Question

a) You invest $4,000 at the end of every year for 35-years of your career. If you want $850,000 in savings at retirement, what

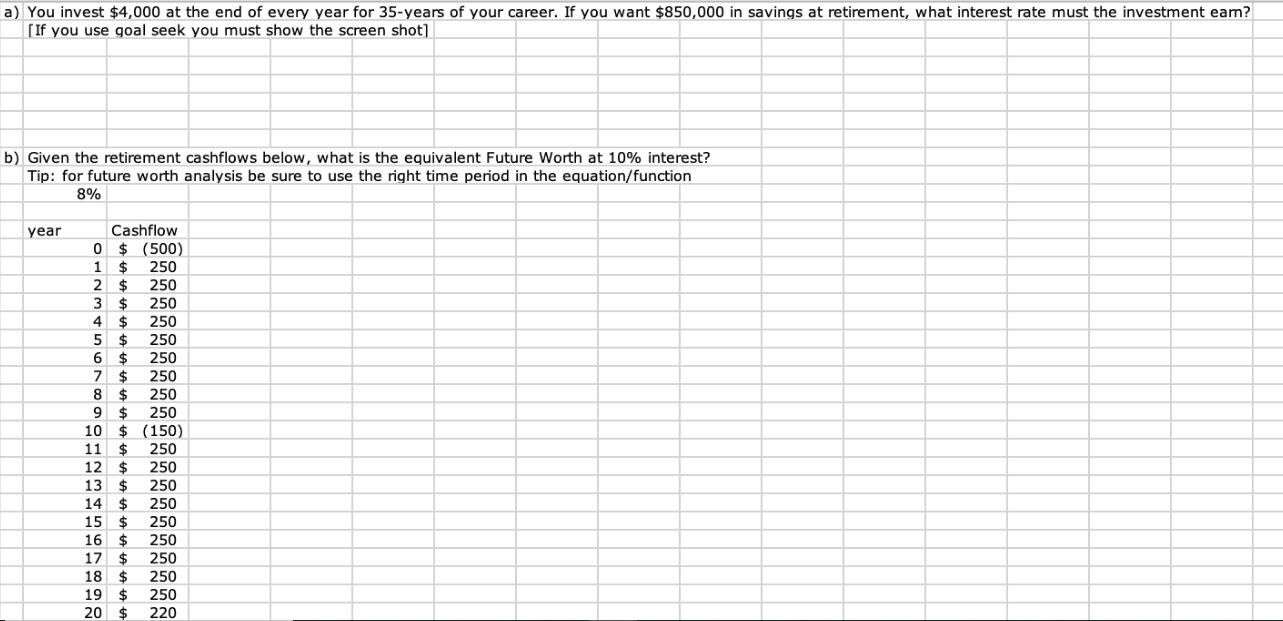

a) You invest $4,000 at the end of every year for 35-years of your career. If you want $850,000 in savings at retirement, what interest rate must the investment eam? [If you use goal seek you must show the screen shot] b) Given the retirement cashflows below, what is the equivalent Future Worth at 10% interest? Tip: for future worth analysis be sure to use the right time period in the equation/function 8% year Cashflow 0 $ (500) 1 $ 250 2 $ 250 3 $ 250 4 $ 250 5 $ 250 6 $ 250 7 $ 250 8 $ 250 9 $ 250 10 $ (150) 11 $ 250 12 $ 250 13 $ 250 14 $ 250 15 $ 250 16 $ 250 17 $ 250 18 $ 250 19 $ 250 20 $ 220

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the interest rate required to achieve a savings goal of 850000 at retirement given an annual investment of 4000 for 35 years we can use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance Turning Money into Wealth

Authors: Arthur J. Keown

8th edition

134730364, 978-0134730363

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App