Answered step by step

Verified Expert Solution

Question

1 Approved Answer

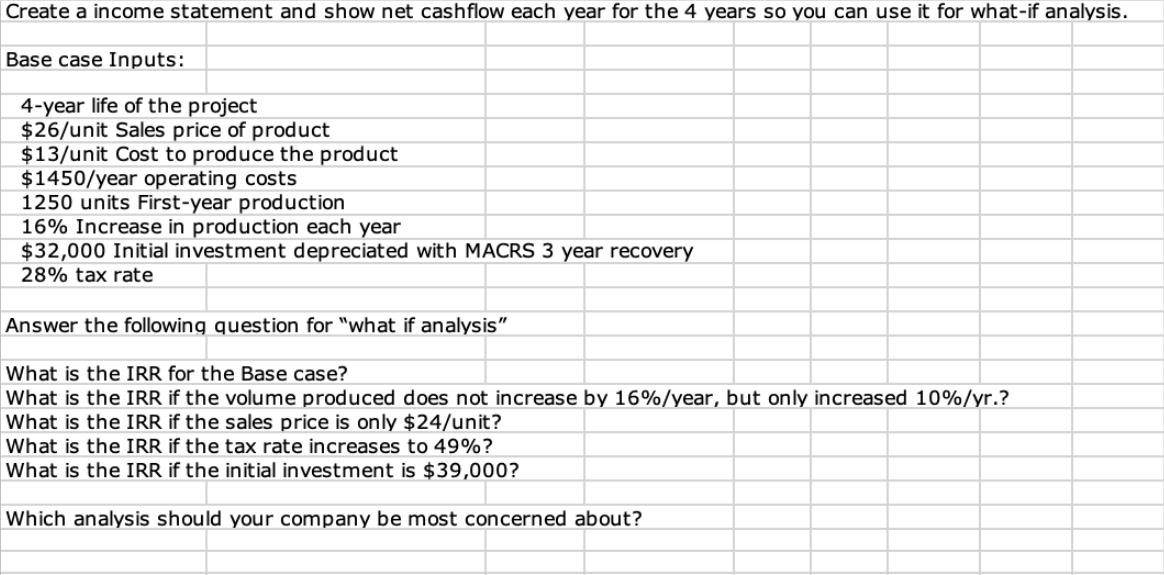

Create a income statement and show net cashflow each year for the 4 years so you can use it for what-if analysis. Base case

Create a income statement and show net cashflow each year for the 4 years so you can use it for what-if analysis. Base case Inputs: 4-year life of the project $26/unit Sales price of product $13/unit Cost to produce the product $1450/year operating costs 1250 units First-year production 16% Increase in production each year $32,000 Initial investment depreciated with MACRS 3 year recovery 28% tax rate Answer the following question for "what if analysis" What is the IRR for the Base case? What is the IRR if the volume produced does not increase by 16%/year, but only increased 10%/yr.? What is the IRR if the sales price is only $24/unit? What is the IRR if the tax rate increases to 49%? What is the IRR if the initial investment is $39,000? Which analysis should your company be most concerned about?

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To perform a whatif analysis and determine the IRR for different scenarios well first need to calculate the annual cash flows for each year based on t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started