Answered step by step

Verified Expert Solution

Question

1 Approved Answer

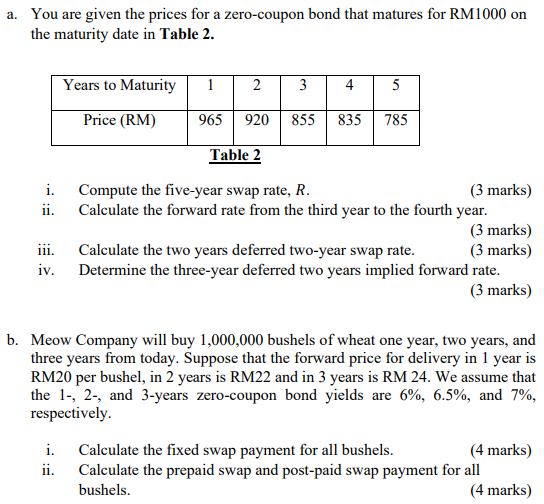

a. You are given the prices for a zero-coupon bond that matures for RM1000 on the maturity date in Table 2. 1 2 3 4

a. You are given the prices for a zero-coupon bond that matures for RM1000 on the maturity date in Table 2. 1 2 3 4 5 Years to Maturity Price (RM) 965 920 855 835 785 Table 2 i. Compute the five-year swap rate, R. (3 marks) ii. Calculate the forward rate from the third year to the fourth year. (3 marks) Calculate the two years deferred two-year swap rate. (3 marks) iv. Determine the three-year deferred two years implied forward rate. (3 marks) iii. b. Meow Company will buy 1,000,000 bushels of wheat one year, two years, and three years from today. Suppose that the forward price for delivery in 1 year is RM20 per bushel, in 2 years is RM22 and in 3 years is RM 24. We assume that the 1-, 2-, and 3-years zero-coupon bond yields are 6%, 6.5%, and 7%, respectively. i. ii. Calculate the fixed swap payment for all bushels. (4 marks) Calculate the prepaid swap and post-paid swap payment for all bushels. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started