Question

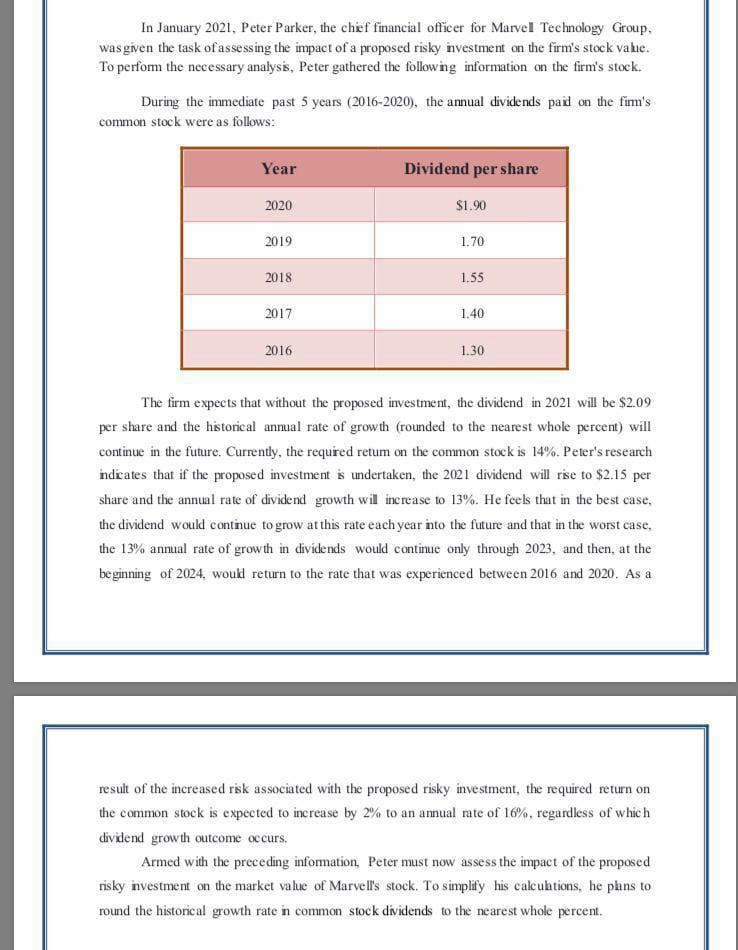

a. years Dividend Growth rate 2016 $1.30 Cost of equity (ke) 14% 2017 $1.40 Terminal growth rate (g) 10.00% 2018 $1.55 2019 $1.70 Stock price

a.

| years | Dividend | Growth rate |

|

|

|

|

|

|

|

|

|

|

| 2016 | $1.30 |

|

| Cost of equity (ke) | 14% |

| 2017 | $1.40 |

|

| Terminal growth rate (g) | 10.00% |

| 2018 | $1.55 |

|

|

|

|

| 2019 | $1.70 |

|

| Stock price formula =D2021/(Ke-g) |

|

| 2020 | $1.90 |

|

|

|

|

| 2021 | $2.09 | 10.00% |

|

|

|

| Current stock Price | $52.25 |

|

|

|

|

Risky investment undertaken (best case)

| Years | Dividend |

|

|

|

| 2016 | $1.30 |

|

|

|

| 2017 | $1.40 |

| Cost of equity (ke) | 16% |

| 2018 | $1.55 |

| Terminal growth rate (g) | 13% |

| 2019 | $1.70 |

|

|

|

| 2020 | $1.90 |

| Stock price formula =D2021/(Ke-g) |

|

| 2021 | $2.15 |

|

|

|

| Current stock price | $71.67 |

|

|

|

b. after undertaking the risky investment, the company stock price has increased by around $20. So, the proposed investment is expected to have a positive impact on stockholders.

c. the proposed investment is a win win situation for both stockholders and company, so the investment should be given a green signal.

| Years | dividend | growth rate | Discounted factors = 1/(1+ke)^n | Discounted dividends |

|

|

|

| 2016 | $1.30 |

|

|

|

|

|

|

| 2017 | $1.40 |

|

|

|

| Cost of equity (ke) | 16% |

| 2018 | $1.55 |

|

|

|

| Terminal growth rate (g) | 10% |

| 2019 | $1.70 |

|

|

|

|

|

|

| 2020 | $1.90 |

|

|

|

| Stock price formula =D2021/(Ke-g) |

|

| 2021 | $2.15 | 13% | 0.86 | $1.85 |

|

|

|

| 2022 | $2.43 | 13% | 0.74 | $1.80 |

|

|

|

| 2023 | $2.74 | 13% | 0.64 | $1.76 |

|

|

|

| Terminal value | $50.26 | 10% | 0.64 | $32.20 |

|

|

|

|

|

|

| Current stock price | $37.61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In this case the stock price has reduced due to increase in discount rate, and the growth rate remaining same is 10% after 2024. So the firm should not do it. As it impacts the wealth negative | ||||

Required

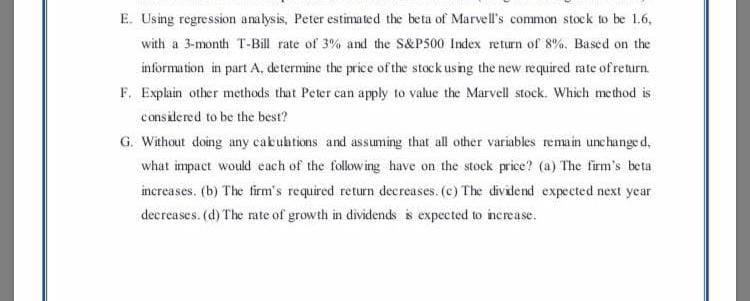

E. Using regression analysis, Peter estimated the beta of Marvell's common stock to be 16, with a 3-month T-Bill rate of 3% and the S&P500 Index return of 8%. Based on the information in part A, determine the price of the stock usng the new required rate of return. F. Explain other methods that Peter can apply to value the Marvell stock. Which method is considered to be the best? G. Without doing any cakuhtions and assuming that all other variables remain unchanged. what impact would each of the following have on the stock price? (a) The firm's beta increases, (b) The firm's required return decreases. (c) The divdend expected next year decreases. (d) The rate of growth in dividends is expected to increase: E. Using regression analysis, Peter estimated the beta of Marvell's common stock to be 16, with a 3-month T-Bill rate of 3% and the S&P500 Index return of 8%. Based on the information in part A, determine the price of the stock usng the new required rate of return. F. Explain other methods that Peter can apply to value the Marvell stock. Which method is considered to be the best? G. Without doing any cakuhtions and assuming that all other variables remain unchanged. what impact would each of the following have on the stock price? (a) The firm's beta increases, (b) The firm's required return decreases. (c) The divdend expected next year decreases. (d) The rate of growth in dividends is expected to increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started