Answered step by step

Verified Expert Solution

Question

1 Approved Answer

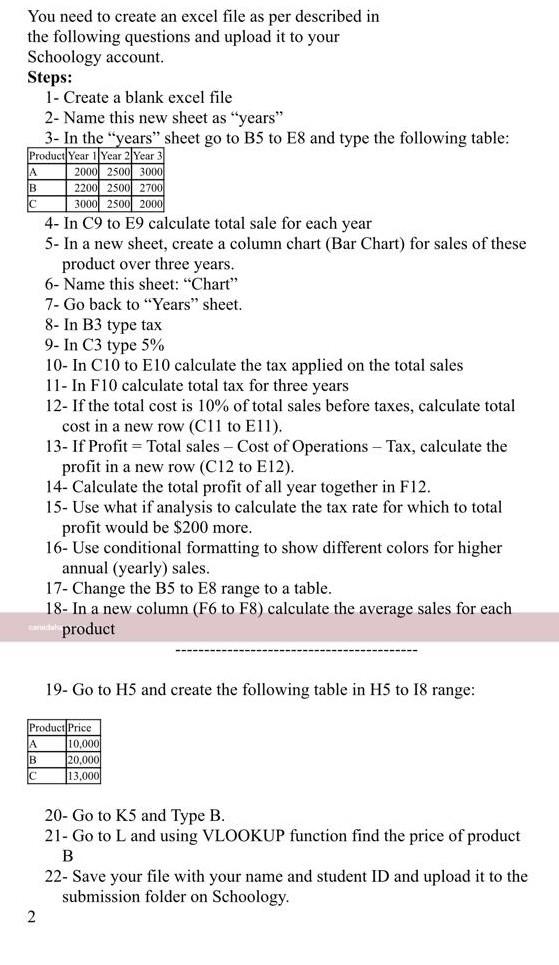

A You need to create an excel file as per described in the following questions and upload it to your Schoology account. Steps: 1 -

A You need to create an excel file as per described in the following questions and upload it to your Schoology account. Steps: 1 - Create a blank excel file 2- Name this new sheet as "years" 3- In the "years" sheet go to B5 to E8 and type the following table: Product Year 1 Year 2 Year 2000 2500 3000 2200 2500 2700 3000 2500 2000 4- In C9 to E9 calculate total sale for each year 5- In a new sheet, create a column chart (Bar Chart) for sales of these product over three years. 6- Name this sheet: "Chart" 7- Go back to "Years" sheet. 8- In B3 type tax 9- In C3 type 5% 10- In C10 to E10 calculate the tax applied on the total sales 11- In F10 calculate total tax for three years 12- If the total cost is 10% of total sales before taxes, calculate total cost in a new row (C11 to Ell). 13- If Profit = Total sales - Cost of Operations - Tax, calculate the profit in a new row (C12 to E12). 14- Calculate the total profit of all year together in F12. 15- Use what if analysis to calculate the tax rate for which to total profit would be $200 more. 16- Use conditional formatting to show different colors for higher annual (yearly) sales. 17- Change the B5 to E8 range to a table. 18- In a new column (F6 to F8) calculate the average sales for each product 19- Go to H5 and create the following table in H5 to 18 range: Product Price A 10.000 20.000 13,000 20- Go to K5 and Type B. 21- Go to L and using VLOOKUP function find the price of product B 22- Save your file with your name and student ID and upload it to the submission folder on Schoology. 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started