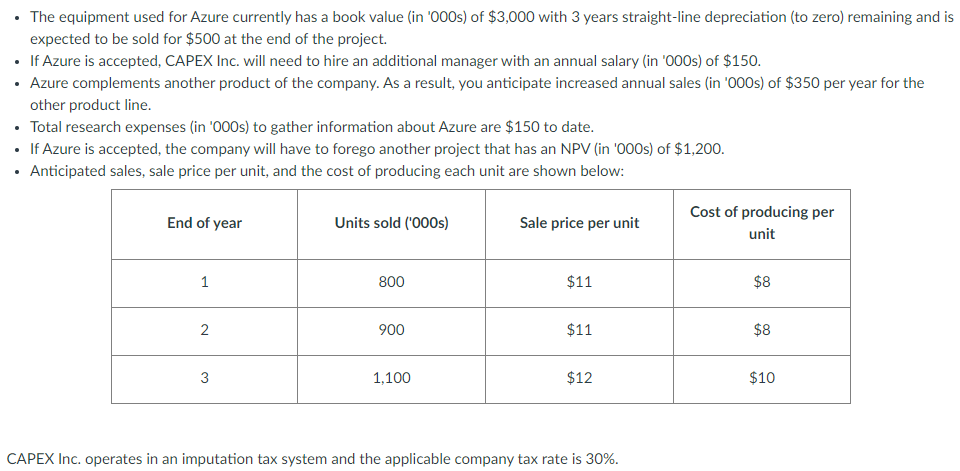

As the project manager of CAPEX Inc., you are considering investing in a project called "Azure", to diversify the product lines. CAPEX Inc. has the following characteristics: Preferred Shares CAPEX Inc's preferred shares pay a constant annual dividend of $2.00 and are currently selling for $20.00. CAPEX Inc. has 150,000 preferred shares outstanding. Common Shares The company is expected to pay an ordinary share dividend of $2.50 in one year, with an anticipated growth rate of 2% p.a. each year thereafter. The ordinary shares are selling at a price of $25.00. CAPEX Inc. has 800,000 common shares outstanding. The ordinary share and preference share dividends are fully franked, and shareholders can fully utilise their franking credits. Bonds CAPEX Inc. has 10-year bonds outstanding with a coupon rate of 7% p.a., with coupons paid annually. The bonds are currently selling at their face value. CAPEX Inc's market value in '000s) of debt is $15,000. It is expected that Project Azure will have the same risk and will use a financing mix similar to that of CAPEX Inc. You have also collected the following information for Project Azure: The equipment used for Azure currently has a book value (in '000s) of $3,000 with 3 years straight-line depreciation (to zero) remaining and isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started