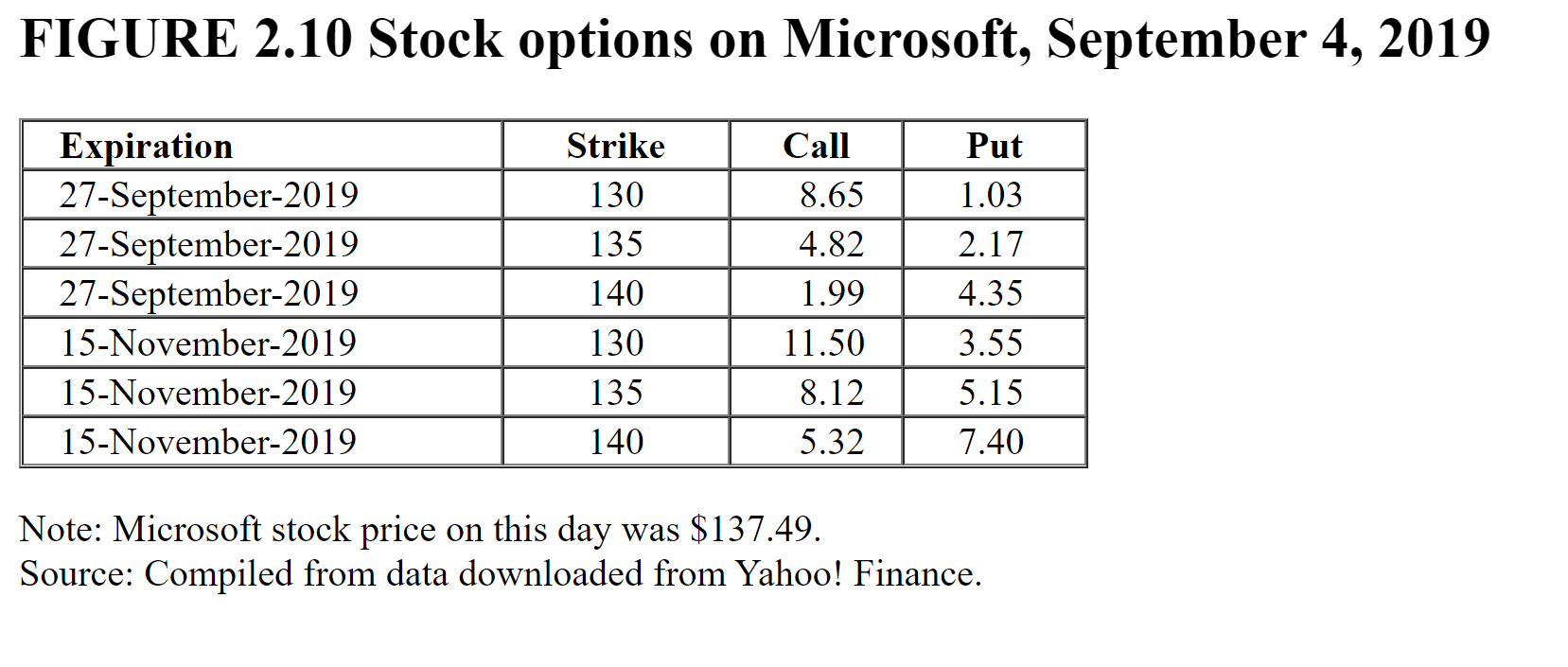

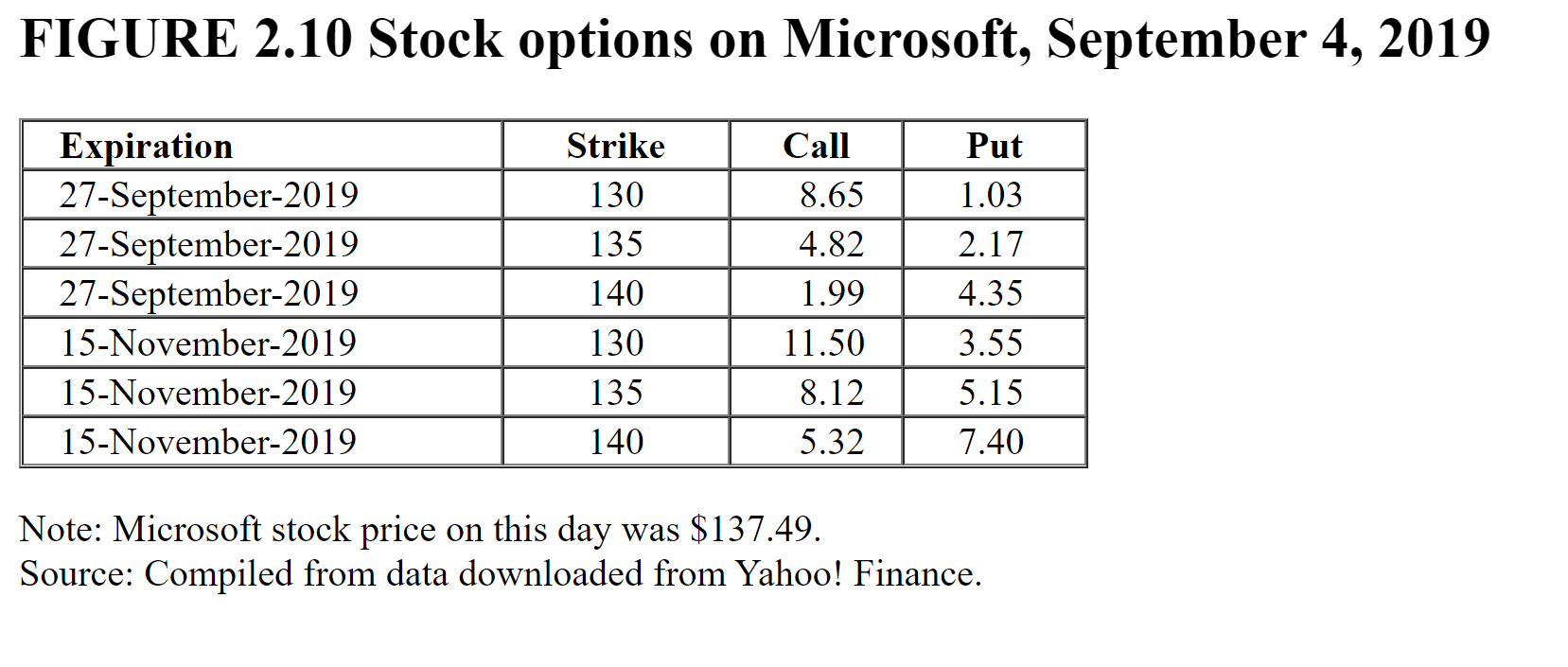

a-1. If the stock price at option explration is $144, will you exercise your call? Yes O No a-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit of | s 800 a-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return 2.86% b-1. Would you exercise the call if you had bought the November call with the exercise price $135? Yes O No b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit of $ 1,800 b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return 6.67% C-1. What if you had bought the November put with exercise price $140 Instead? Would you exercise the put at a stock price of $140? O Yes No c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Rate of return FIGURE 2.10 Stock options on Microsoft, September 4, 2019 Expiration 27-September-2019 27-September-2019 27-September-2019 15-November-2019 15-November-2019 15-November-2019 Strike 130 135 140 130 135 140 Call 8.65 4.82 1.99 11.50 8.12 5.32 Put 1.03 2.17 4.35 3.55 5.15 7.40 Note: Microsoft stock price on this day was $137.49. Source: Compiled from data downloaded from Yahoo! Finance. a-1. If the stock price at option explration is $144, will you exercise your call? Yes O No a-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit of | s 800 a-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return 2.86% b-1. Would you exercise the call if you had bought the November call with the exercise price $135? Yes O No b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) Net profit of $ 1,800 b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Rate of return 6.67% C-1. What if you had bought the November put with exercise price $140 Instead? Would you exercise the put at a stock price of $140? O Yes No c-2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Rate of return FIGURE 2.10 Stock options on Microsoft, September 4, 2019 Expiration 27-September-2019 27-September-2019 27-September-2019 15-November-2019 15-November-2019 15-November-2019 Strike 130 135 140 130 135 140 Call 8.65 4.82 1.99 11.50 8.12 5.32 Put 1.03 2.17 4.35 3.55 5.15 7.40 Note: Microsoft stock price on this day was $137.49. Source: Compiled from data downloaded from Yahoo! Finance