Answered step by step

Verified Expert Solution

Question

1 Approved Answer

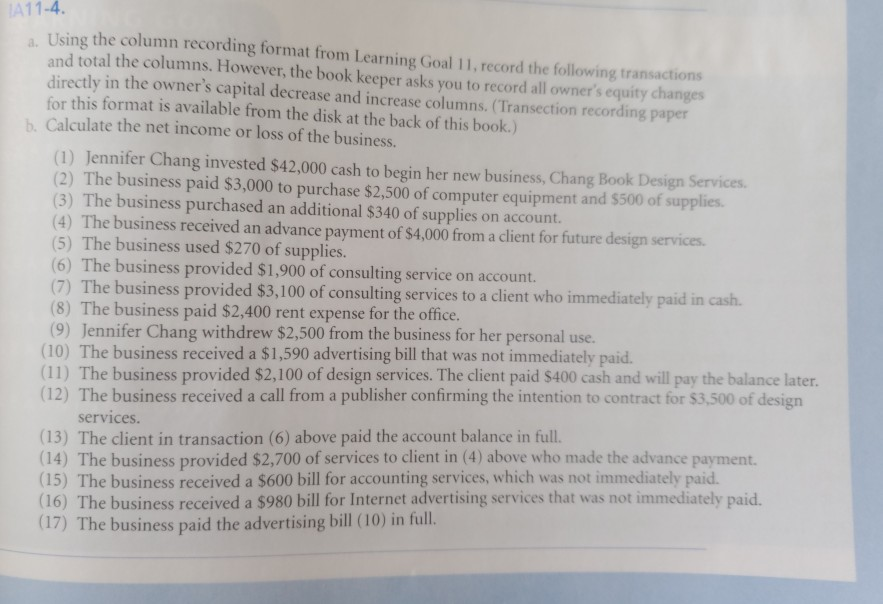

A11-4 Using the column recording format from Learning Goal 11, record the following transactions a. and total the columns. However, the book keeper asks you

A11-4 Using the column recording format from Learning Goal 11, record the following transactions a. and total the columns. However, the book keeper asks you to record all owner's equity changes directly in the owner's capital decrease and increase columns. (Transection recording paper for this format is available from the disk at the back of this book.) h. Calculate the net income or loss of the business (1) Jennifer Chang invested $42,000 cash to begin her new business, Chang Book Design Services. (2) The business paid $3,000 to purchase $2,500 of computer equipment and $500 of supplies. (3) The business purchased an additional $340 of supplies on account. (4) The business received an advance payment of $4,000 from a client for future design services. (5) The business used $270 of supplies. (6) The business provided $1,900 of consulting service (7) The business provided $3,100 of consulting services to a client who immediately paid in cash. (8) The business paid $2,400 rent expense for the office. (9) Jennifer Chang withdrew $2,500 from the business for her personal use. (10) The business received a $1,590 advertising bill that was not immediately paid. (11) The business provided $2,100 of design services. The client paid $400 cash and will pay the balance later. (12) The business received a call from a publisher confirming the intention to contract for $3,500 of design on account. services. (13) The client in transaction (6) above paid the account balance in full. (14) The business provided $2,700 of services to client in (4) above who made the advance payment. (15) The business received a $600 bill for accounting services, which was not immediately paid (16) The business received a $980 bill for Internet advertising services that was not immediately paid. (17) The business paid the advertising bill (10) in full. Page A11-4 Using the column recording format from Learning Goal 11, record the following transactions a. and total the columns. However, the book keeper asks you to record all owner's equity changes directly in the owner's capital decrease and increase columns. (Transection recording paper for this format is available from the disk at the back of this book.) h. Calculate the net income or loss of the business (1) Jennifer Chang invested $42,000 cash to begin her new business, Chang Book Design Services. (2) The business paid $3,000 to purchase $2,500 of computer equipment and $500 of supplies. (3) The business purchased an additional $340 of supplies on account. (4) The business received an advance payment of $4,000 from a client for future design services. (5) The business used $270 of supplies. (6) The business provided $1,900 of consulting service (7) The business provided $3,100 of consulting services to a client who immediately paid in cash. (8) The business paid $2,400 rent expense for the office. (9) Jennifer Chang withdrew $2,500 from the business for her personal use. (10) The business received a $1,590 advertising bill that was not immediately paid. (11) The business provided $2,100 of design services. The client paid $400 cash and will pay the balance later. (12) The business received a call from a publisher confirming the intention to contract for $3,500 of design on account. services. (13) The client in transaction (6) above paid the account balance in full. (14) The business provided $2,700 of services to client in (4) above who made the advance payment. (15) The business received a $600 bill for accounting services, which was not immediately paid (16) The business received a $980 bill for Internet advertising services that was not immediately paid. (17) The business paid the advertising bill (10) in full. Page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started