Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) You need to assess the validity of this proposition by calculating the following financial ratios: i) Gross profit margin ii) Operating profit margin iii)

a) You need to assess the validity of this proposition by calculating the following financial ratios:

i) Gross profit margin

ii) Operating profit margin

iii) Return of capital employed

iv) Current ratio

v) Acid test ratio

vi) Trade receivable days

vii) Trade payable days

viii) Inventory days (16 marks)

b) Interpret the ratios computed for 2021 and 2022. Further, and using the above computed ratios, advise Gower Plc whether it could grant the request made by the managing director of Ager Ltd.

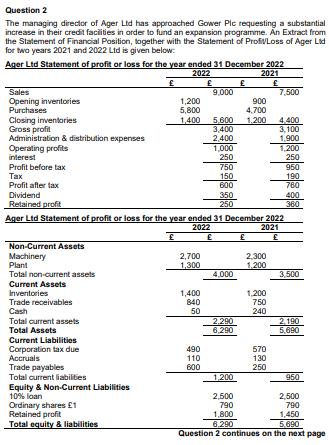

Question 2 The managing director of Ager Ltd has approached Gower Plc requesting a substantial increase in their credit facilities in order to fund an expansion programme. An Extract from the Statement of Financial Position, together with the Statement of ProfiLoss of Ager Lid for two years 2021 and 2022 Ltd is given below: Ager Ltd Statement of profit or loss for the year ended 31 December 2022 2022 2021 Sales Opening inventories Purchases Closing inventories Gross profit Administration & distribution expenses Operating profits interest Profit before tax Tax Profit after tax Dividend Retained profit Non-Current Assets Machinery Plant Total non-current assets Current Assets Inventories Trade receivables Cash Total current assets Total Assets Current Liabilities Corporation tax due Accruals Trade payables Total current liabilities Equity & Non-Current Liabilities 10% loan Ordinary shares 1 Retained profit Total equity & liabilities 1,200 5,800 1,400 2,700 1,300 Ager Ltd Statement of profit or loss for the year ended 31 December 2022 2022 2021 1,400 840 50 490 110 600 9.000 5,600 3,400 2,400 1,000 250 750 150 600 350 250 4,000 900 4,700 1,200 2,290 6,290 2,300 1,200 1,200 750 7,500 240 4,400 3,100 1,900 570 130 250 1,200 250 950 190 760 400 360 3,500 2,190 5,690 1.200 2,500 790 1,800 6,290 Question 2 continues on the next page 960 2,500 790 1,450 5.690

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started