Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A zero coupon bond has 5 years to maturity and face value of $1000. The current yieid of the bond is 2.8%. Suppose that five

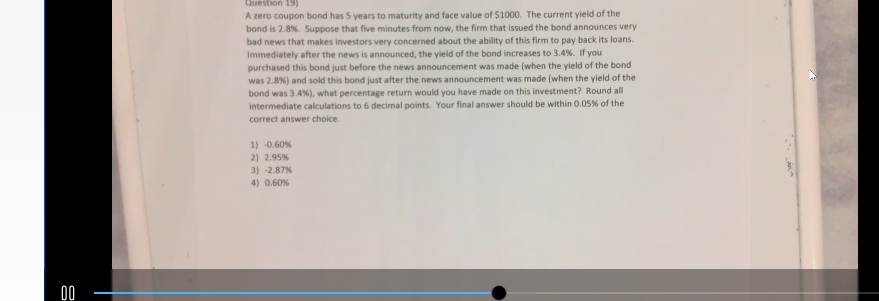

A zero coupon bond has 5 years to maturity and face value of $1000. The current yieid of the bond is 2.8%. Suppose that five minutes from now, the firm that issued the bond announces very bad news that makes investors very concerned about the ability of this firm to pay back its loans. Immediately after the news is announced, the yield of the bond increases to 3.4%. If you purchased this bond just before the news announcement was made (when the yield of the bond was 2.8% ) and sold this bond just after the news announcement was made (when the yield of the bond was 3.4% ), what percentage return would you have made on this investment? Round all intermediate calculations to 6 decimal points. Your final answer should be within 0.05% of the correct answer choice. 1) 0.60% 2) 2.95% 3) 2.87% 4) 0.60%

A zero coupon bond has 5 years to maturity and face value of $1000. The current yieid of the bond is 2.8%. Suppose that five minutes from now, the firm that issued the bond announces very bad news that makes investors very concerned about the ability of this firm to pay back its loans. Immediately after the news is announced, the yield of the bond increases to 3.4%. If you purchased this bond just before the news announcement was made (when the yield of the bond was 2.8% ) and sold this bond just after the news announcement was made (when the yield of the bond was 3.4% ), what percentage return would you have made on this investment? Round all intermediate calculations to 6 decimal points. Your final answer should be within 0.05% of the correct answer choice. 1) 0.60% 2) 2.95% 3) 2.87% 4) 0.60% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started