Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) You work for Dynamic Hardware Division (DHD) of Dynamic IT plc. DHD is considering the development of a wireless router that will provide

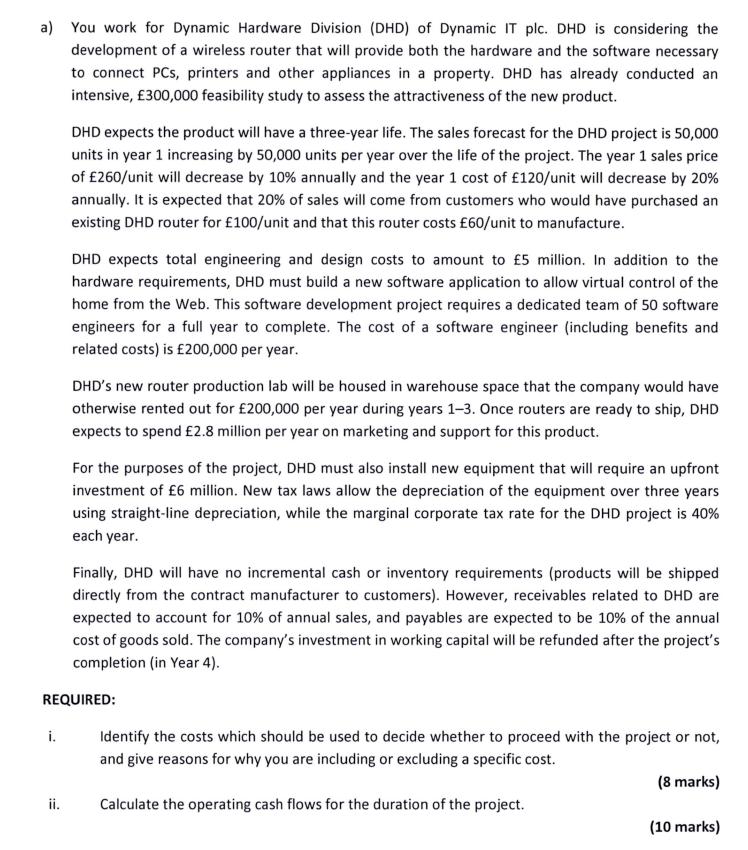

a) You work for Dynamic Hardware Division (DHD) of Dynamic IT plc. DHD is considering the development of a wireless router that will provide both the hardware and the software necessary to connect PCs, printers and other appliances in a property. DHD has already conducted an intensive, 300,000 feasibility study to assess the attractiveness of the new product. DHD expects the product will have a three-year life. The sales forecast for the DHD project is 50,000 units in year 1 increasing by 50,000 units per year over the life of the project. The year 1 sales price of 260/unit will decrease by 10% annually and the year 1 cost of 120/unit will decrease by 20% annually. It is expected that 20% of sales will come from customers who would have purchased an existing DHD router for 100/unit and that this router costs 60/unit to manufacture. DHD expects total engineering and design costs to amount to 5 million. In addition to the hardware requirements, DHD must build a new software application to allow virtual control of the home from the Web. This software development project requires a dedicated team of 50 software engineers for a full year to complete. The cost of a software engineer (including benefits and related costs) is 200,000 per year. DHD's new router production lab will be housed in warehouse space that the company would have otherwise rented out for 200,000 per year during years 1-3. Once routers are ready to ship, DHD expects to spend 2.8 million per year on marketing and support for this product. For the purposes of the project, DHD must also install new equipment that will require an upfront investment of 6 million. New tax laws allow the depreciation of the equipment over three years using straight-line depreciation, while the marginal corporate tax rate for the DHD project is 40% each year. Finally, DHD will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). However, receivables related to DHD are expected to account for 10% of annual sales, and payables are expected to be 10% of the annual cost of goods sold. The company's investment in working capital will be refunded after the project's completion (in Year 4). REQUIRED: i. Identify the costs which should be used to decide whether to proceed with the project or not, and give reasons for why you are including or excluding a specific cost. ii. Calculate the operating cash flows for the duration of the project. (8 marks) (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the operating cash flows for the duration of the project we need to co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started