Answered step by step

Verified Expert Solution

Question

1 Approved Answer

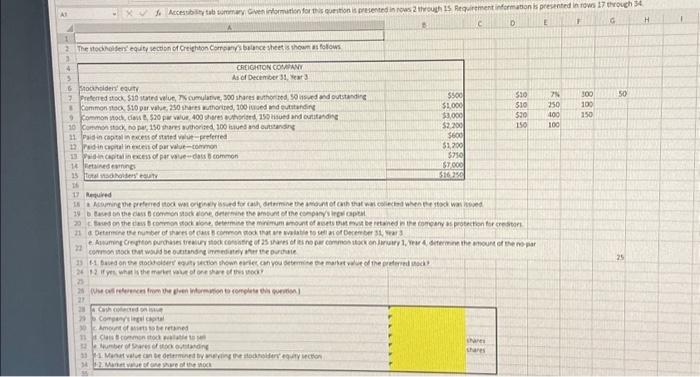

A1 1 2 3 4 x Accessibility tab summary: Given information for this question is presented in rows 2 through 15. Requirement information is presented

A1 1 2 3 4 x Accessibility tab summary: Given information for this question is presented in rows 2 through 15. Requirement information is presented in rows 17 through 34. C D F G 7 8 A The stockholders' equity section of Creighton Company's balance sheet is shown as follows 5 6 Stockholders equity Preferred stock, $10 stated value, 7% cumulative, 300 shares authorized, 50 issued and outstanding Common stock, $10 par value, 250 shares authorized, 100 issued and outstanding Common stock, class B, $20 par value, 400 shares authorized, 150 issued and outstanding CREIGHTON COMPANY As of December 31, Year 3 9 10 Common stock, no par, 150 shares authorized, 100 issued and outstanding 11 Paid-in capital in excess of stated value-preferred 12 Paid-in capital in excess of par value-common 13 Paid-in capital in excess of par value-dass B common 14 Retained earnings Total stockholders' equity Cash collected on issue b. Company's legal capital Amount of assets to be retained 23 1-1. Based on the stockholders' equity section shown earlier, can you determine the market value of the preferred stock? 24 1-2 If yes, what is the market value of one share of this stock? 25 26 (Use cell references from the given information to complete this question.) 27 28 29 30 B 15 16 17 Required 18 a Assuming the preferred stock was originally issued for cash, determine the amount of cash that was collected when the stock was issued. 19 b. Based on the class B common stock alone, determine the amount of the company's legal capital. 20 c. Based on the class B common stock alone, determine the minimum amount of assets that must be retained in the company as protection for creditors. 21 d. Determine the number of shares f class B common stock that are available to sell as of December 31, Year 3 22 e Assuming Creighton purchases treasury stock consisting of 25 shares of its no par common stock on January 1, Year 4, determine the amount of the no-par common stock that would be outstanding immediately after the purchase. 31 d. Class B common stock available to sell 32 e Number of Shares of stock outstanding 33 -1. Market value can be determined by analyzing the stockholders' equity section 34 f-2. Market value of one share of the stock 35 $500 $1,000 $3,000 $2,200 $600 $1,200 5750 $7,000 $16,250 $10 $10 $20 150 shares shares E 7% 250 400 100 300 100 150 50 25 H

how do i properly put in the excel formula. please show xample

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started