help!

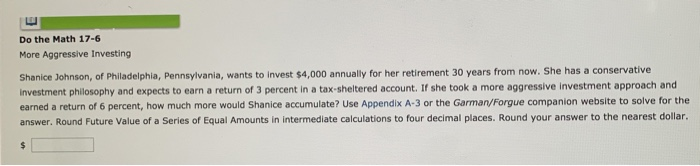

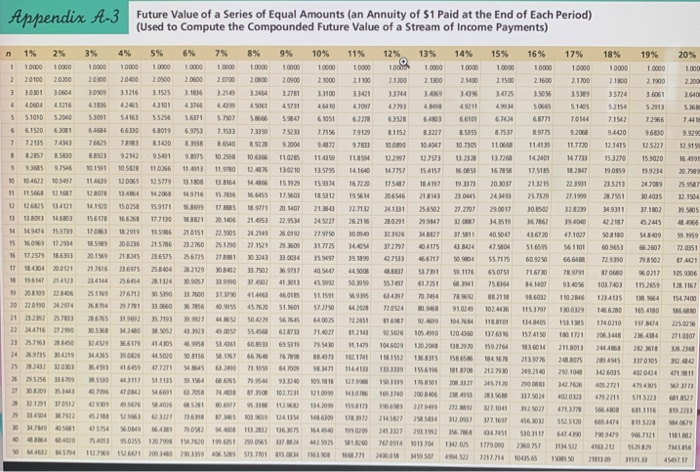

Do the Math 17-6 More Aggressive Investing Shanice Johnson, of Philadelphia, Pennsylvania, wants to invest $4,000 annually for her retirement 30 years from now. She has a conservative Investment philosophy and expects to earn a return of 3 percent in a tax-sheltered account. If she took a more aggressive investment approach and earned a return of 6 percent, how much more would Shanice accumulate? Use Appendix A-3 or the Garman/Forgue companion website to solve for the answer. Round Future Value of a Series of Equal Amounts in intermediate calculations to four decimal places. Round your answer to the nearest dollar. $ Appendix A-3 Future Value of a Series of Equal Amounts (an Annuity of S1 Paid at the end of each Period) (Used to Compute the Compounded Future Value of a Stream of Income Payments) 75 12% 15% 17% 11% 10000 2.1100 33401 13% 10000 2.1300 16% 10000 2. 16:00 18% 10000 2.1800 20% 1.000 10000 19% 10000 2.1900 20900 2.100 2.1.200 33744 3 2.1700 35389 2.200 3540 HAZE 3.5056 3.5724 900 VIOS 56 47001 6.2278 2.1500 3.05 49934 6.744 8.7537 11.0668 WS 51405 7,014 3.6061 5.2012 7.2966 96800 4011 6.6100 8.5955 10.7305 02 7.41 63528 8.1152 1000 12.2997 6.8771 8.9773 1141 7.1542 94420 9.9293 12,919 117730 12729 125227 15.9020 199234 16.4991 64803 8.3227 194911 12.7573 154157 184197 2181) 256502 147757 7.9129 9713 11.8994 14.1640 167220 195614 22.7132 26.11 20.7989 14.7733 18287 22.3901 7.19 167858 20.02 24493 CE 12.1415 15320 19.0859 23.5213 23.7551 349311 1933 14 01 17.5185 21.125 257329 30.8502 36.7862 416720 207089 304035 205 206516 201331 280291 27.2707 25.9587 32.1504 5805 13.4566 59.359 72.0351 9847 37.1802 15.2445 53-609 34 3519 40.500 323925 372797 37.5811 3804 47.50 n 1% 2% 3% 4% 5% 8% 9% 10% 1 10000 10000 10000 10000 1.0000 1 000 10000 10000 2 20100 2.0000 20300 2.0400 2.0500 2.0600 2.0000 2.000 3 30201 30 3.1216 3.1515 3106 3.271 33100 4 04 13101 43106 40 45711 46410 5 5.1010 5.3091 5.4163 55256 56371 5.70 5.90 6.1051 66.1520 6.301 6.4584 66330 68019 6.9753 7.1533 73390 7.5230 7.7156 7 7205 7434) 8.1420 83138 BO 9.2004 9.6872 8 82857 85830 8803 9501 9.2575 10. 10.6306 11.025 11.359 9 10.1991 105828 110266 11.50 12:48 13.0210 13.5795 114 120061 12.5779 13.18 13.164 1. 15.1929 15.934 11 123000 13:44 14.103 9716 15.30 17.500 185312 12 126825334121 14.1900 15.0258 15.9171 17.5 07 20.1407 21.3843 13 8093546803 156178 1668 17.7130 138821 21.4953 22.9534 245227 1944 15 170 18.2919 210151 270750 15 16.099 172934 18599 215786 23 2760 25.10 27.1521 29.3609 317725 16 17.257916) 20.12 218245 256725 30.3043 33.0034 35.9497 17 18.00 700121 258404 232129 33.7502 40 1864 11 20.1124 14502 45.92 1203199 200 25.119 276712 30.5.190 33.7600 46.015 SL150 20 2010 2014 33.000 35.7856 51.01 57.220 21 2022 2001 1902 35.7193 50 56 22471627290 30538 34360 5052 55.4568 62871 71.4027 23 257163 324129 36 6179 414105 69.531 29.5410 24975304219 5000 767890 25 202 203 545 23.109 34.7009 98.3471 295256 36709 51.1135 99.1964 7.9541 93.240 109.818 27 103 140 47042 546001 . 87.30 102.7231 210090 102 14016 9.3 112 114 1.45042 12663 16 31419 WM90 M9 02 0812160 1640040 0400 5035 103 11020 10 90 MM 4611 1127 11 20 19 6 5737701 151 51.6595 422187 508180 60.9653 72.990 47 10.4175 166717 53.791 47.1037 54. 1101 66.6468 78971 66.2607 79.8502 60.9050 17421 1009 344054 39.1899 400 50 250 69 2000 2251 59.1176 OSBE 716730 841400 110 2016 96.0217 121167 U14 1547400 165.4780 TO 557175 65.0751 75.354 88.2118 1024436 11110101 137.631 159.2264 14N W7000 103.7403 123.405 1466780 1140210 70.784 80. 2.49 105.000 120.2018 1363115 78.9690 91020 100 120.4360 138.2970 206.14 236.4384 11210 91.1479 2.506 1045019 118192 98.6032 115.3797 114140 157.4150 183.604 21WN 19.2140 2900 1375024 21021 2414868 2710307 219 480 01011 B0105 2118013 208.8075 292.100 140766 10201 09 59999 16015 4052721 145.7120 176 8901 200386 10930 10 W 5715223 GH 1116 785014 456012 094474 1979 119 112.00 156. 12.05 127.1041 171692 047451 1779.000 7212.714 512.5120 647AMO 530.1111 101413704 50 OP M IL 110212 2013 100S Somo