Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Will the new system make money for Mind Your Own Business Bank in the first year? b) Suppose that in the second year, $10,000

a) Will the new system make money for Mind Your Own Business Bank in the first year?

b) Suppose that in the second year, $10,000 is required to maintain and update the software. Two employees are still needed to operate the software in year 2. 99% of your customers keep up with their payments again. Is the system now making money? (Assume that only 94% of customers would have paid without the software.)

c. If subsequent years resemble year 2, is it worthwhile to buy the software? What other factors might influence your decision?

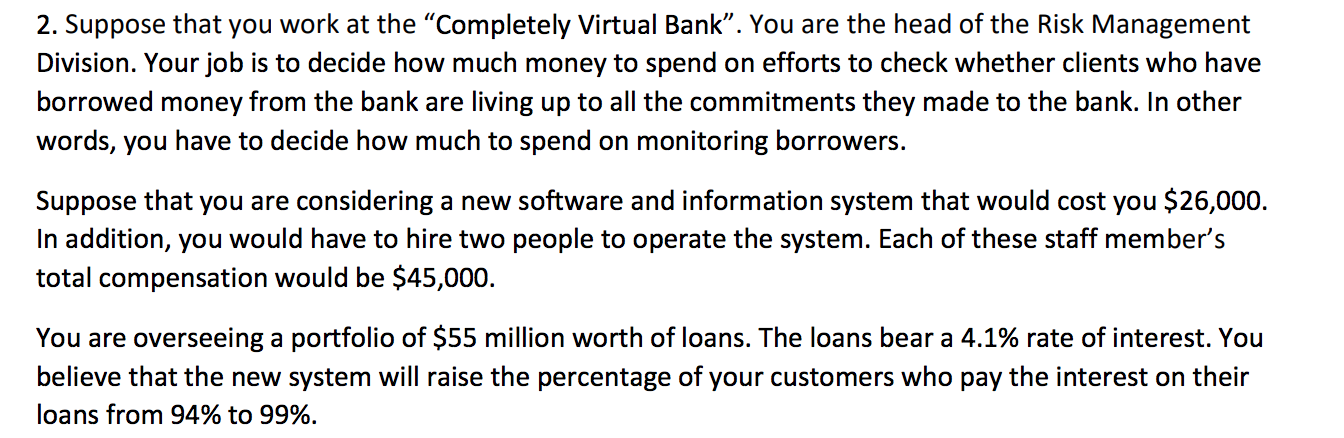

2. Suppose that you work at the Completely Virtual Bank. You are the head of the Risk Management Division. Your job is to decide how much money to spend on efforts to check whether clients who have borrowed money from the bank are living up to all the commitments they made to the bank. In other words, you have to decide how much to spend on monitoring borrowers. Suppose that you are considering a new software and information system that would cost you $26,000. In addition, you would have to hire two people to operate the system. Each of these staff member's total compensation would be $45,000. You are overseeing a portfolio of $55 million worth of loans. The loans bear a 4.1% rate of interest. You believe that the new system will raise the percentage of your customers who pay the interest on their loans from 94% to 99%. 2. Suppose that you work at the Completely Virtual Bank. You are the head of the Risk Management Division. Your job is to decide how much money to spend on efforts to check whether clients who have borrowed money from the bank are living up to all the commitments they made to the bank. In other words, you have to decide how much to spend on monitoring borrowers. Suppose that you are considering a new software and information system that would cost you $26,000. In addition, you would have to hire two people to operate the system. Each of these staff member's total compensation would be $45,000. You are overseeing a portfolio of $55 million worth of loans. The loans bear a 4.1% rate of interest. You believe that the new system will raise the percentage of your customers who pay the interest on their loans from 94% to 99%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started