Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A15-10 Convertible Debt; Three Cases: The following cases are independent: Case A On 1 January 20X6, Wilson Products Ltd. issued a bond when market

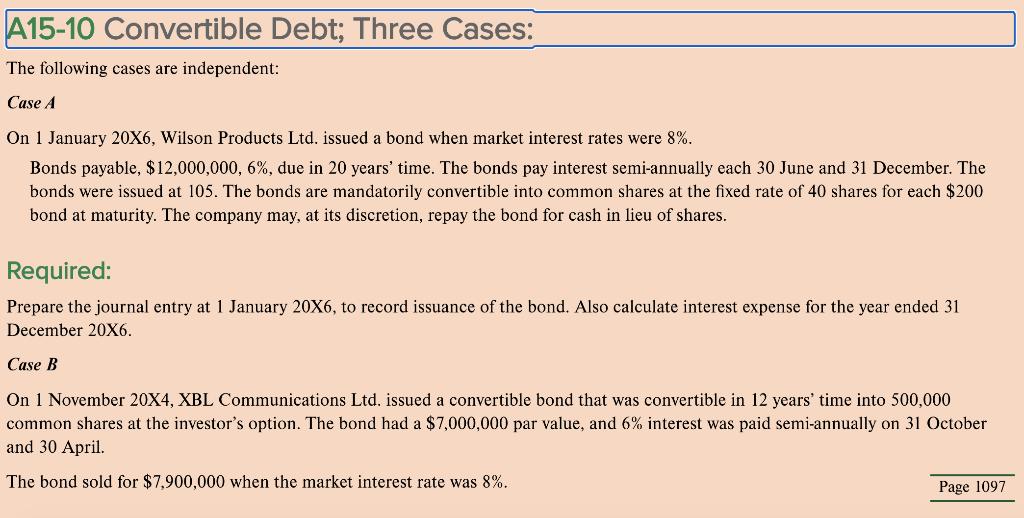

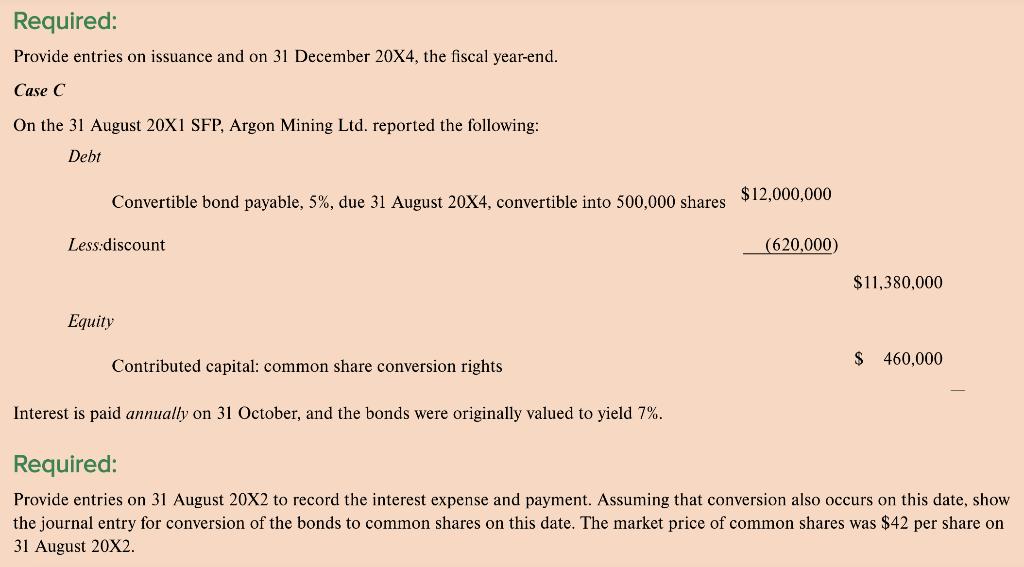

A15-10 Convertible Debt; Three Cases: The following cases are independent: Case A On 1 January 20X6, Wilson Products Ltd. issued a bond when market interest rates were 8%. Bonds payable, $12,000,000, 6%, due in 20 years' time. The bonds pay interest semi-annually each 30 June and 31 December. The bonds were issued at 105. The bonds are mandatorily convertible into common shares at the fixed rate of 40 shares for each $200 bond at maturity. The company may, at its discretion, repay the bond for cash in lieu of shares. Required: Prepare the journal entry at 1 January 20X6, to record issuance of the bond. Also calculate interest expense for the year ended 31 December 20X6. Case B On 1 November 20X4, XBL Communications Ltd. issued a convertible bond that was convertible in 12 years' time into 500,000 common shares at the investor's option. The bond had a $7,000,000 par value, and 6% interest was paid semi-annually on 31 October and 30 April. The bond sold for $7,900,000 when the market interest rate was 8%. Page 1097 Required: Provide entries on issuance and on 31 December 20X4, the fiscal year-end. Case C On the 31 August 20X1 SFP, Argon Mining Ltd. reported the following: Debt Convertible bond payable, 5%, due 31 August 20X4, convertible into 500,000 shares Less:discount Equity Contributed capital: common share conversion rights Interest is paid annually on 31 October, and the bonds were originally valued to yield 7%. $12,000,000 (620,000) $11,380,000 $ 460,000 Required: Provide entries on 31 August 20X2 to record the interest expense and payment. Assuming that conversion also occurs on this date, show the journal entry for conversion of the bonds to common shares on this date. The market price of common shares was $42 per share on 31 August 20X2.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started