Question

a) Your company has just exported crude palm oil to a Japanese customer. You will receive 30 million yen in 90 days. Do you

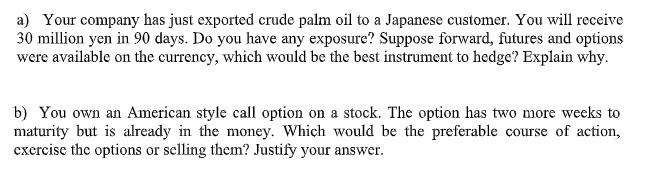

a) Your company has just exported crude palm oil to a Japanese customer. You will receive 30 million yen in 90 days. Do you have any exposure? Suppose forward, futures and options were available on the currency, which would be the best instrument to hedge? Explain why. b) You own an American style call option on a stock. The option has two more weeks to maturity but is already in the money. Which would be the preferable course of action, exercise the options or selling them? Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine if there is any exposure in this scenario we need to consider the potential exchange rate risk If you are receiving 30 million yen in 9...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations Of Multinational Financial Management

Authors: Alan C Shapiro, Atulya Sarin

6th Edition

047012895X, 9780470128954

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App