Question

A1 Stock dividends are reported in connection with a statement of cash flows as: A) A financing activity. B) An investing activity. C) A noncash

| A1 | Stock dividends are reported in connection with a statement of cash flows as: A) A financing activity. B) An investing activity. C) A noncash activity. D) Not reported on the statement of cash flows.

| ||||||||||||||||||||||||||||||||

| A2 | Property dividends are reported in connection with a statement of cash flows as: A) A financing activity. B) An investing activity. C) A noncash activity. D) Not reported on the statement of cash flows.

| ||||||||||||||||||||||||||||||||

| A3 | Interest paid to bondholders is reported in connection with a statement of cash flows as: A) An operating activity. B) An investing activity. C) A noncash activity. D) A financing activity.

| ||||||||||||||||||||||||||||||||

| A4 | Investment revenue is reported in connection with a statement of cash flows as: A) An operating activity. B) An investing activity. C) A noncash activity. D) A financing activity.

| ||||||||||||||||||||||||||||||||

| A5 | On January 4, Childers Corporation issued $200 million of bonds for $193 million. During the same year, $500,000 of the bond discount was amortized. In the operating activities section prepared by the indirect method, Childers Corporation should report:

a. A positive adjustment and amount ___________________

or

b. A negative adjustment and amount ___________________

| ||||||||||||||||||||||||||||||||

| A6 | On January 4, Childers Corporation issued $200 million of bonds for $193 million. During the same year, $500,000 of the bond discount was amortized.

a. Investing activities would have cash inflow of _______________

b. Investing activities would have cash outflow of _______________

c. Financing activities would have cash inflow of _________________

d. Financing activities would have cash outflow of _______________

| ||||||||||||||||||||||||||||||||

| Approx. 6 pts | In the operating activities section, indicate the sign of the following items using the indirect method. You only get credit if you answer more than 3 correctly. (e.g. if you answer 5 out of 7 correctly, you get 1/2 credit.)

|

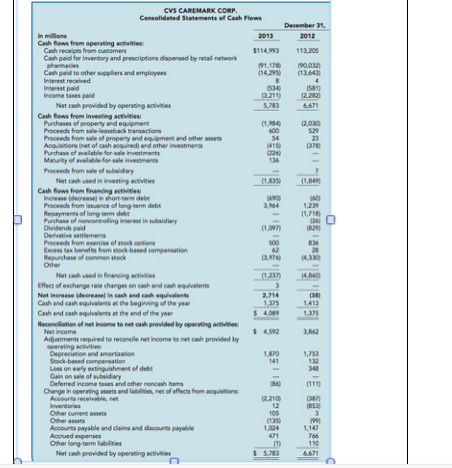

| B. 5 questions, 10 pts total | |

| B |

|

| 1 pt. | What was the percentage change in net income? (show work)

|

| 1 pt. | What was the percentage change in operating cash flow (show work)

|

| 4 pts. | What was the AMOUNT OF free cash flow? (show work)

2013

2012

|

| 1 pt. | What was the percentage change in free cash flow

|

| 3 pts. | Which of the three measures (NI, Operating CF, Free Cash flow) grew fastest compared to the other two, and WHY?

|

| Section C. 22 questions, approximately 3 points per question, 64 pts total | |

| C1 | A publicly owned corporation is required by law to do which of the following?

A) Prepare and issue financial statements in conformity with generally accepted accounting principles.

B) Have their annual statements audited by an independent firm of certified public accountants.

C) Comply with federal securities laws.

D) Do all of the above.

|

| C2 | Two of the three primary account classifications within shareholders' equity are:

A. Preferred stock and retained earnings. B. The par value of common stock and retained earnings. C. Paid-in capital and retained earnings. D. Preferred and common stock.

|

| C3 | Consider the following: Calculate the total paid-in capital of the corporation. A) $8,700,000 B) $1,700,000 C) $4,900,000 D) $11,900,000

|

| C4 | The dividend yield on preferred stock is 10% on a market price of $80 per share at the end of Year One. The preferred stock is selling for $40 at the end of Year Two. What is its dividend yield at the end of Year Two? A) 20% B) 10% C) 8% D) 16%

|

| C5 | Common shareholders usually have all of the following rights except:

A. To share in the profits. B. To share in assets upon liquidation. C. To elect a board of directors. D. To participate in the day-to-day operations.

|

| C6 | Which of the following is false?

A) Book value is a historical concept. B) Investors' confidence in a company's management can be measured. C) Book value excludes amounts earned and retained by the corporation. D) The sign of a successful corporation is when the market price of its stock exceeds the book value of its stock.

|

| C7 | Preferred stock is called preferred because it usually has two preferences. These preferences relate to:

A. Dividends and voting rights. B. Par value and dividends. C. The preemptive right and voting rights. D. Assets at liquidation and dividends.

|

| C8 | A corporation purchased treasury stock for $50,000 cash. The journal entry for this transaction included which of the following?

A) A debit to Cash and a credit to Common stock. B) A debit to Treasury Stock and a credit to Cash. C) A debit to Retained Earnings and a credit to Treasury Stock. D) A debit to Treasury Stock and a credit to Preferred Stock.

|

| C9 | Which of the following statements is true when dividends are not declared or paid on cumulative preferred stock?

