Pat has become concerned about the profitability and cash needs for the business as it grows. You have been asked to prepare some budgets

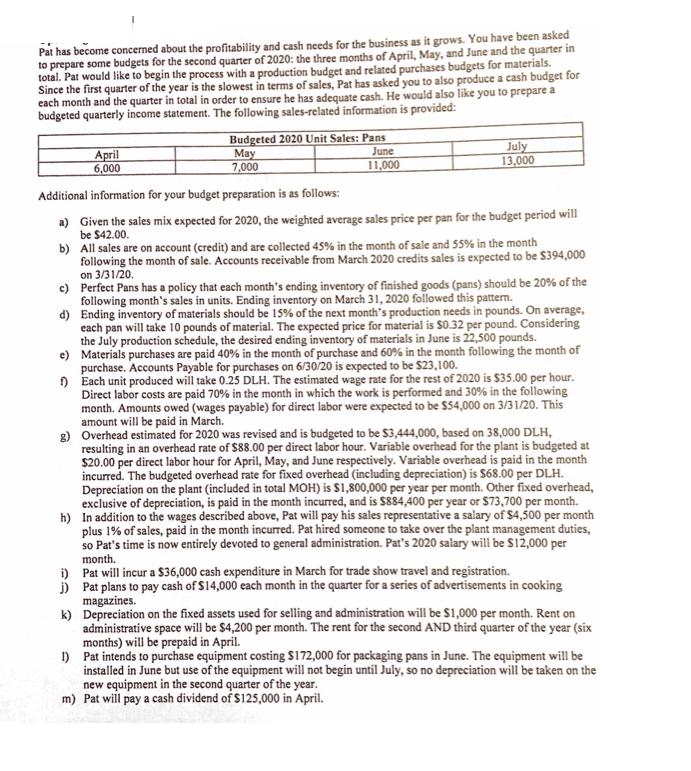

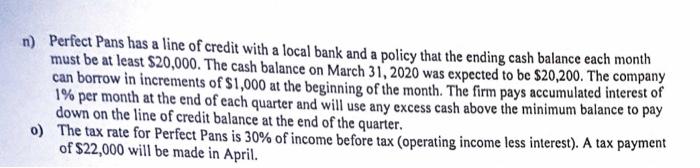

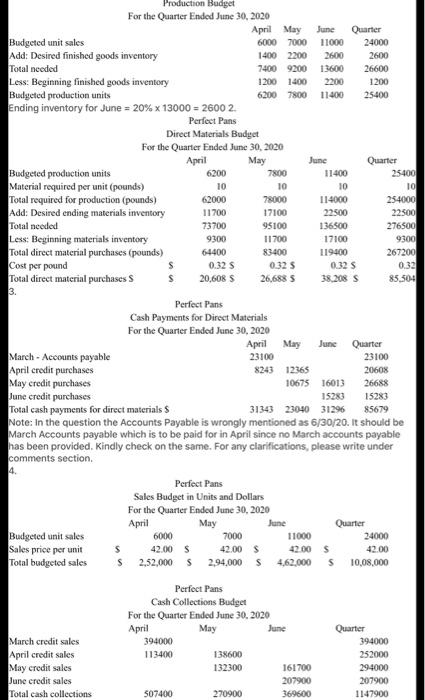

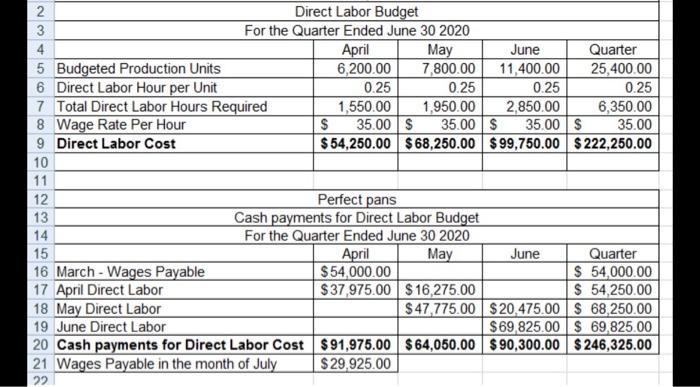

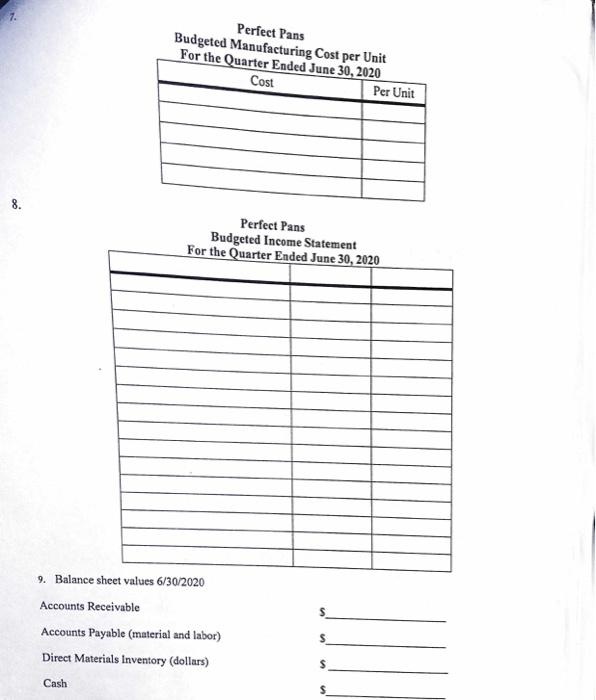

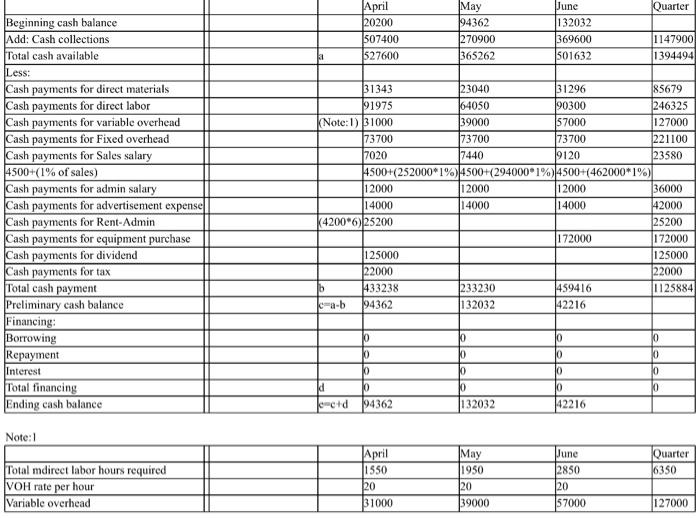

Pat has become concerned about the profitability and cash needs for the business as it grows. You have been asked to prepare some budgets for the second quarter of 2020: the three months of April, May, and June and the quarter in total. Pat would like to begin the process with a production budget and related purchases budgets for materials. Since the first quarter of the year is the slowest in terms of sales, Pat has asked you to also produce a cash budget for each month and the quarter in total in order to ensure he has adequate cash. He would also like you to prepare a budgeted quarterly income statement. The following sales-related information is provided: c) d) April 6,000 Additional information for your budget preparation is as follows: a) Given the sales mix expected for 2020, the weighted average sales price per pan for the budget period will be $42.00. Budgeted 2020 Unit Sales: Pans June May 7,000 11,000 b) All sales are on account (credit) and are collected 45% in the month of sale and 55% in the month following the month of sale. Accounts receivable from March 2020 credits sales is expected to be $394,000 on 3/31/20. e) 1) July 13,000 i) j) Ending inventory of materials should be 15% of the next month's production needs in pounds. On average, each pan will take 10 pounds of material. The expected price for material is $0.32 per pound. Considering the July production schedule, the desired ending inventory of materials in June is 22,500 pounds. Materials purchases are paid 40% in the month of purchase and 60% in the month following the month of purchase. Accounts Payable for purchases on 6/30/20 is expected to be $23,100. Each unit produced will take 0.25 DLH. The estimated wage rate for the rest of 2020 is $35.00 per hour. Direct labor costs are paid 70% in the month in which the work is performed and 30% in the following month. Amounts owed (wages payable) for direct labor were expected to be $54,000 on 3/31/20. This amount will be paid in