Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. You recently graduated from university, and you are preparing for your up- coming interview with an investment firm. The manager who will be

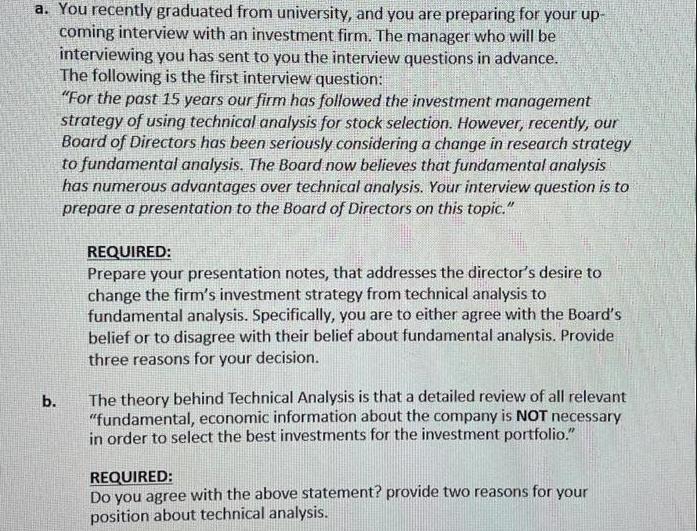

a. You recently graduated from university, and you are preparing for your up- coming interview with an investment firm. The manager who will be interviewing you has sent to you the interview questions in advance. The following is the first interview question: "For the past 15 years our firm has followed the investment management strategy of using technical analysis for stock selection. However, recently, our Board of Directors has been seriously considering a change in research strategy to fundamental analysis. The Board now believes that fundamental analysis has numerous advantages over technical analysis. Your interview question is to prepare a presentation to the Board of Directors on this topic." b. REQUIRED: Prepare your presentation notes, that addresses the director's desire to change the firm's investment strategy from technical analysis to fundamental analysis. Specifically, you are to either agree with the Board's belief or to disagree with their belief about fundamental analysis. Provide three reasons for your decision. The theory behind Technical Analysis is that a detailed review of all relevant "fundamental, economic information about the company is NOT necessary in order to select the best investments for the investment portfolio." REQUIRED: Do you agree with the above statement? provide two reasons for your position about technical analysis.

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer a I agree that fundamental analysis has numerous advantages over technical analysis First fun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started