Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. You own all the equity of Glory Ltd. The company has no debt. The company's annual cash flow is GH1800, 000 before interest and

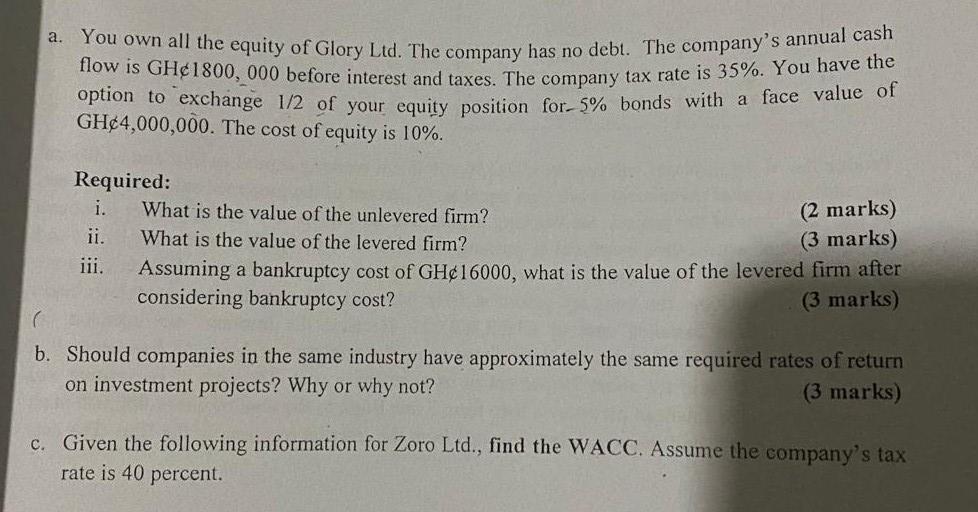

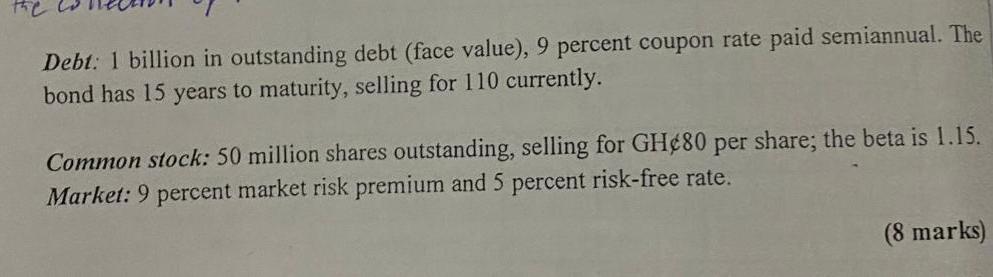

a. You own all the equity of Glory Ltd. The company has no debt. The company's annual cash flow is GH1800, 000 before interest and taxes. The company tax rate is 35%. You have the option to exchange 1/2 of your equity position for-5% bonds with a face value of GH4,000,000. The cost of equity is 10%. Required: i. What is the value of the unlevered firm? (2 marks) ii. What is the value of the levered firm? (3 marks) iii. Assuming a bankruptcy cost of GH16000, what is the value of the levered firm after considering bankruptcy cost? (3 marks) b. Should companies in the same industry have approximately the same required rates of return on investment projects? Why or why not? (3 marks) c. Given the following information for Zoro Ltd., find the WACC. Assume the company's tax rate is 40 percent. the Debt: 1 billion in outstanding debt (face value), 9 percent coupon rate paid semiannual. The bond has 15 years to maturity, selling for 110 currently. Common stock: 50 million shares outstanding, selling for GH80 per share; the beta is 1.15. Market: 9 percent market risk premium and 5 percent risk-free rate. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started