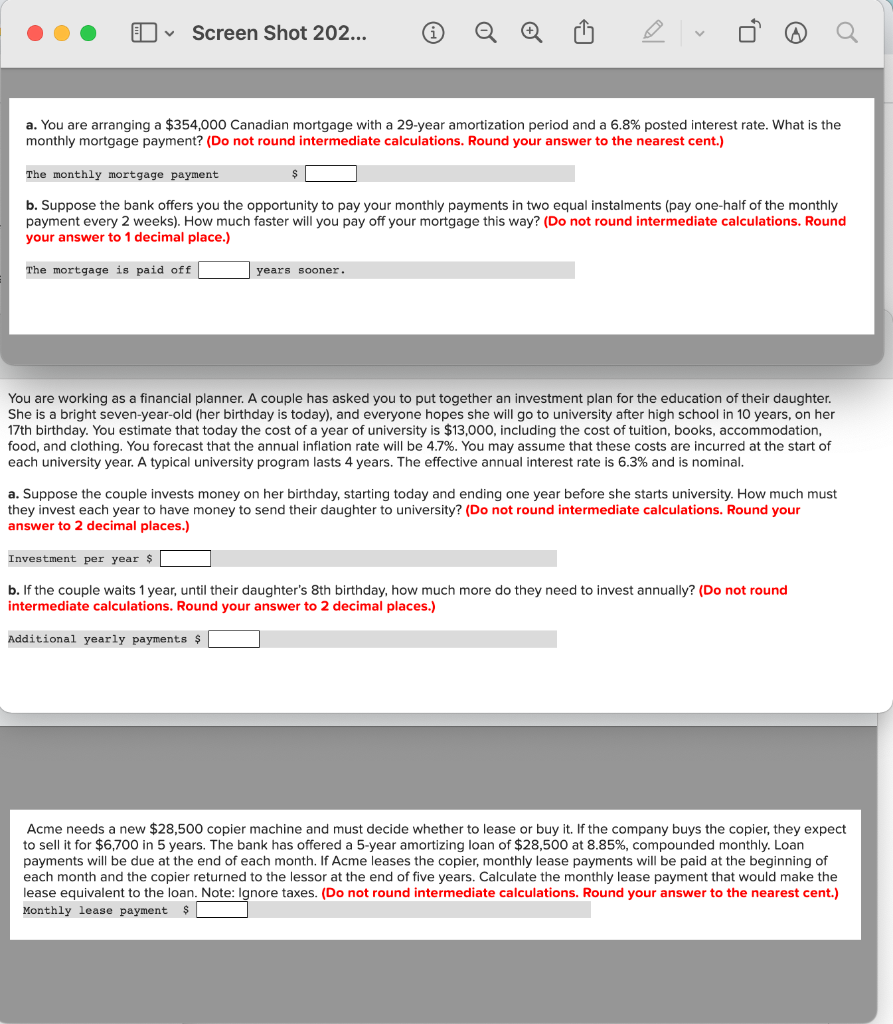

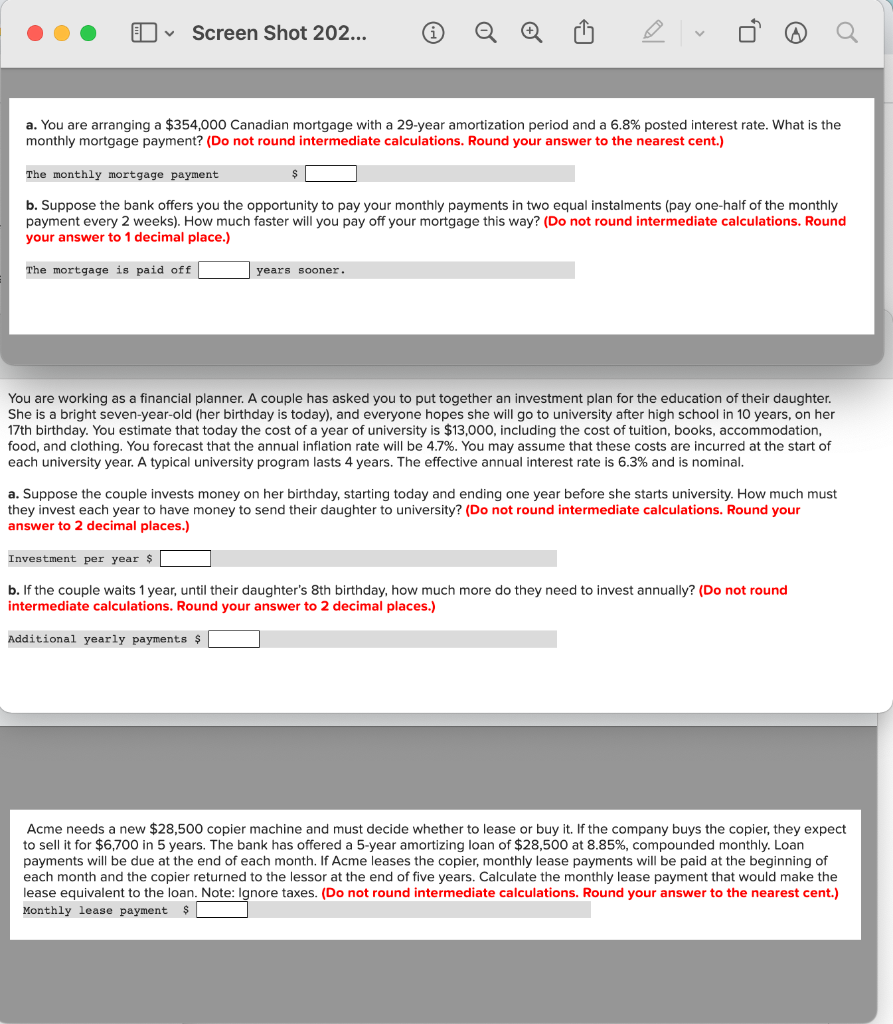

a. You are arranging a $354,000 Canadian mortgage with a 29 -year amortization period and a 6.8% posted interest rate. What is the monthly mortgage payment? (Do not round intermediate calculations. Round your answer to the nearest cent.) The monthly mortgage payment b. Suppose the bank offers you the opportunity to pay your monthly payments in two equal instalments (pay one-half of the monthly payment every 2 weeks). How much faster will you pay off your mortgage this way? (Do not round intermediate calculations. Round your answer to 1 decimal place.) The mortgage is paid off years sooner. You are working as a financial planner. A couple has asked you to put together an investment plan for the education of their daughter. She is a bright seven-year-old (her birthday is today), and everyone hopes she will go to university after high school in 10 years, on her 17 th birthday. You estimate that today the cost of a year of university is $13,000, including the cost of tuition, books, accommodation, food, and clothing. You forecast that the annual inflation rate will be 4.7%. You may assume that these costs are incurred at the start of each university year. A typical university program lasts 4 years. The effective annual interest rate is 6.3% and is nominal. a. Suppose the couple invests money on her birthday, starting today and ending one year before she starts university. How much must they invest each year to have money to send their daughter to university? (Do not round intermediate calculations. Round your answer to 2 decimal places.) per year \$ b. If the couple waits 1 year, until their daughter's 8th birthday, how much more do they need to invest annually? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Additional yearly payments $ Acme needs a new $28,500 copier machine and must decide whether to lease or buy it. If the company buys the copier, they expect to sell it for $6,700 in 5 years. The bank has offered a 5-year amortizing loan of $28,500 at 8.85%, compounded monthly. Loan payments will be due at the end of each month. If Acme leases the copier, monthly lease payments will be paid at the beginning of each month and the copier returned to the lessor at the end of five years. Calculate the monthly lease payment that would make the lease equivalent to the loan. Note: Ignore taxes. (Do not round intermediate calculations. Round your answer to