Question

a) You are given the following information: Share Price 16 Strike/Exercise Price 18 Risk free rate of return 2% Time to expiry 3 months In

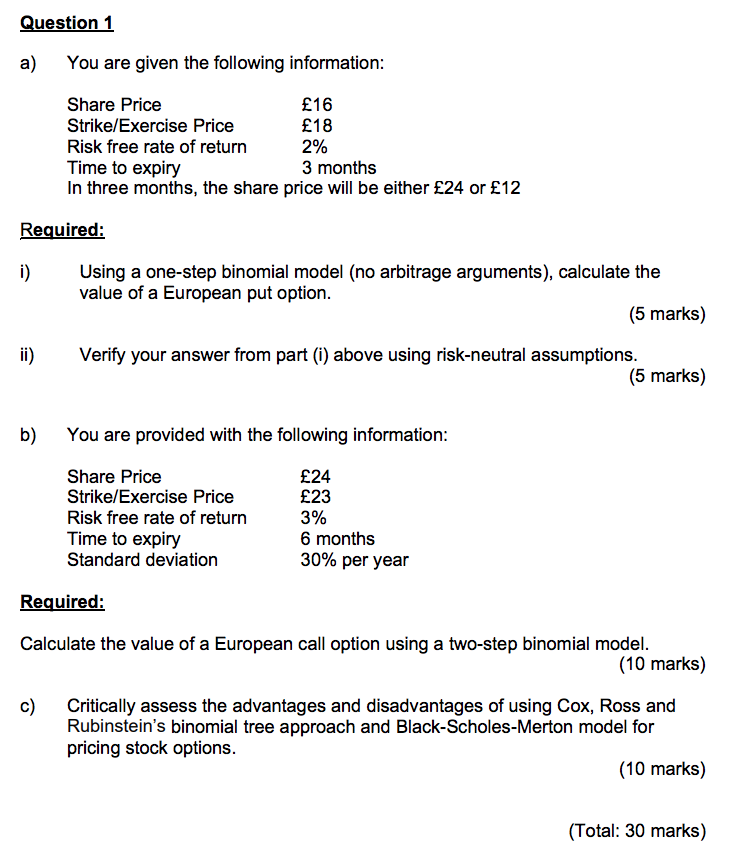

a) You are given the following information: Share Price 16 Strike/Exercise Price 18 Risk free rate of return 2% Time to expiry 3 months In three months, the share price will be either 24 or 12 Required: i) Using a one-step binomial model (no arbitrage arguments), calculate the value of a European put option. (5 marks) ii) Verify your answer from part (i) above using risk-neutral assumptions. (5 marks) b) You are provided with the following information: Share Price 24 Strike/Exercise Price 23 Risk free rate of return 3% Time to expiry 6 months Standard deviation 30% per year Required: Calculate the value of a European call option using a two-step binomial model. (10 marks) c) Critically assess the advantages and disadvantages of using Cox, Ross and Rubinsteins binomial tree approach and Black-Scholes-Merton model for pricing stock options. (10 marks) (Total: 30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started