Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Wrybill Ltd has an outstanding perpetual bond with a 6 percent coupon rate. The bonds make semi-annual coupon payments. There is a 30 percent

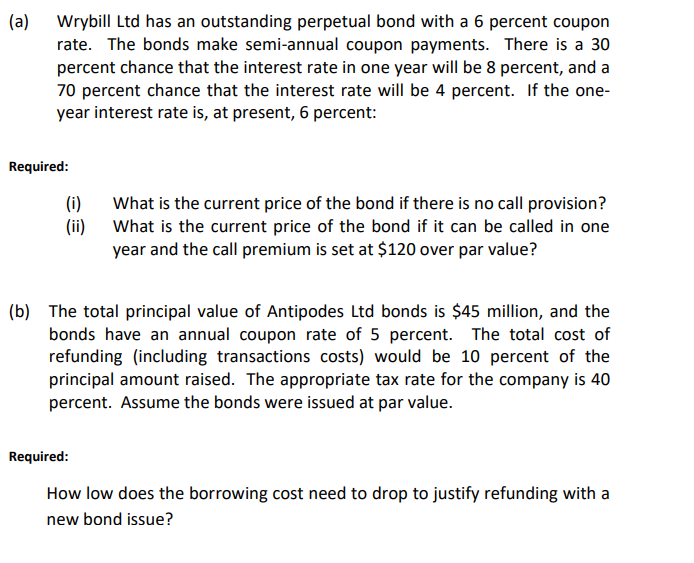

(a) Wrybill Ltd has an outstanding perpetual bond with a 6 percent coupon rate. The bonds make semi-annual coupon payments. There is a 30 percent chance that the interest rate in one year will be 8 percent, and a 70 percent chance that the interest rate will be 4 percent. If the one-year interest rate is, at present, 6 percent: Required: (i) What is the current price of the bond if there is no call provision? (ii) What is the current price of the bond if it can be called in one year and the call premium is set at $120 over par value? (b) The total principal value of Antipodes Ltd bonds is $45 million, and the bonds have an annual coupon rate of 5 percent. The total cost of refunding (including transactions costs) would be 10 percent of the principal amount raised. The appropriate tax rate for the company is 40 percent. Assume the bonds were issued at par value. Required: How low does the borrowing cost need to drop to justify refunding with a new bond issue

(a) Wrybill Ltd has an outstanding perpetual bond with a 6 percent coupon rate. The bonds make semi-annual coupon payments. There is a 30 percent chance that the interest rate in one year will be 8 percent, and a 70 percent chance that the interest rate will be 4 percent. If the one-year interest rate is, at present, 6 percent: Required: (i) What is the current price of the bond if there is no call provision? (ii) What is the current price of the bond if it can be called in one year and the call premium is set at $120 over par value? (b) The total principal value of Antipodes Ltd bonds is $45 million, and the bonds have an annual coupon rate of 5 percent. The total cost of refunding (including transactions costs) would be 10 percent of the principal amount raised. The appropriate tax rate for the company is 40 percent. Assume the bonds were issued at par value. Required: How low does the borrowing cost need to drop to justify refunding with a new bond issue Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started