the nearest cent.) Monthly lease payment $ a. You are arranging a $354,000 Canadian mortgage with a 29 -year amortization period and a 6.8% posted interest rate. What is the monthly mortgage payment? (Do not round intermediate calculations. Round your answer to the nearest cent.) The monthly mortgage payment b. Suppose the bank offers you the opportunity to pay your monthly payments in two equal instalments (pay one-half of the monthly payment every 2 weeks). How much faster will you pay off your mortgage this way? (Do not round intermediate calculations. Round your answer to 1 decimal place.) The mortgage is paid off years sooner. You are working as a financial planner. A couple has asked you to put together an investment plan for the education of their daughter. She is a bright seven-year-old (her birthday is today), and everyone hopes she will go to university after high school in 10 years, on her 17 th birthday. You estimate that today the cost of a year of university is $13,000, including the cost of tuition, books, accommodation, food, and clothing. You forecast that the annual inflation rate will be 4.7%. You may assume that these costs are incurred at the start of each university year. A typical university program lasts 4 years. The effective annual interest rate is 6.3% and is nominal. a. Suppose the couple invests money on her birthday, starting today and ending one year before she starts university. How much must they invest each year to have money to send their daughter to university? (Do not round intermediate calculations. Round your answer to 2 decimal places.) per year \$ b. If the couple waits 1 year, until their daughter's 8th birthday, how much more do they need to invest annually? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Additional yearly payments $ Acme needs a new $28,500 copier machine and must decide whether to lease or buy it. If the company buys the copier, they expect to sell it for $6,700 in 5 years. The bank has offered a 5-year amortizing loan of $28,500 at 8.85%, compounded monthly. Loan payments will be due at the end of each month. If Acme leases the copier, monthly lease payments will be paid at the beginning of each month and the copier returned to the lessor at the end of five years. Calculate the monthly lease payment that would make the lease equivalent to the loan. Note: Ignore taxes. (Do not round intermediate calculations. Round your answer to the nearest cent.) Monthly lease payment $