Answered step by step

Verified Expert Solution

Question

1 Approved Answer

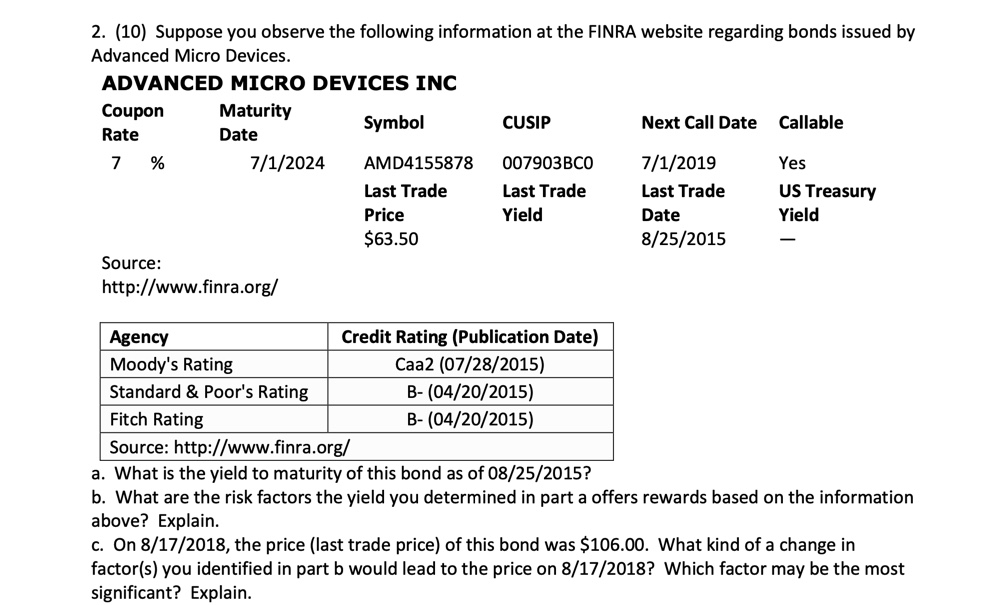

a. What is the yield to maturity of this bond as of 08/25/2015? b. What are the risk factors the yield you determined in part

a. What is the yield to maturity of this bond as of 08/25/2015?

b. What are the risk factors the yield you determined in part a offers rewards based on the information above? Explain.

c. On 8/17/2018, the price (last trade price) of this bond was $106.00. What kind of a change in factor(s) you identified in part b would lead to the price on 8/17/2018? Which factor may be the most significant? Explain.

2. (10) Suppose you observe the following information at the FINRA website regarding bonds issued by Advanced Micro Devices. ADVANCED MICRO DEVICES INC Maturity Date Coupon Rate 7 % Source: 7/1/2024 http://www.finra.org/ Agency Moody's Rating Standard & Poor's Rating Symbol AMD4155878 Last Trade Price $63.50 CUSIP 007903BC0 Last Trade Yield Credit Rating (Publication Date) Caa2 (07/28/2015) B- (04/20/2015) B- (04/20/2015) Next Call Date Callable 7/1/2019 Last Trade Date 8/25/2015 Yes US Treasury Yield Fitch Rating Source: http://www.finra.org/ a. What is the yield to maturity of this bond as of 08/25/2015? b. What are the risk factors the yield you determined in part a offers rewards based on the information above? Explain. c. On 8/17/2018, the price (last trade price) of this bond was $106.00. What kind of a change in factor(s) you identified in part b would lead to the price on 8/17/2018? Which factor may be the most significant? Explain.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the yield to maturity of the bond as of 08252015 we need more information such as the current market price of the bond and the bonds ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started