March. g) Overhead estimated for 2020 was revised and is budgeted to be $3,444,000, based on 38,000 DLH, resulting in an overhead rate of $88.00 per direct labor hour. Variable overhead for the plant is budgeted at $20.00 per direct labor hour for April, May, and June respectively. Variable overhead is paid in the month incurred. The budgeted overhead rate for fixed overhead (including depreciation) is $68.00 per DLH. Depreciation on the plant (included in total MOH) is $1,800,000 per year per month. Other fixed overhead, exclusive of depreciation, is paid in the month incurred, and is $884,400 per year or $73,700 per month. h) In addition to the wages described above, Pat will pay his sales representative a salary of $4,500 per month plus 1% of sales, paid in the month incurred. Pat hired someone to take over the plant management duties, so Pat's time is now entirely devoted to general administration. Pat's 2020 salary will be $12,000 per month. Perfect Pans has a policy that each month's ending inventory of finished goods (pans) should be 20% of the following month's sales in units. Ending inventory on March 31, 2020 followed this pattern. Pat will incur a $36,000 cash expenditure in March for trade show travel and registration. Pat plans to pay cash of $14,000 each month in the quarter for a series of advertisements in cooking magazines. k) Depreciation on the fixed assets used for selling and administration will be $1,000 per month. Rent on administrative space will be $4,200 per month. The rent for the second AND third quarter of the year (six months) will be prepaid in April. 1) Pat intends to purchase equipment costing $172,000 for packaging pans in June. The equipment will be installed in June but use of the equipment will not begin until July, so no depreciation will be taken on the new equipment in the second quarter of the year. m) Pat will pay a cash dividend of $125,000 in April. n) Perfect Pans has a line of credit with a local bank and a policy that the ending cash balance each month must be at least $20,000. The cash balance on March 31, 2020 was expected to be $20,200. The company can borrow in increments of $1,000 at the beginning of the month. The firm pays accumulated interest of 1% per month at the end of each quarter and will use any excess cash above the minimum balance to pay down on the line of credit balance at the end