Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are working on the development of a device to automate an inspection task. This will decrease labor costs. You have been asked to

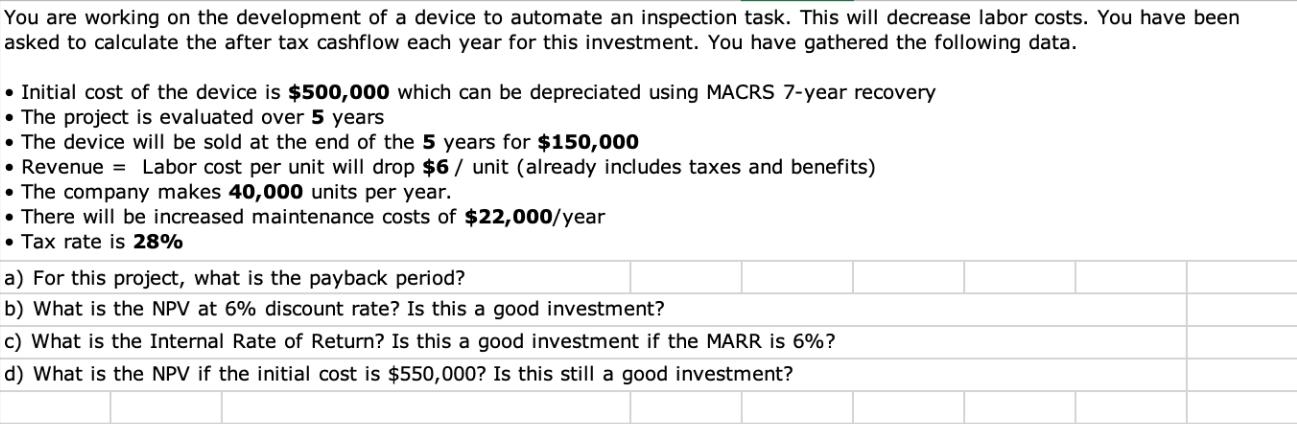

You are working on the development of a device to automate an inspection task. This will decrease labor costs. You have been asked to calculate the after tax cashflow each year for this investment. You have gathered the following data. Initial cost of the device is $500,000 which can be depreciated using MACRS 7-year recovery . The project is evaluated over 5 years . The device will be sold at the end of the 5 years for $150,000 Revenue = Labor cost per unit will drop $6/ unit (already includes taxes and benefits) The company makes 40,000 units per year. There will be increased maintenance costs of $22,000/year Tax rate is 28% a) For this project, what is the payback period? b) What is the NPV at 6% discount rate? Is this a good investment? c) What is the Internal Rate of Return? Is this a good investment if the MARR is 6%? d) What is the NPV if the initial cost is $550,000? Is this still a good investment?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Payback Period To calculate the payback period we need to determine the time it takes for the initial investment to be recovered from the cash flows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started