Question

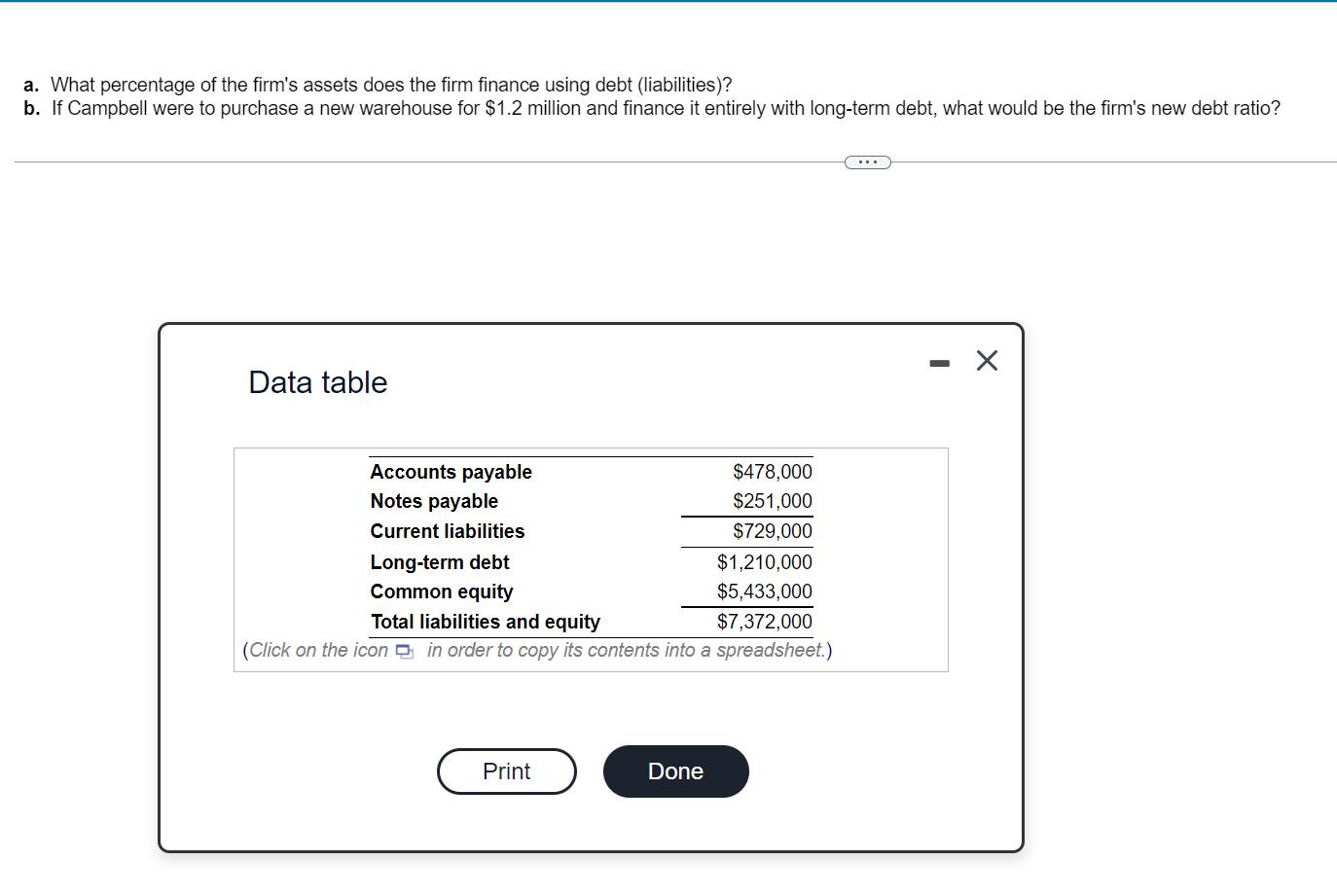

a. What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for

a. What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.2 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? Data table Accounts payable Notes payable Current liabilities Long-term debt Common equity $1,210,000 $5,433,000 Total liabilities and equity $7,372,000 (Click on the icon in order to copy its contents into a spreadsheet.) Print $478,000 $251,000 $729,000 Done (... X

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the percentage of the firms assets financed with debt we need to calculate the debt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Principles and Applications

Authors: Sheridan Titman, Arthur J. Keown, John H. Martin

13th edition

134417216, 978-0134417509, 013441750X, 978-0134417219

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App