Answered step by step

Verified Expert Solution

Question

1 Approved Answer

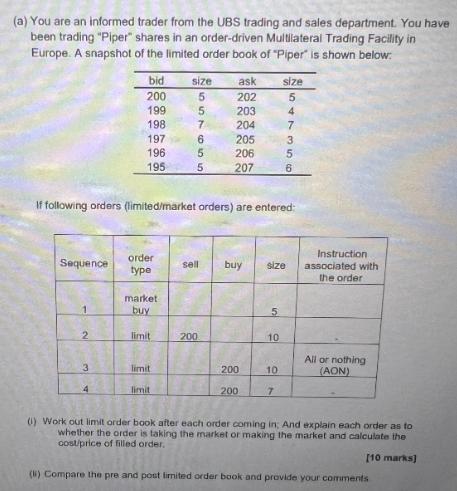

(a) You are an informed trader from the UBS trading and sales department. You have been trading Piper shares in an order-driven Multilateral Trading

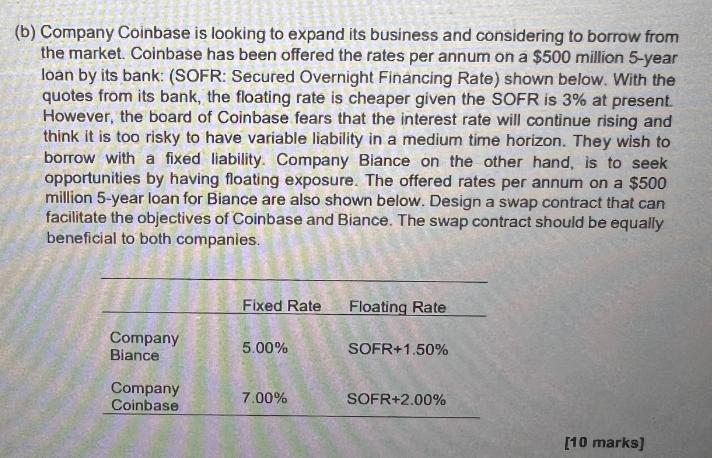

(a) You are an informed trader from the UBS trading and sales department. You have been trading "Piper" shares in an order-driven Multilateral Trading Facility in Europe. A snapshot of the limited order book of "Piper" is shown below: Sequence 1 N. 2 3 bid 200 4 199 198 197 196 195 order type market buy If following orders (limited/market orders) are entered: limit limit 2557655 limit size sell ask 202 200 203 204 205 206 207 200 200 buy size 5 10 size 10 547356 7 Instruction associated with the order All or nothing (AON) () Work out limit order book after each order coming in; And explain each order as to whether the order is taking the market or making the market and calculate the cost/price of filled order. [10 marks] (i) Compare the pre and post limited order book and provide your comments (b) Company Coinbase is looking to expand its business and considering to borrow from the market. Coinbase has been offered the rates per annum on a $500 million 5-year loan by its bank: (SOFR: Secured Overnight Financing Rate) shown below. With the quotes from its bank, the floating rate is cheaper given the SOFR is 3% at present. However, the board of Coinbase fears that the interest rate will continue rising and think it is too risky to have variable liability in a medium time horizon. They wish to borrow with a fixed liability. Company Biance on the other hand, is to seek opportunities by having floating exposure. The offered rates per annum on a $500 million 5-year loan for Biance are also shown below. Design a swap contract that can facilitate the objectives of Coinbase and Biance. The swap contract should be equally beneficial to both companies. Company Biance Company Coinbase 5.00% Then Fixed Rate Floating Rate 7.00% The SOFR+1.50% SOFR+2.00% [10 marks]

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

b To facilitate the objectives of Coinbase and Binance a fixedtofloating interest rate swap contract ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started