Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) You are working on the accounting records of a business for the year ended 31 May 2018. You are looking into insurance expenses for

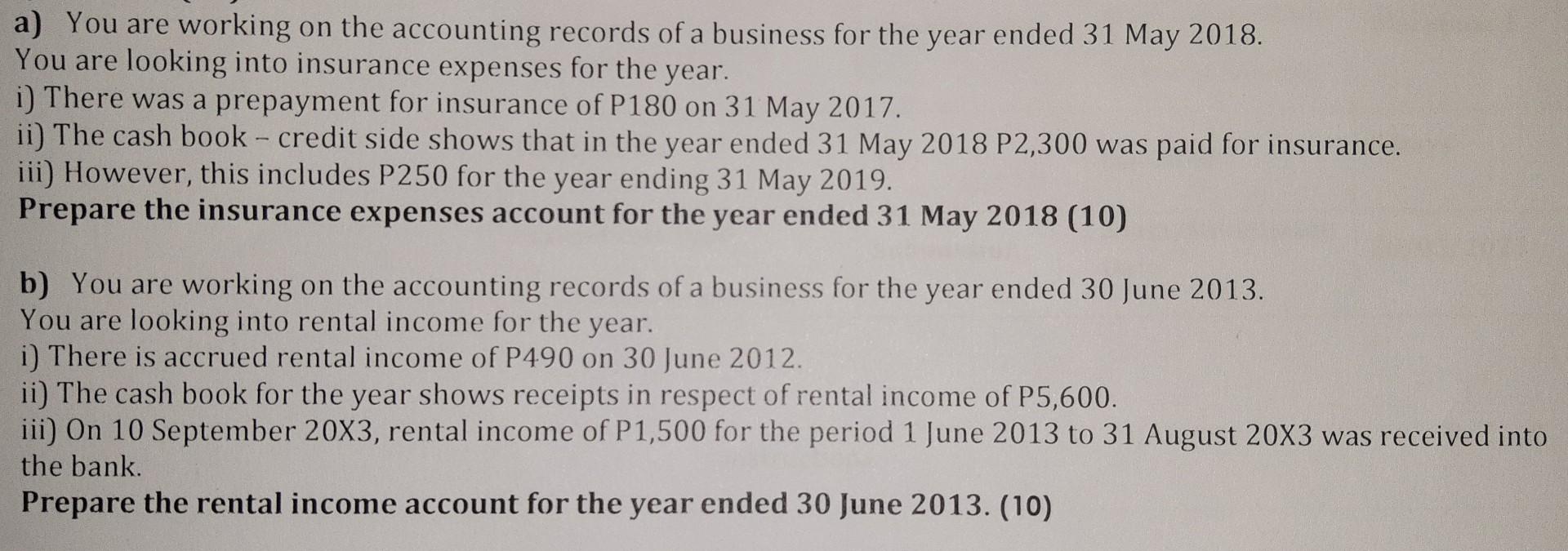

a) You are working on the accounting records of a business for the year ended 31 May 2018. You are looking into insurance expenses for the year. i) There was a prepayment for insurance of P180 on 31 May 2017. ii) The cash book - credit side shows that in the year ended 31 May 2018 P2,300 was paid for insurance. iii) However, this includes P250 for the year ending 31 May 2019. Prepare the insurance expenses account for the year ended 31 May 2018 (10) b) You are working on the accounting records of a business for the year ended 30 June 2013. You are looking into rental income for the year. i) There is accrued rental income of P490 on 30 June 2012. ii) The cash book for the year shows receipts in respect of rental income of P5,600. iii) On 10 September 20X3, rental income of P1,500 for the period 1 June 2013 to 31 August 203 was received into the bank. Prepare the rental income account for the year ended 30 June 2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started