Question

As investors go increasingly global and market turbulence grows, stock-index futures are emerging as the favorite way for nimble money managers to deploy their funds.

As investors go increasingly global and market turbulence grows, stock-index futures are emerging as the favorite way for nimble money managers to deploy their funds. Indeed, in most major markets, trading in stock futures now exceeds the buying and selling of actual shares.

For instance, by selling futures equal to the underlying portfolio, a manager can completely insulate a portfolio from market moves. Say a manager succeeds in outperforming the market, but still loses 2.75% while the market as a whole falls 12%. Hedging with futures would capture that margin of out-performance, transforming the loss into a profit of roughly 9.25%. You are provided the information outlined as follows:

Scenario 1: A fixed-income manager holding a $25 million market value position of US Treasury 15 4/5% bonds maturing 3 July, 2030, expects the economic growth rate and the inflation rate to be above market expectations in the near future. Institutional rigidities prevent any existing bonds in the portfolio from being sold in the cash market.

Scenario 2: The treasurer of Airbus has recently become convinced that interest rates will decline in the near future. She believes it is an opportune time to purchase her companys sinking fund bonds in advance of requirements because these bonds are trading at a discount from par value. She is preparing to purchase in the open market $25 million par value Airbus 16 11/20% bonds maturing 3 July, 2025. A $25 million par value position of these bonds is currently offered in the open market at 95.Unfortunately, the treasurer must obtain approval from the board of directors for such a purchase, and this approval process can take up to 3 months. The board of directors approval in this instance is only a formality.

QUESTIONS

(i) Explain to the management of Airbus how interest rate and currency swaps work.

(ii) For each of these two scenarios, demonstrate how interest rate risk can be hedged using the Treasury bond futures contract. Show all calculations.

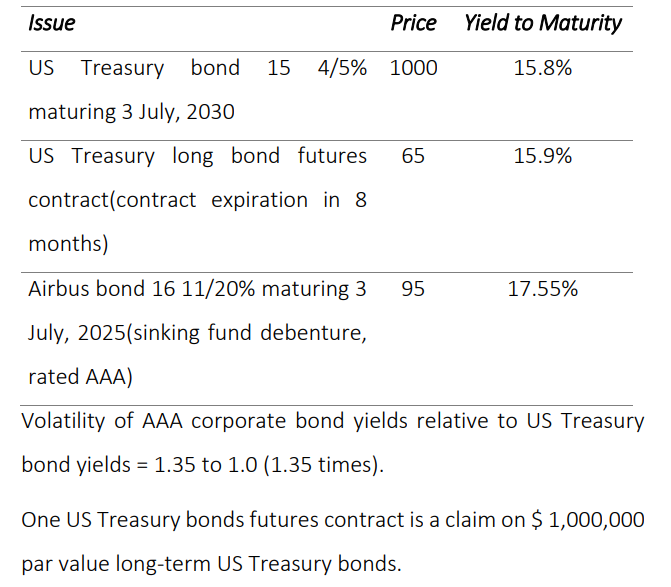

Issue Price Yield to Maturity US Treasury bond 15 4/5% 1000 15.8% maturing 3 July, 2030 US Treasury long bond futures 65 15.9% contract(contract expiration in 8 months) Airbus bond 16 11/20% maturing 3 95 17.55% July, 2025(sinking fund debenture, rated AAA) Volatility of AAA corporate bond yields relative to US Treasury bond yields = 1.35 to 1.0 (1.35 times). One US Treasury bonds futures contract is a claim on $ 1,000,000 par value long-term US Treasury bondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started