Answered step by step

Verified Expert Solution

Question

1 Approved Answer

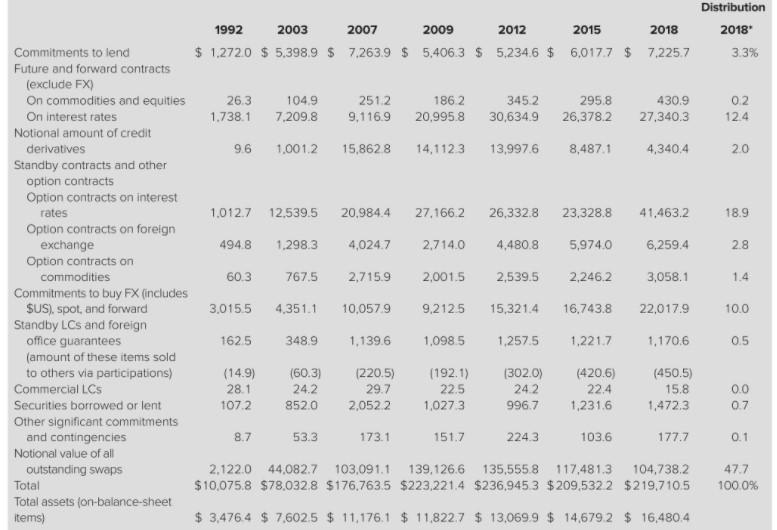

a. What was the average annual growth rate in OBS total commitments over the period 19922018? b. What categories of contingencies have had the highest

a. What was the average annual growth rate in OBS total commitments over the period 19922018?

b. What categories of contingencies have had the highest annual growth rates?

c. What factors are credited for the significant growth in derivative securities activities by banks?

Distribution 2018 3.3% 02 12.4 20 18.9 2.8 1992 2003 2007 2009 2012 2015 2018 Commitments to lend $ 1,2720 $ 5.398.9 $ 7.263.9 $ 5,406.3 $ 5.234.6 $ 6,0177 $ 7,2257 Future and forward contracts (exclude FX) On commodities and equities 26.3 1049 2512 186 2 3452 295.8 430.9 On interest rates 1.738.1 7,209.8 9,116.9 20,995.8 30,634.9 26,378.2 27,340.3 Notional amount of credit derivatives 9.6 1,0012 15,8628 14.1123 13,997.6 8,487.1 4,340.4 Standby contracts and other option contracts Option contracts on interest rates 1.012.7 12.539.5 20.984.4 27.1662 26,332.8 23,328.8 41,463.2 Option contracts on foreign exchange 4948 1,298.3 4,0247 2,714.0 4.480.8 5,9740 6,259.4 Option contracts on commodities 60.3 767.5 2,715.9 2,001.5 2,539.5 2,246.2 3,058.1 Commitments to buy FX (includes SUS), spot, and forward 3,015.5 4.351.1 10.0579 9,2125 15,321.4 16.743.8 22,017.9 Standby LCs and foreign office guarantees 1625 348.9 1.139.6 1.098.5 1,2575 1,221.7 1,170.6 (amount of these items sold to others via participations) (14.9) (60.3) (220.5) (192.1) (302.0) (420.6) (450.5) Commercial LCS 28.1 242 29.7 22.5 242 22.4 15.8 Securities borrowed or lent 1072 8520 2,0522 1,0273 996.7 1,231.6 1,472.3 Other significant commitments and contingencies 8.7 53.3 173.1 151.7 2243 103.6 177.7 Notional value of all outstanding swaps 2.122.0 44,082.7 103,091.1 139,126.6 135,555.8 117,481.3 104,738.2 Total $10,075.8 $78,0328 $176.763.5 $223,221.4 $236.9453 $ 209,5322 $219.710.5 Total assets (on-balance-sheet items) $ 3,4764 $ 7.6025 $ 11,176.1 $ 11.822.7 $ 13,069.9 $ 14,679 2 $ 16,480.4 1.4 10.0 0.5 0.0 0.7 0.1 47.7 100.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started