Question

A-1 Green Brands, Incorporated (GBI) presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from GBIs

A-1

Green Brands, Incorporated (GBI) presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from GBIs Year 2 and Year 1 year-end balance sheets. Assume all sales and purchases of inventory are made on account.

Account TitleYear 2Year 1Accounts receivable$ 21,600$ 28,700Inventory57,60048,600Prepaid insurance17,70026,800Accounts payable24,70018,600Salaries payable4,8004,150Unearned service revenue6002,900

The Year 2 income statement is shown next.

The Year 2 income statement is shown next.

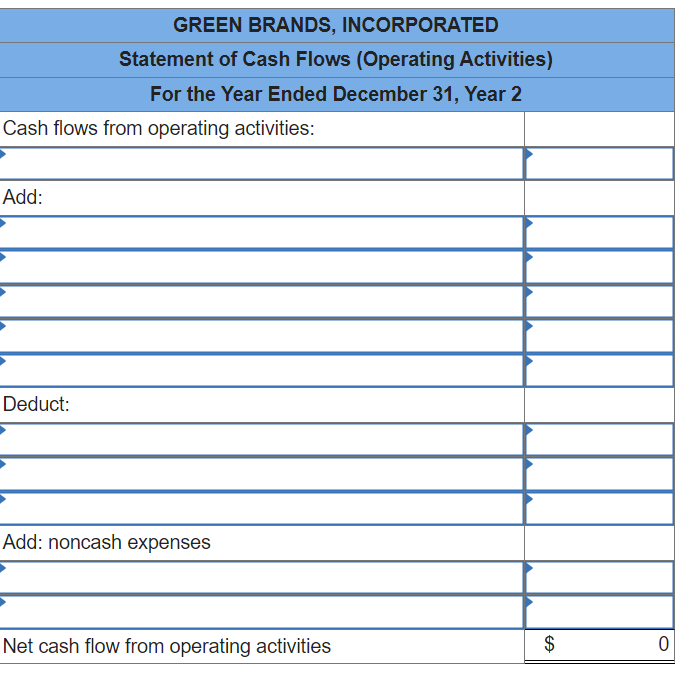

a.Prepare the operating activities section of the statement of cash flows using the indirect method.

A-2

Shim Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Shims Year 2 and Year 1 year-end balance sheets.

Account TitleYear 2Year 1Accounts receivable$31,859$38,231Prepaid rent1,5301,339Interest receivable547438Accounts payable10,07712,092Salaries payable2,7713,167Unearned revenue3,1774,236

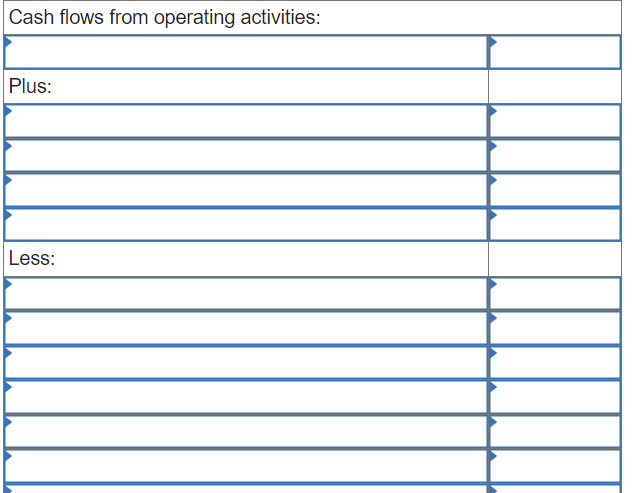

The income statement reported a $1,260 gain on the sale of equipment, an $940 loss on the sale of land, and $3,300 of depreciation expense. Net income for the period was $51,220. Required Prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.)

A-3

Alfonza Incorporated presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from the companys Year 2 and Year 1 year-end balance sheets.

Account TitleYear 2Year 1Accounts receivable$11,500$17,300Accounts payable7,10010,100

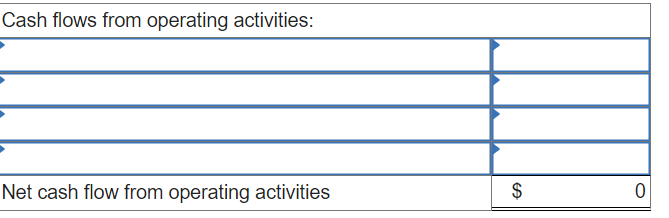

The Year 2 income statement showed net income of $29,100. Required a. Prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.)

A-4

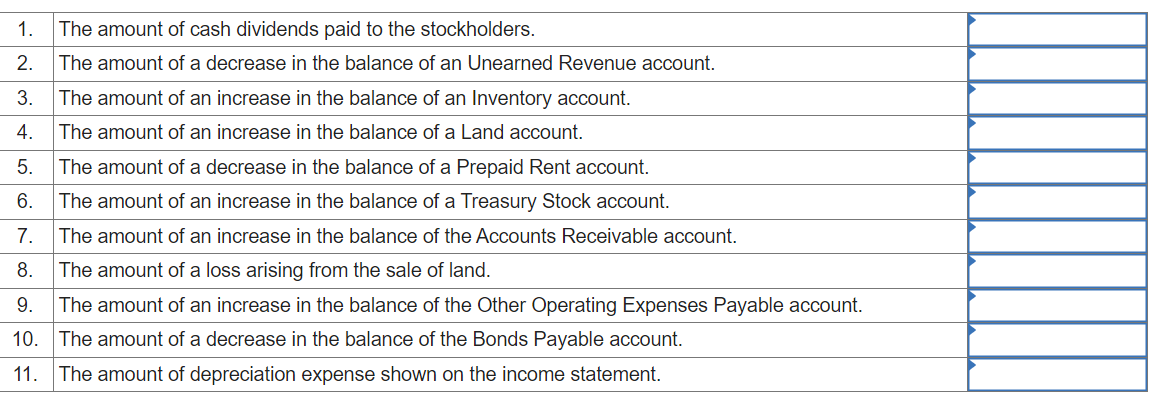

An accountant for Southern Manufacturing Companies (SMC) computed the following information by making comparisons between SMCs Year 1 and Year 2 balance sheets. Further information was determined by examining the companys Year 2 income statement. Required For each item described in the list below, indicate whether the amount should be added to or subtracted from the amount of net income when determining the amount of net cash flow from operating activities using the indirect method. Also identify any items that do not affect net cash flow from operating activities because they are reported as investing or financing activities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started