Answered step by step

Verified Expert Solution

Question

1 Approved Answer

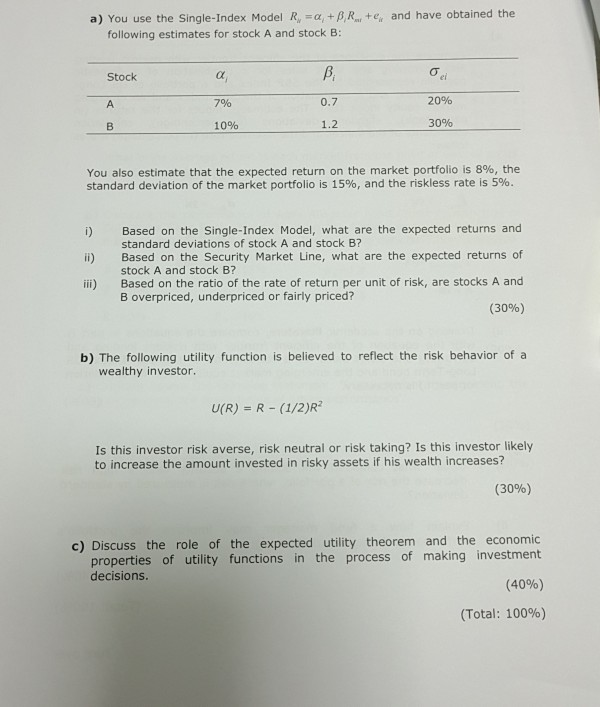

a) You use the Single-Index Model R, a, B,R., +e and have obtained the following estimates for stock A and stock B: a, 7% 10%

a) You use the Single-Index Model R, a, B,R., +e and have obtained the following estimates for stock A and stock B: a, 7% 10% p, 0.7 1.2 Stock ei 2096 3096 You also estimate that the expected return on the market portfolio is 8%, the standard deviation of the market portfolio is 15%, and the riskless rate is 5%. i) Based on the Single-Index Model, what are the expected returns and ii) Based on the Security Market Line, what are the expected returns of ii) Based on the ratio of the rate of return per unit of risk, are stocks A and (3096) standard deviations of stock A and stock B? stock A and stock B? B overpriced, underpriced or fairly priced? b) The following utility function is believed to reflect the risk behavior of a wealthy investor U(R) -R (1/2)R2 Is this investor risk averse, risk neutral or risk taking? Is this investor likely to increase the amount invested in risky assets if his wealth increases? (30%) c) Discuss the role of the expected utility theorem and the economic properties of utility functions in the process of making investment (40%) (Total: 100%) decisions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started