Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(A1) If you could, please explain why you chose to solve it the way you did and what method you used! :) Thanks! Broadening Your

(A1) If you could, please explain why you chose to solve it the way you did and what method you used! :) Thanks!

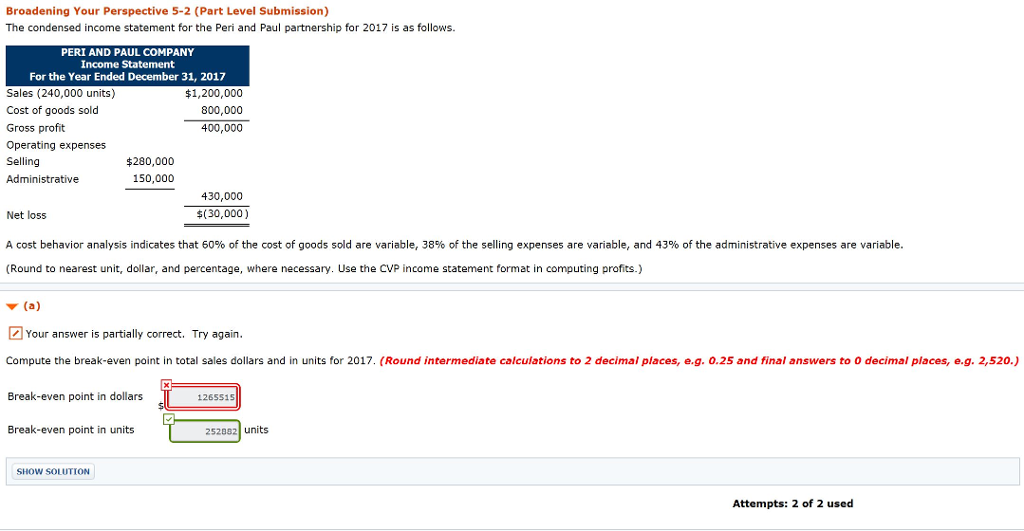

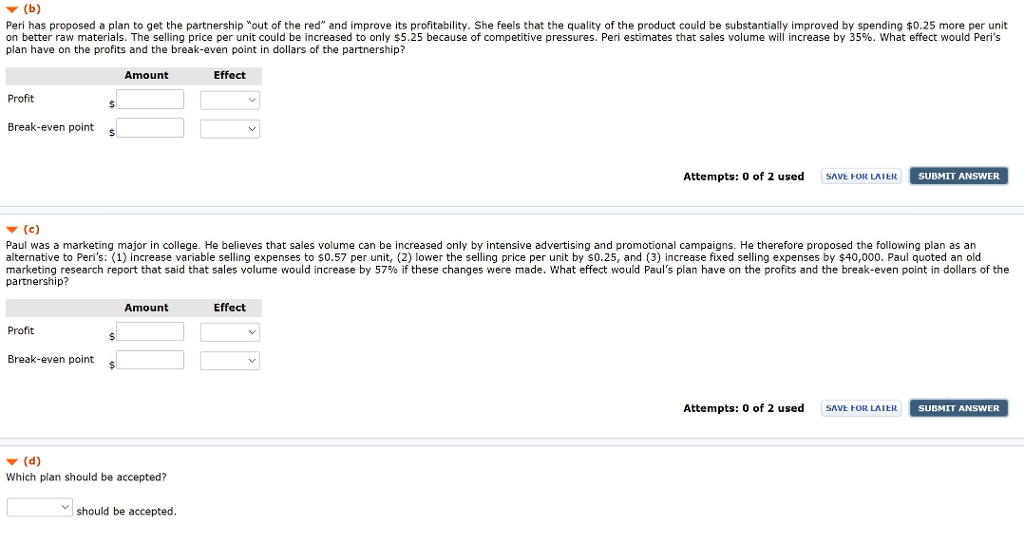

Broadening Your Perspective 5-2 (Part Level Submission) The condensed income statement for the Peri and Paul partnership for 2017 is as follows. PERI AND PAUL COMPANY Income Statement For the Year Ended December 31, 2017 $1,200,000 800,000 400,000 Sales (240,000 units) Cost of goods sold Gross profit Operating expenses Selling Administrative $280,000 150,000 -430,000 Net loss A cost behavior analysis indicates that 60% of the cost of goods sold are variable, 38% of the selling expenses are variable, and 43% of the administrative expenses are variable (Round to nearest unit, dollar, and percentage, where necessary. Use the CVP income statement format in computing profits.) $(30,000) (a) Your answer is partially correct. Try again Compute the break-even point in total sales dollars and in units for 2017. (Round intermediate calculations to 2 decimal places, e.g. o.25 and final answers to 0 decimal places, e.g. 2,520) Break-even point in dollars Break-even point in units 1265515 252882 units SHOW SOLUTION Attempts: 2 of 2 usedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started