Answered step by step

Verified Expert Solution

Question

1 Approved Answer

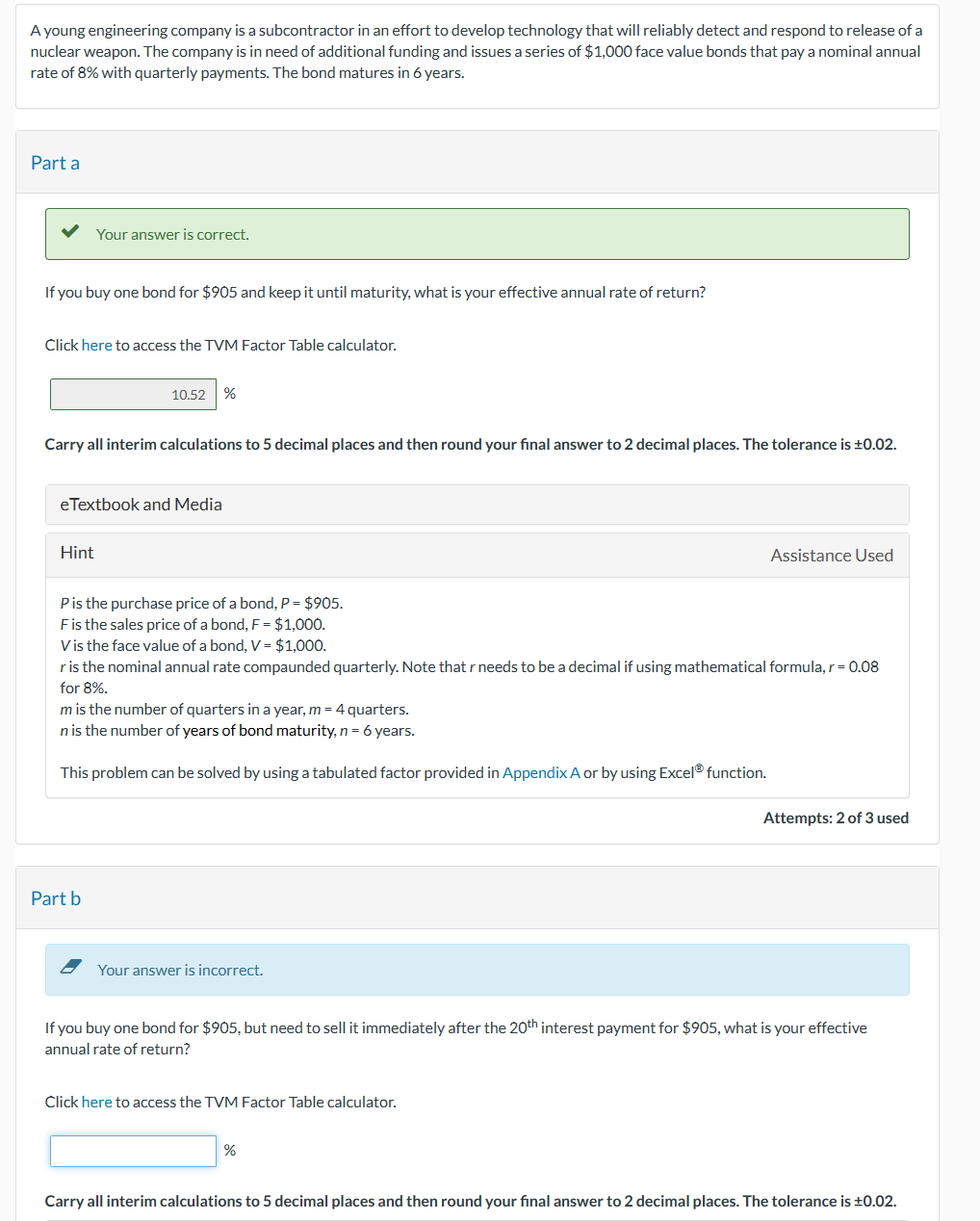

A young engineering company is a subcontractor in an effort to develop technology that will reliably detect and respond to release of a nuclear weapon.

A young engineering company is a subcontractor in an effort to develop technology that will reliably detect and respond to release of a

nuclear weapon. The company is in need of additional funding and issues a series of $ face value bonds that pay a nominal annual

rate of with quarterly payments. The bond matures in years.

Part a

Your answer is correct.

If you buy one bond for $ and keep it until maturity, what is your effective annual rate of return?

Click here to access the TVM Factor Table calculator.

Carry all interim calculations to decimal places and then round your final answer to decimal places. The tolerance is

eTextbook and Media

Hint

is the purchase price of a bond, $

is the sales price of a bond, $

is the face value of a bond, $

is the nominal annual rate compaunded quarterly. Note that needs to be a decimal if using mathematical formula,

for

is the number of quarters in a year, quarters.

is the number of years of bond maturity, years.

This problem can be solved by using a tabulated factor provided in Appendix A or by using Excel function.

Part b

Your answer is incorrect.

If you buy one bond for $ but need to sell it immediately after the interest payment for $ what is your effective

annual rate of return?

Click here to access the TVM Factor Table calculator.

Carry all interim calculations to decimal places and then round your final answer to decimal places. The tolerance is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started