Answered step by step

Verified Expert Solution

Question

1 Approved Answer

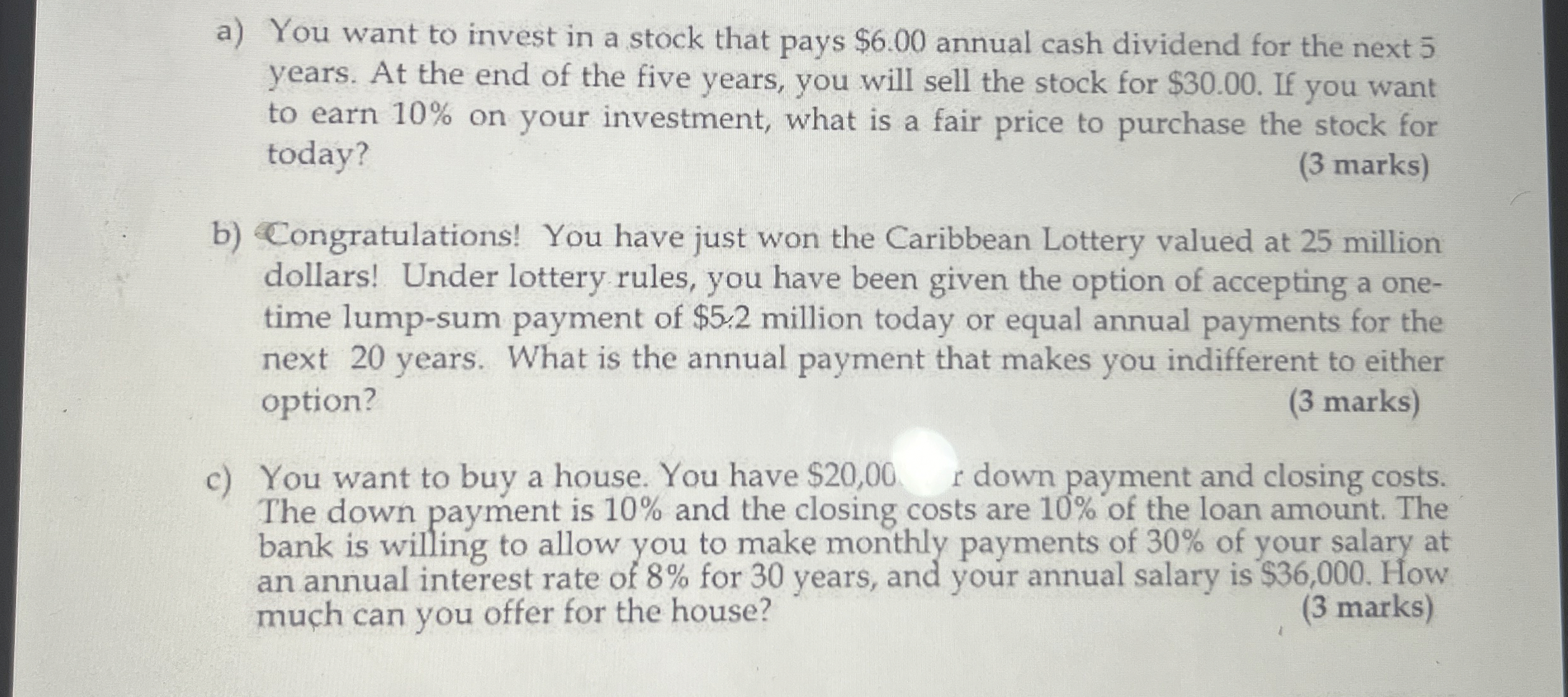

a ) You want to invest in a stock that pays $ 6 . 0 0 annual cash dividend for the next 5 years. At

a You want to invest in a stock that pays $ annual cash dividend for the next years. At the end of the five years, you will sell the stock for $ If you want to earn on your investment, what is a fair price to purchase the stock for today?

marks

b Congratulations! You have just won the Caribbean Lottery valued at million dollars! Under lottery rules, you have been given the option of accepting a onetime lumpsum payment of $ million today or equal annual payments for the next years. What is the annual payment that makes you indifferent to either option?

marks

c You want to buy a house. You have $ down payment and closing costs. The down payment is and the closing costs are of the loan amount. The bank is willing to allow you to make monthly payments of of your salary at an annual interest rate of for years, and your annual salary is $ How much can you offer for the house?

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started