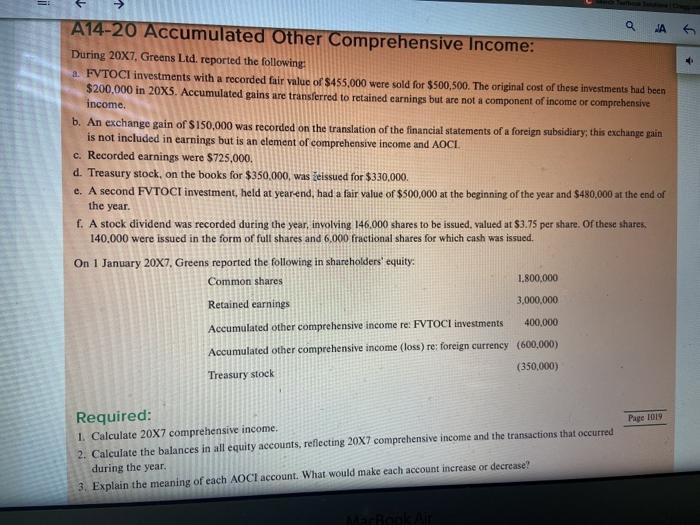

=: A14-20 Accumulated Other Comprehensive Income: 6 During 20X7, Greens Ltd. reported the following: 2. FVTOCI investments with a recorded fair value of S455,000 were sold for $500,500. The original cost of these investments had been $200,000 in 20X5. Accumulated gains are transferred to retained earnings but are not a component of income or comprehensive income. b. An exchange gain of S150,000 was recorded on the translation of the financial statements of a foreign subsidiary: this exchange pain is not included in earnings but is an element of comprehensive income and AOCI. c. Recorded earnings were $725.000 d. Treasury stock, on the books for $350,000, was elssued for $330.000. e. A second FVTOCI investment, held at yearend, had a fair value of $500,000 at the beginning of the year and $480,000 at the end of the year. f. A stock dividend was recorded during the year, involving 146.000 shares to be issued. valued at $3.75 per share. Of these shares 140.000 were issued in the form of full shares and 6.000 fractional shares for which cash was issued. On 1 January 20X7, Greens reported the following in shareholders' equity: 1.800.000 Common shares 3.000.000 Retained earnings 400,000 Accumulated other comprehensive income re: FVTOCI investments Accumulated other comprehensive income (loss) re: foreign currency (600,000) (350,000) Treasury stock Pape 1019 Required: 1. Calculate 20X7 comprehensive income. 2. Calculate the balances in all equity accounts, reflecting 20X7 comprehensive income and the transactions that occurred during the year 3. Explain the meaning of each AOCI account. What would make each account increase or decrease! =: A14-20 Accumulated Other Comprehensive Income: 6 During 20X7, Greens Ltd. reported the following: 2. FVTOCI investments with a recorded fair value of S455,000 were sold for $500,500. The original cost of these investments had been $200,000 in 20X5. Accumulated gains are transferred to retained earnings but are not a component of income or comprehensive income. b. An exchange gain of S150,000 was recorded on the translation of the financial statements of a foreign subsidiary: this exchange pain is not included in earnings but is an element of comprehensive income and AOCI. c. Recorded earnings were $725.000 d. Treasury stock, on the books for $350,000, was elssued for $330.000. e. A second FVTOCI investment, held at yearend, had a fair value of $500,000 at the beginning of the year and $480,000 at the end of the year. f. A stock dividend was recorded during the year, involving 146.000 shares to be issued. valued at $3.75 per share. Of these shares 140.000 were issued in the form of full shares and 6.000 fractional shares for which cash was issued. On 1 January 20X7, Greens reported the following in shareholders' equity: 1.800.000 Common shares 3.000.000 Retained earnings 400,000 Accumulated other comprehensive income re: FVTOCI investments Accumulated other comprehensive income (loss) re: foreign currency (600,000) (350,000) Treasury stock Pape 1019 Required: 1. Calculate 20X7 comprehensive income. 2. Calculate the balances in all equity accounts, reflecting 20X7 comprehensive income and the transactions that occurred during the year 3. Explain the meaning of each AOCI account. What would make each account increase or decrease