Question

A-1 Products manufactures wooden furniture using an assembly-line process. All direct materials are introduced at the start of the process, and conversion cost is incurred

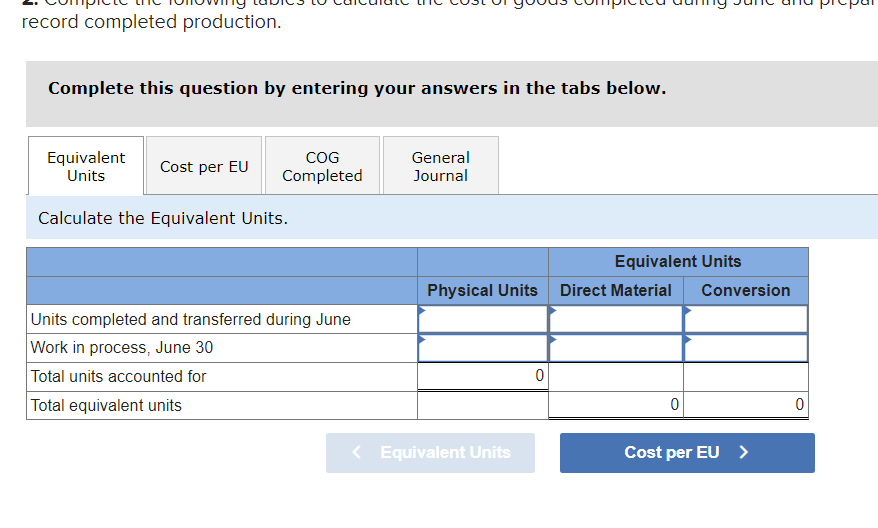

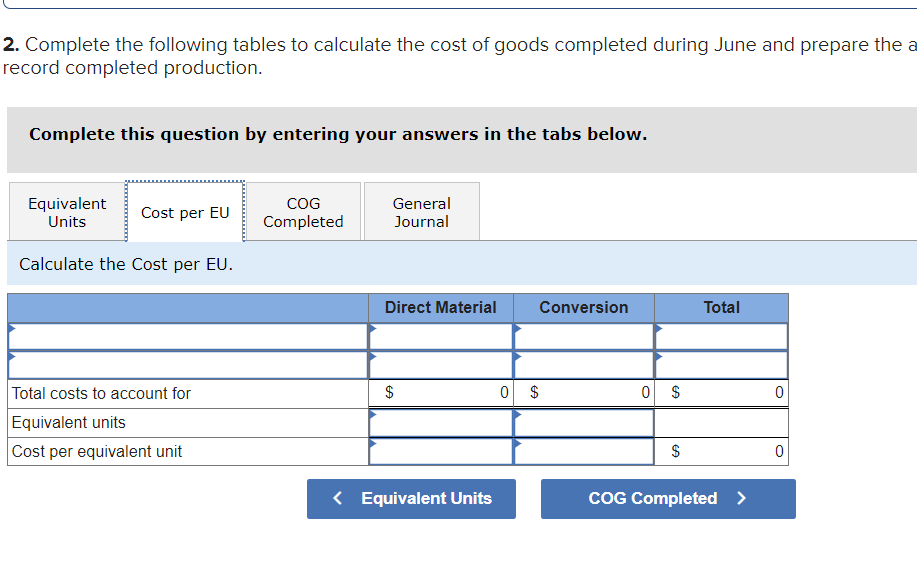

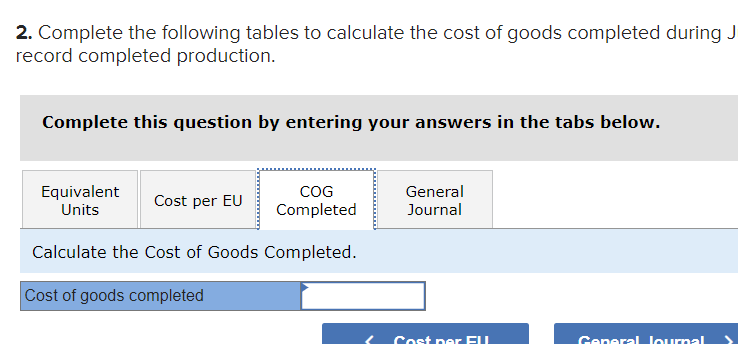

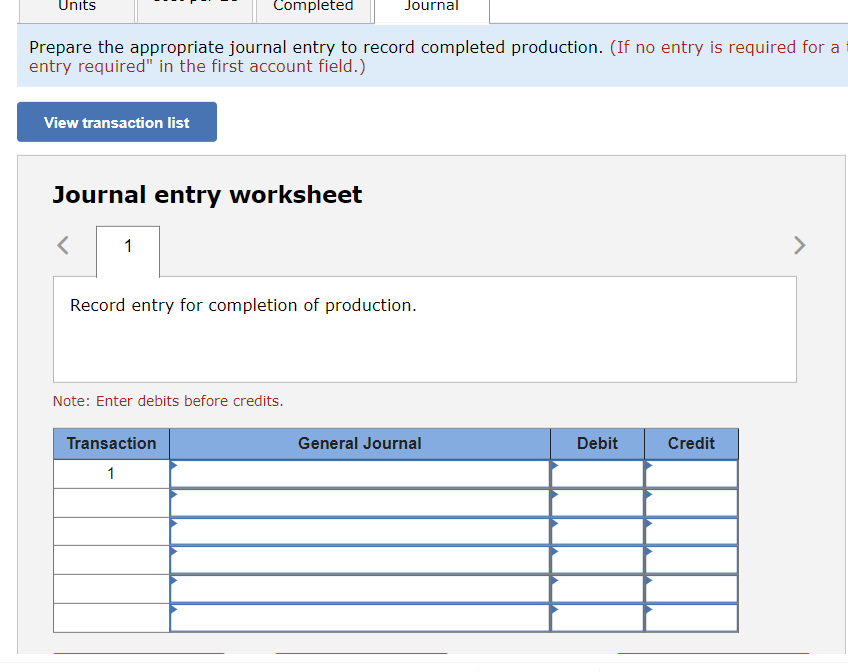

A-1 Products manufactures wooden furniture using an assembly-line process. All direct materials are introduced at the start of the process, and conversion cost is incurred evenly throughout manufacturing. An examination of the companys Work-in-Process Inventory account for June revealed the following selected information.

| Debit side: |

| June 1 balance: 300 units, 30% complete as to conversion, cost $21,300* |

| Production started: 900 units |

| Direct material used during June: $45,000 |

| June conversion cost: $25,700 |

| Credit side: |

| Production completed: 700 units |

*Supplementary records revealed direct-material cost of $15,000 and conversion cost of $6,300. Conversations with manufacturing personnel revealed that the ending work in process was 60 percent complete as to conversion.

Please complete the attached charts using the above data

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started