A. The shareholders must be allowed to convert their shares to common stock. B. The unpaid dividends are accrued as a liability. C. The unpaid dividends are reported in a note to the financial statements. D. The unpaid dividends accrue interest until paid.

|

| C10 | The par value of shares issued is normally recorded in the:

A. Paid-in capital in excess of par account. B. Common stock account. C. Retained earnings account. D. Appropriated retained earnings account.

|

| C11 | Accumulated other comprehensive income is reported:

A. In the balance sheet as an asset. B. In the balance sheet as a liability. C. In the balance sheet as a component of shareholders' equity. D. In the statement of comprehensive income.

|

| C12 | Authorized common stock refers to the total number of shares:

A. Outstanding. B. Issued. C. Issued and outstanding. D. That can be issued.

|

| C13 | When stock traded on an active exchange is issued for a machine:

A. No entry is recorded until restrictions are lifted. B. An asset is recorded for the fair value of the stock. C. An asset is recorded for the appraised value of the machine. D. Paid-in capital is increased by the appraised value of the machine.

|

| C14 | When stock is issued in exchange for property, the best evidence of fair value might be any of the following except:

A. The appraised value of the property received. B. The selling price of the stock in a recent transaction. C. The price of the stock quoted on the stock exchange. D. The average book value of outstanding stock.

|

| C15 | Heidi Aurora Imports issued shares of the company's Class B stock. Heidi Aurora Imports should report the stock in the company's statement of financial position:

A. Among liabilities if the shares are mandatorily redeemable or redeemable at the option of the shareholder.

B. As equity unless the shares are mandatorily redeemable.

C. As equity unless the shares are redeemable at the option of the issuer.

D. Among liabilities unless the shares are mandatorily redeemable.

|

| C16 | When a company issues a stock dividend, which of the following would be affected?

A. Earnings per share. B. Total assets. C. Total liabilities. D. Total shareholders' equity.

|

| C17 | Outstanding common stock is:

A. Stock that is performing well on the New York Stock Exchange. B. Stock that has been authorized by the state for issue. C. Stock held in the corporate treasury. D. Stock in the hands of shareholders.

|

| C18 | When preferred stock carries a redemption privilege, the shareholders may:

A. Purchase new shares as they become available. B. Exchange their preferred shares for common shares. C. Surrender the preferred shares for a specified amount of cash. D. Purchase treasury shares ahead of common shareholders.

|

| C19. Approx. 6 pts. | Roberto Corporation was organized on January 1, 2016. The firm was authorized to issue 100,000 shares of $5 par common stock. During 2016, Roberto had the following transactions relating to shareholders' equity:

Issued 10,000 shares of common stock at $7 per share. Issued 20,000 shares of common stock at $8 per share. Reported a net income of $100,000. Paid dividends of $50,000. Treasury Stock increased by $30,000.

What is total shareholders' equity at the end of 2016?

|

| C20 | Gabriel Company views share buybacks as treasury stock. In its first treasury stock transaction, Gabriel purchased treasury stock for more than the price at which the stock was originally issued. What is the effect of the purchase of the treasury stock on each of the following?

Total paid-in capital Retained earnings a. decrease decrease b. decrease no effect c. no effect decrease d. no effect no effect

|

| C21 | Gabriel Company views share buybacks as retirements. In its first treasury stock transaction, Gabriel purchased treasury stock for more than the price at which the stock was originally issued. What is the effect of the purchase of the treasury stock on each of the following?

Total paid-in capital Retained earnings a. decrease decrease b. decrease no effect c. no effect decrease d. no effect no effect

|

D. From last exam, 3 pts total, 1.5 pts. each.

| D1 | When bonds are issued between interest dates the entry to record the issuance of the bonds contains:

Dr Cr Cr

|

| D2 | Give an example of a separate performance obligation (i.e. where there is more than one performance obligation).

|

Consolidated Statements of Cash Flows December 31, 2011 Cash flows from operating artvites Cash receipts from customers S114993 Cashpad for inventory and prescriptions dispensed by retal network Cash paid to other suppliers and employees Income taxes paid Net cash provided operating activities Cash saws frem investing activities of property and equipment Proceeds from saleleaseback transactions. Preeeeds sale propery and equipment and other assets Aequisitorainet of cash acquired and other investments Purchase of avalable for tale investments Manurity available forsale investments Proceeds from sale of Net cash used in investing activities Cash fews frem financing actitlesi short-term debt from issuance of long- Repayments of term debt Excess benefis from based compensation Net caused financing Effect of changes on and cash equalents in cash and equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year 4089 Reconciation of net income to net pravidedby operating Adjustments requined to reconcile net income to net cash provided by Depreciation and amortiation Stock-based compensation Lass on eally extinguishment of debt Gain on sale of subsidiay Change operating assets and abilities netofeffects fomaoquistons Alcounts receivable, net Other current assets Accounts payable and claims and ducounts payable other long- S 5.083 Net cash provided by operating activites

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started