Answered step by step

Verified Expert Solution

Question

1 Approved Answer

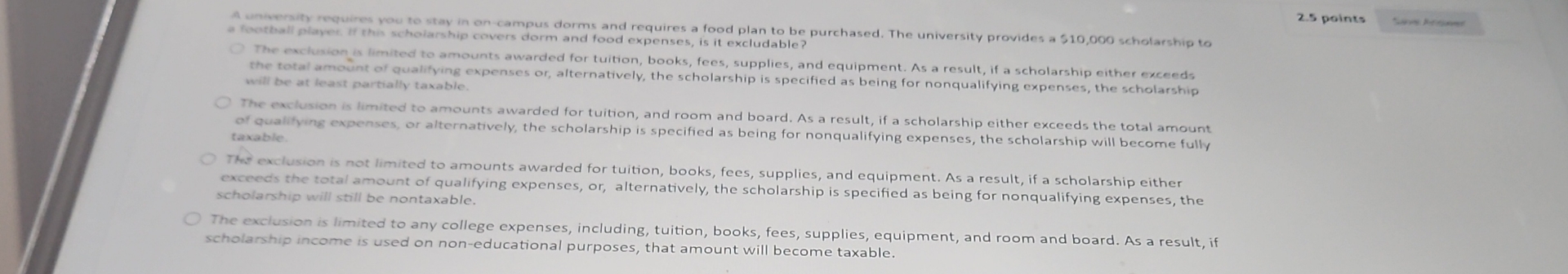

A whernity requires you to stay in on campus dorms and requires a food plan to be purchased. The university provides a 5 1 0

A whernity requires you to stay in on campus dorms and requires a food plan to be purchased. The university provides a scholarship to

a korthall playes, it this scholarship covers dorm and food expenses, is it excludable?

The exchusion is limited to amounts awarded for twition, books, fees, supplies, and equipment. As a result, if a scholarship either exceeds

the total amount of qualifing expenses or alternatively, the scholarship is specified as being for nonqualifying expenses, the scholarship

will be at least partially taxable.

The exclusion is limited to amounts awarded for tuition, and room and board. As a result, if a scholarship either exceeds the total amount

of quakhying expenses, or alternatively, the scholarship is specified as being for nonqualifying expenses, the scholarship will become fully

taxable.

Then makum is not himited to amounts awarded for tuition, books, fees, supplies, and equipment. As a result, if a scholarship either

cxceeds the total amount of qualifying expenses, or alternatively, the scholarship is specified as being for nonqualifying expenses, the

scholarship will still be nontaxable.

The exclusion is limited to any college expenses, including, tuition, books, fees, supplies, equipment, and room and board. As a result, if

scholarship income is used on noneducational purposes, that amount will become taxable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started