of the quarter. o) The tax rate for Perfect Pans is 30% of income before tax (operating income less interest). A tax payment of $22,000 will be made in April. Budgeted unit sales Add: Desired finished goods inventory Total needed Less: Beginning finished goods inventory Budgeted production units Ending inventory for June = 20 % x 13000 = 2600 2. Perfect Pans Budgeted production units Material required per unit (pounds) Production Budget For the Quarter Ended June 30, 2020 Total required for production (pounds) Add: Desired ending materials inventory Total needed Less: Beginning materials inventory Total direct material purchases (pounds) Cost per pound Total direct material purchases $ 3. 4. Budgeted unit sales Sales price per unit Total budgeted sales March credit sales April credit sales May credit sales June credit sales Total cash collections Direct Materials Budget For the Quarter Ended June 30, 2020 April May S S S S 6200 10 62000 11700 73700 9300 64400 0.32 S 20,608 S 6000 42.00 2,52,000 $2,94,000 394000 113400 Perfect Pans Cash Payments for Direct Materials For the Quarter Ended June 30, 2020 April S 507400 April May June Quarter 6000 7000 11000 24000 1400 2200 2600 2600 7400 9200 13600 26600 1200 1400 2200 1200 6200 7800 11400 25400 May Junc Quarter 23100 March - Accounts payable April credit purchases 20608 May credit purchases 26688 June credit purchases 15283 Total cash payments for direct materials S 85679 Note: In the question the Accounts Payable is wrongly mentioned as 6/30/20. It should be March Accounts payable which is to be paid for in April since no March accounts payable has been provided. Kindly check on the same. For any clarifications, please write under comments section. 7800 10 Perfect Pans Sales Budget in Units and Dollars For the Quarter Ended June 30, 2020 April May 78000 17100 95100 11700 83400 0.32 S 26,688 S 138600 132300 7000 42.00 S 270900 23100 8243 Perfect Pans Cash Collections Budget For the Quarter Ended June 30, 2020 April May June June 12365 10675 16013 15283 31343 23040 31296 S 4,62,000 June 11400 10 114000 22500 136500 17100 119400 0.32 S 38,208 S 161700 207900 369600 11000 42.00 S Quarter Quarter 25400 10 254000 22500 276500 9300 267200 0.32 85,504 24000 42.00 Quarter S 10,08,000 394000 252000 294000 207900 1147900 2 3 4 Direct Labor Budget For the Quarter Ended June 30 2020 5 Budgeted Production