Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a0=rate of use at the begining a=(a0)*e^(rt) Estimate the lifetime of energy resources of Eldorado. The country of Eldorado, population 34 million, area 160,000 sq

a0=rate of use at the begining

a=(a0)*e^(rt)

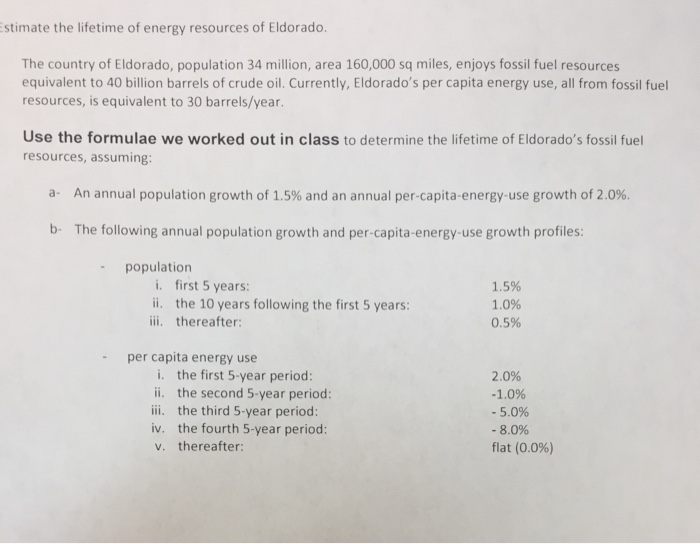

Estimate the lifetime of energy resources of Eldorado. The country of Eldorado, population 34 million, area 160,000 sq miles, enjoys fossil fuel resources equivalent to 40 billion barrels of crude oil. Currently, Eldorado's per capita energy use, all from fossil fuel resources, is equivalent to 30 barrels/year. Use the formulae we worked out in class to determine the lifetime of Eldorado's fossil fuel resources, assuming: a. An annual population growth of 1.5% and an annual per capita-energy-use growth of 2.0%. b. The following annual population growth and per-capita-energy-use growth profiles: population i. first 5 years: ii. the 10 years following the first 5 years: iii. thereafter: 1.5% 1.0% 0.5% per capita energy use i. the first 5-year period: ii. the second 5-year period: iii. the third 5-year period: iv. the fourth 5-year period: V. thereafter: 2.0% -1.0% - 5.0% - 8.0% flat (0.0%) Estimate the lifetime of energy resources of Eldorado. The country of Eldorado, population 34 million, area 160,000 sq miles, enjoys fossil fuel resources equivalent to 40 billion barrels of crude oil. Currently, Eldorado's per capita energy use, all from fossil fuel resources, is equivalent to 30 barrels/year. Use the formulae we worked out in class to determine the lifetime of Eldorado's fossil fuel resources, assuming: a. An annual population growth of 1.5% and an annual per capita-energy-use growth of 2.0%. b. The following annual population growth and per-capita-energy-use growth profiles: population i. first 5 years: ii. the 10 years following the first 5 years: iii. thereafter: 1.5% 1.0% 0.5% per capita energy use i. the first 5-year period: ii. the second 5-year period: iii. the third 5-year period: iv. the fourth 5-year period: V. thereafter: 2.0% -1.0% - 5.0% - 8.0% flat (0.0%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started