The salespeople at Ivanhoe, a notebook manufacturer, commonly pressured operations managers to keep costs down so the company could give bigger discounts to large

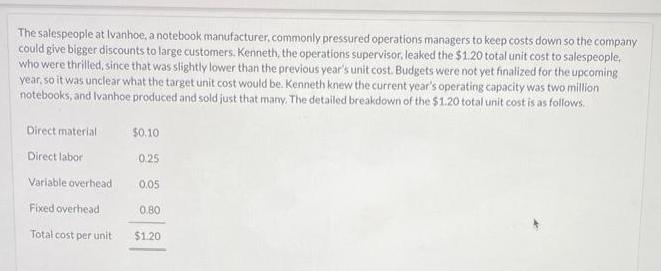

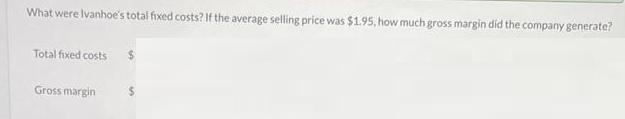

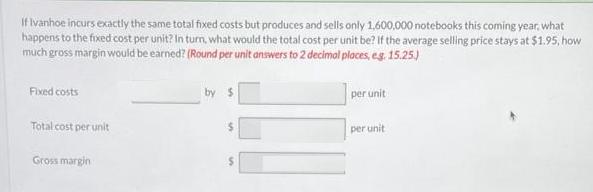

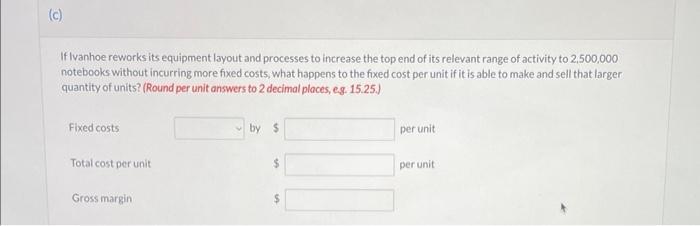

The salespeople at Ivanhoe, a notebook manufacturer, commonly pressured operations managers to keep costs down so the company could give bigger discounts to large customers. Kenneth, the operations supervisor, leaked the $1.20 total unit cost to salespeople, who were thrilled, since that was slightly lower than the previous year's unit cost. Budgets were not yet finalized for the upcoming year, so it was unclear what the target unit cost would be. Kenneth knew the current year's operating capacity was two million notebooks, and Ivanhoe produced and sold just that many. The detailed breakdown of the $1.20 total unit cost is as follows. Direct material Direct labor Variable overhead Fixed overhead Total cost per unit $0,10 0.25 0.05 0.80 $1.20 What were Ivanhoe's total fixed costs? If the average selling price was $1.95, how much gross margin did the company generate? Total fixed costs Gross margin If Ivanhoe incurs exactly the same total fixed costs but produces and sells only 1,600,000 notebooks this coming year, what happens to the fixed cost per unit? In turn, what would the total cost per unit be? If the average selling price stays at $1.95, how much gross margin would be earned? (Round per unit answers to 2 decimal places, eg. 15.25.) Fixed costs Total cost per unit Gross margin by $ $ $ per unit per unit (c) If Ivanhoe reworks its equipment layout and processes to increase the top end of its relevant range of activity to 2,500,000 notebooks without incurring more fixed costs, what happens to the fixed cost per unit if it is able to make and sell that larger quantity of units? (Round per unit answers to 2 decimal places, e.g. 15.25.) Fixed costs Total cost per unit Gross margin by $ $ per unit per unit

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The costs are classified as fixed and variable costs The f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started