Units 6 Direct Labor Hour per Unit 7 Total Direct Labor Hours Required 8 Wage Rate Per Hour 9 Direct Labor Cost 10 11 12 13 14 April 6,200.00 0.25 15 16 March-Wages Payable 17 April Direct Labor 18 May Direct Labor 19 June Direct Labor 20 Cash payments for Direct Labor Cost 21 Wages Payable in the month of July 22 May June 11,400.00 7,800.00 0.25 0.25 1,550.00 1,950.00 2,850.00 $ 35.00 $ 35.00 $ 35.00 $ $54,250.00 $68,250.00 $99,750.00 $222,250.00 Perfect pans Cash payments for Direct Labor Budget For the Quarter Ended June 30 2020 May April $54,000.00 $37,975.00 $16,275.00 June Quarter $ 54,000.00 $ 54,250.00 $ 68,250.00 $69,825.00 $ 69,825.00 $91,975.00 $64,050.00 $90,300.00 $246,325.00 $29,925.00 Quarter 25,400.00 $47,775.00 $20,475.00 0.25 6,350.00 35.00 7. Perfect Pans Budgeted Manufacturing Cost per Unit For the Quarter Ended June 30, 2020 Cost Cash 9. Balance sheet values 6/30/2020 Accounts Receivable Accounts Payable (material and labor) Direct Materials Inventory (dollars) Perfect Pans Budgeted Income Statement For the Quarter Ended June 30, 2020 Per Unit S Beginning cash balance Add: Cash collections Total cash available Less: Cash payments for direct materials Cash payments for direct labor Cash payments for variable overhead Cash payments for Fixed overhead Cash payments for Sales salary 4500+(1% of sales) Cash payments for admin salary Cash payments for advertisement expense Cash payments for Rent-Admin Cash payments for equipment purchase Cash payments for dividend Cash payments for tax Total cash payment Preliminary cash balance Financing: Borrowing Repayment Interest Total financing Ending cash balance Note: 1 Total mdirect labor hours required VOH rate per hour Variable overhead 31 April 20200 31343 91975 (Note: 1) 31000 b c-a-b 507400 527600 d c=c+d 73700 7020 (4200*6)25200 12000 14000 125000 22000 433238 94362 4500+(252000*1%) 4500+(2940001%) 4500+(462000*1%) 10 0 lo 0 94362 May 94362 270900 365262 April 1550 20 31000 23040 64050 39000 73700 7440 12000 14000 233230 132032 10 0 0 10 132032 June 132032 369600 501632 May 1950 20 39000 31296 90300 57000 73700 9120 12000 14000 172000 459416 42216 10 lo 10 10 42216 June 2850 20 57000 Quarter 1147900 1394494 85679 246325 127000 221100 23580 36000 42000 25200 172000 125000 22000 1125884 0 0 0 10 Quarter 6350 127000

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started